Great Eastern reports 1H-24 Financial Results

Singapore, 31 July 2024 – Great Eastern Holdings Limited (the “Group”) today reported its financial results for the half-year ended 30 June 2024 (“1H-24”).

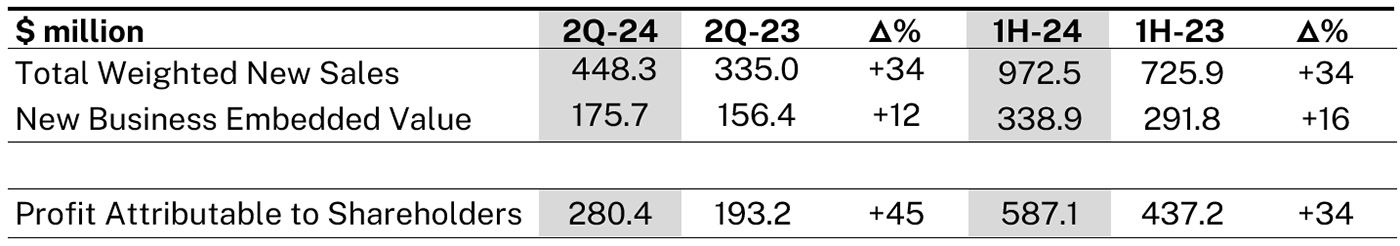

- Profit Attributable to Shareholders grew by 34% to S$ 587.1 million

- Total Weighted New Sales grew 34% to S$ 972.5 million

- New Business Embedded Value grew 16% to S$ 338.9 million

Total Weighted New Sales (“TWNS”) and New Business Embedded Value (“NBEV”)

The Group registered strong TWNS growth for 1H-24, reporting an increase of 34% over the same period last year, driven by sustained sales momentum in Singapore and Malaysia markets. NBEV grew by 16% over the same period on the back of strong sales performance.

Profit Attributable to Shareholders

Group’s Profit Attributable to Shareholders registered an increase of 34% over 1H-24, driven by higher profit from insurance business and favourable investment performance in shareholders’ fund.

In the first half of 2024, the Group has taken steps to optimise its capital and funding structure through issuance of subordinated and medium term notes in both Singapore and Malaysia by its subsidiaries. This further enhanced its return on equity.

Regulatory Capital

The Capital Adequacy Ratios of the Group’s insurance subsidiaries remain strong and well above their respective minimum regulatory levels.

Dividend

The Board of Directors has declared an interim one-tier tax exempt dividend of 45 cents per ordinary share, to be paid on 29 August 2024.

This represents an increase of 12.5% from the previous dividend payout, which is consistent with the Company’s practice of paying progressive dividends in line with sustainable profit trends. Barring unforeseen circumstances, the Company aims to maintain each dividend amount to be no lower than the preceding one.

Commenting on the Group’s financial results, Group Chief Executive Officer Mr Khor Hock Seng said:

“I am pleased to announce that the Group has delivered a robust set of results in the second quarter, building on the strong performance achieved in the first quarter. This achievement is a testament to our unwavering commitment and disciplined approach to managing the business.

As we commemorate our 116th anniversary this August, we are launching an exciting line-up of new products to meet the growing demand for protection, wealth accumulation and legacy planning. In Singapore, we launched the Great Bundle of Joy and Great Maternity Care 2 to serve customers who are welcoming their little ones into the family. We have also launched a suite of prestige products for customers with legacy planning needs. We will keep on enhancing our service offerings that we know our customers value, stemming from the long-standing relationships we have with them and our desire to serve them better.

In October, we will be organising the 18th edition of the Great Eastern Women’s Run at the National Stadium. Great Eastern is motivating young girls to get physically active and experience the joy of exercising together by bringing in Sanrio character Cinnamoroll as a special treat for participants of the “2KM Mummy + Me” and the “100M Princess Dash” categories.

Our focus remains firmly on achieving long-term, sustainable growth. We are dedicated to delivering value to our customers by anticipating and responding to their evolving needs. This customer-centric approach has been instrumental in driving our success. While we have achieved positive momentum for the first half of 2024, we remain vigilant of the dynamic and changing market conditions that may impact our business and profits.”

About Great Eastern

Founded in 1908, Great Eastern is a well-established market leader and trusted brand in Singapore and Malaysia. With over S$100 billion in assets and more than 16 million policyholders, including 12.5 million from government schemes, it provides insurance solutions to customers through three successful distribution channels – a tied agency force, bancassurance, and financial advisory firm Great Eastern Financial Advisers. The Group also operates in Indonesia and Brunei.

The Great Eastern Life Assurance Company Limited and Great Eastern General Insurance Limited have been assigned the financial strength and counterparty credit ratings of "AA-" by S&P Global Ratings since 2010, one of the highest among Asian life insurance companies. Great Eastern's asset management subsidiary, Lion Global Investors Limited, is one of the leading asset management companies in Southeast Asia.

Great Eastern is a subsidiary of OCBC Bank, the longest established Singapore bank, formed in 1932. It is the second largest financial services group in Southeast Asia by assets and one of the world’s most highly-rated banks, with an Aa1 rating from Moody’s and AA- by both Fitch and S&P. Recognised for its financial strength and stability, OCBC Bank is consistently ranked among the World’s Top 50 Safest Banks by Global Finance and has been named Best Managed Bank in Singapore by The Asian Banker.

#GreatEasternSG #ReachforGreat

For more information, please contact:

Keith Chia

Head, Group Brand & Marketing

Email: Corpcomms-sg@greateasternlife.com

Low Lai Fong

Head, Business Finance

Email: Investor-relations@greateasternlife.com