Tax residency self-certification

Common Reporting Standard (CRS)

The Common Reporting Standard (CRS) requires financial institutions around the world to determine where their customers are tax resident and report that information to the government.

CRS may affect you as an individual or business customer if you purchase or hold a policy that is within the CRS scope.

We will contact you to make a declaration regarding your tax residency if you are affected.

The following information regarding CRS terms may be useful.

CRS Terms

Reportable information

The following will be reported to the local tax authority:

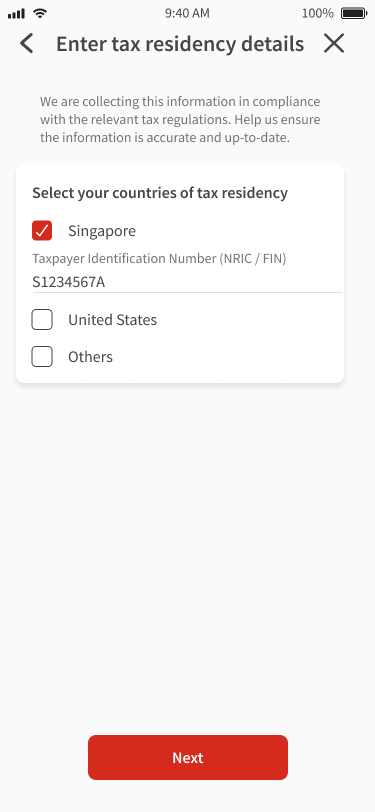

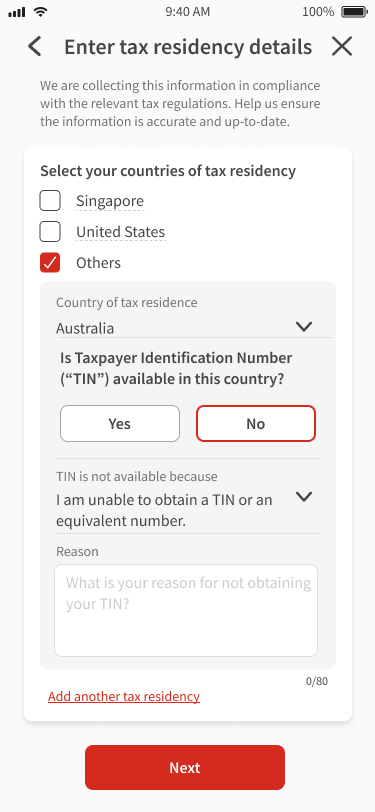

- Personal information on the reportable person, i.e. name, address, Tax Identification Number (TIN), date of birth.

- Financial account information, i.e. account number, balance, interest, dividends, other income and gross proceeds.

Legal enforcement of Automatic Exchange Of Information (AEOI)

Each jurisdiction is able to decide whether it will implement AEOI or not. Consequently, AEOI is implemented on a country-by-country basis.

In addition, in order for two jurisdictions to be able to exchange information, they must have an intergovernmental agreement – a so-called Competent Authority Agreement (CAA) – in place.

Status of commitments

More than 100 jurisdictions have committed to the implementation of AEOI. However, the enforcement is subject to local law and needs to be enacted by every single jurisdiction.

The list with current status of commitments can be found here.

Effective date

Jurisdictions committed to undertake first exchanges by 2017 (early adopter jurisdictions) are expected to implement the due diligence procedures as of 1 January 2016.

Jurisdictions committed to undertake first exchanges by 2018 (late adopter jurisdictions) are expected to implement the due diligence procedures as of 1 January 2017.

For more information on CRS, please refer to the FAQs below.

Additional information is also available via the OECD website, including rules governing tax residence and the status of country commitments.

Foreign Account Tax Compliance Act (FATCA)

The Foreign Account Tax Compliance Act (FATCA) requires all financial institutions (FIs) outside of the United States (U.S.) to report account information belonging to U.S. persons to the U.S. Internal Revenue Service (U.S. IRS).

FATCA may affect you as an Individual or Entity Account Holder if you purchase or hold a policy with Great Eastern that falls within the scope of FATCA requirements. We will contact you to obtain the necessary self-certification form, U.S. IRS W series form and supporting documents (where applicable) if you are affected.

For more information on FATCA, please refer to the FAQs below.

You can also refer to the IRAS FAQs. Additional information is also available via the IRAS website.

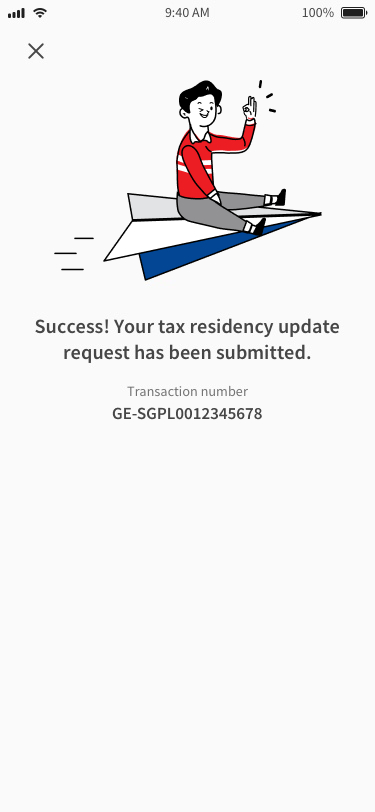

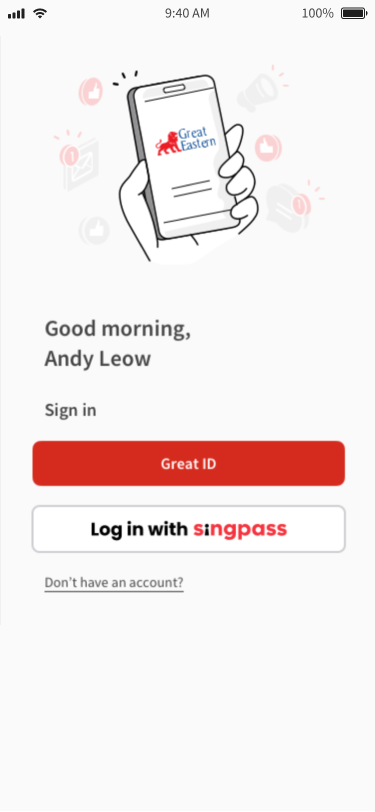

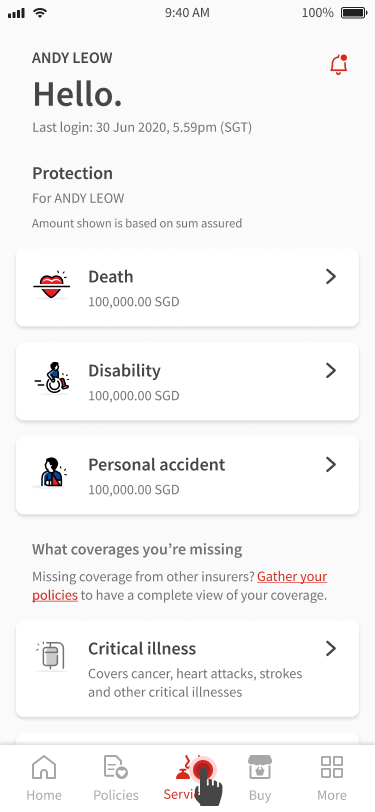

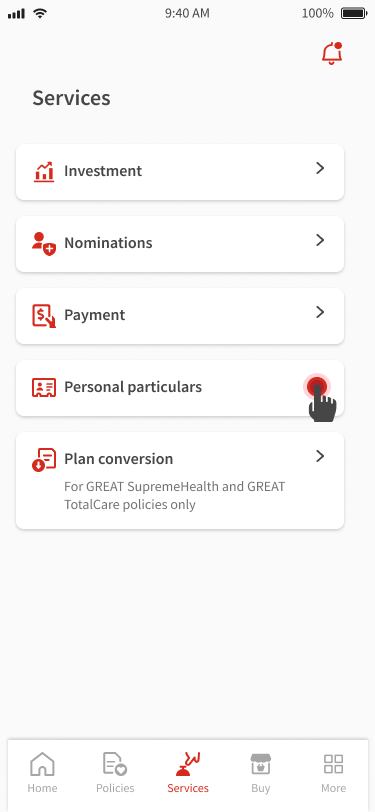

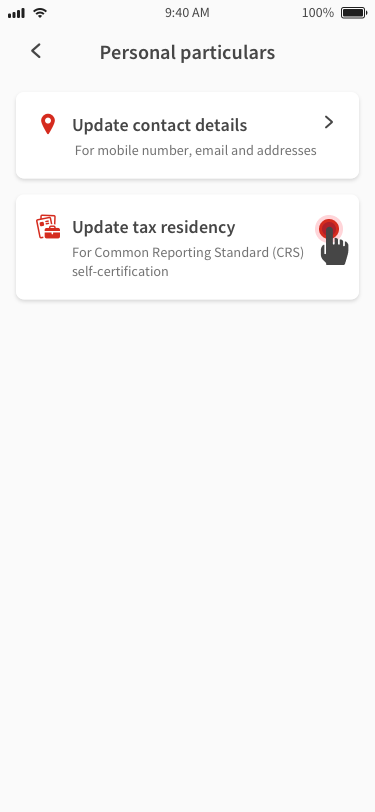

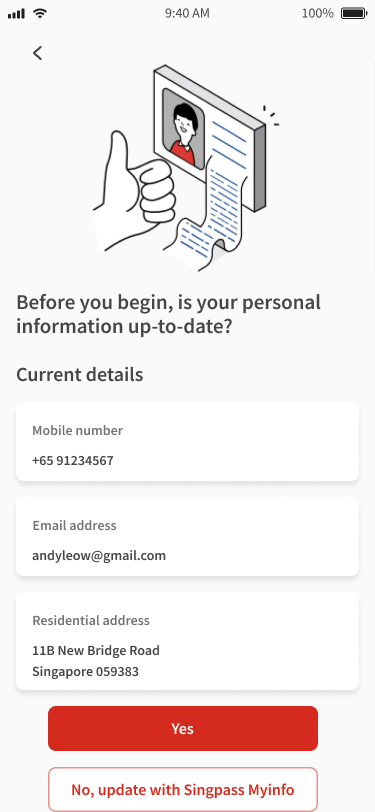

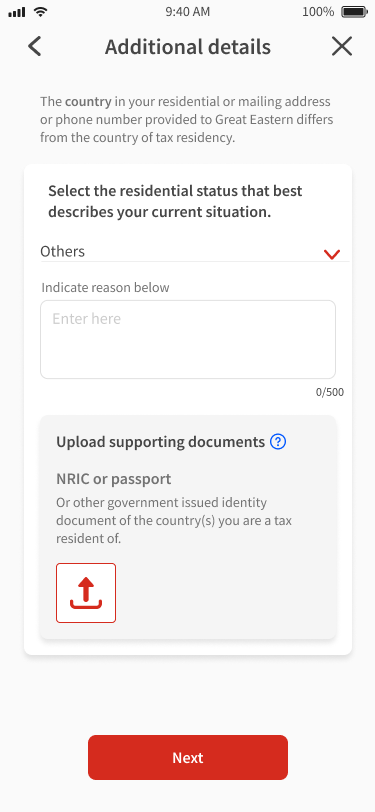

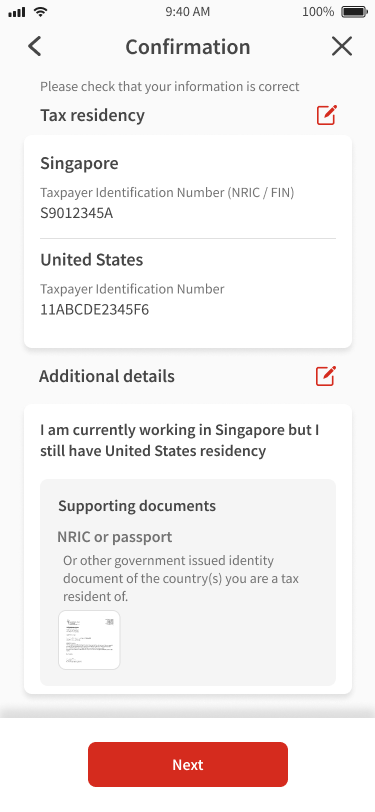

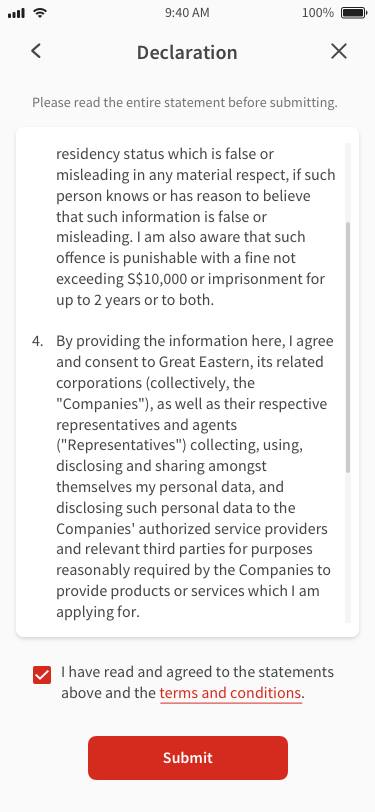

How to submit tax declaration

- Great Eastern App

- Email and post