Great Eastern reports 1Q-24 Financial Results

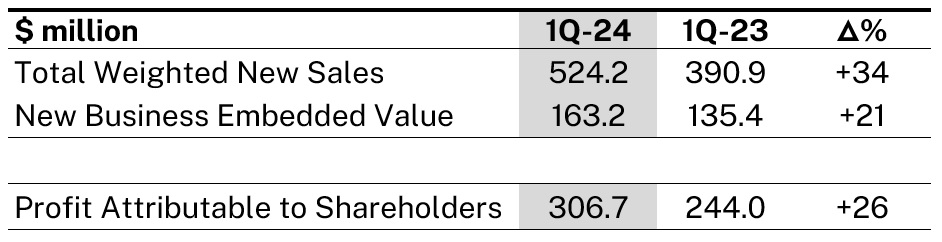

- Group Profit Attributable to Shareholders increased by 26% to S$306.7 million

- Total Weighted New Sales increased by 34% to S$524.2 million

- New Business Embedded Value increased by 21% to S$163.2 million

Singapore, 29 April 2024 – Great Eastern Holdings Limited (the “Group”) today reported its financial results for first quarter ended 31 March 2024 (“1Q-24”).

Total Weighted New Sales (“TWNS”) and New Business Embedded Value (“NBEV”)

The Group registered strong TWNS growth for 1Q-24, reporting an increase of 34% over last year. The Group’s operations in Singapore, Malaysia and Indonesia continued its growth momentum, driven by its core distribution channels across the markets. On the back of strong sales, NBEV increased 21% for the quarter.

Profit Attributable to Shareholders

Group’s Profit Attributable to Shareholders for the first quarter of 2024 recorded a 26% increase compared to the same period last year, driven by higher profit from insurance business as well as favourable investment performance in our shareholders fund.

Regulatory Capital

The Capital Adequacy Ratios of the Group’s insurance subsidiaries are strong and well above their respective minimum regulatory levels.

Commenting on the Group’s financial results, Group Chief Executive Officer Mr Khor Hock Seng said:

“For the first quarter, the Group registered strong growth momentum despite the challenging business environment, underscoring the effectiveness of our distribution, product, and digital strategies.

On 3 April, we published our 2023 Sustainability Report and affirmed our commitment to net zero by 2050 through our three-pronged approach of Accelerating the Transition to a Net Zero future, Bringing Impact to Communities and Conducting our Business Responsibly.

On 17 April, we issued S$500,000,000 subordinated notes priced at 3.928% under our Euro Medium Term Note Programme, as part of the Group’s capital management programme to optimise its capital mix while providing flexibility in deploying funds for general corporate and working capital purposes, including for growth and strategic investments.

Moving forward, we will continue to take firm steps to grow our business and create sustainable value for our stakeholders as the market leader in Singapore and Malaysia.”

About Great Eastern

Founded in 1908, Great Eastern is a well-established market leader and trusted brand in Singapore and Malaysia. With over S$100 billion in assets and more than 16 million policyholders, including 13 million from government schemes, it provides insurance solutions to customers through three successful distribution channels – a tied agency force, bancassurance, and financial advisory firm Great Eastern Financial Advisers. The Group also operates in Indonesia and Brunei.

The Great Eastern Life Assurance Company Limited and Great Eastern General Insurance Limited have been assigned the financial strength and counterparty credit ratings of "AA-" by S&P Global Ratings since 2010, one of the highest among Asian life insurance companies. Great Eastern's asset management subsidiary, Lion Global Investors Limited, is one of the leading asset management companies in Southeast Asia.

Great Eastern is a subsidiary of OCBC Bank, the longest established Singapore bank, formed in 1932. It is the second largest financial services group in Southeast Asia by assets and one of the world’s most highly-rated banks, with an Aa1 rating from Moody’s and AA- by both Fitch and S&P. Recognised for its financial strength and stability, OCBC Bank is consistently ranked among the World’s Top 50 Safest Banks by Global Finance and has been named Best Managed Bank in Singapore by The Asian Banker.

#GreatEasternSG #ReachforGreat

For more information, please contact:

Keith Chia

Head, Group Brand & Marketing

Email: Corpcomms-sg@greateasternlife.com

Low Lai Fong

Head, Business Finance

Email: Investor-relations@greateasternlife.com