Top concerns for new parents during pregnancy

Find out from new parents about the pressing concerns they face during pregnancy

What are some of the most pressing concerns new parents face during pregnancy? We sat down with five new parents to uncover them.

Pregnancy is a transformative journey marked by joy and anticipation. But it also comes with a long list of do’s and don’ts to safeguard the health and nutrition of both mother and baby. Navigating the world of prenatal care, delivery, and postpartum services can be very daunting for first-time parents.

To better understand the anxieties and concerns of expectant parents, we spoke with a group of first-time parents about their biggest concerns during their pregnancy journeys.

Q: What were you most concerned with when it comes to pregnancy and childbirth?

Concerns about the health and well-being of both mother and baby, the complexities of labour, and the responsibilities of parenthood were the overarching worries expressed by the new parents.

“I was worried about baby abnormalities, whether there would be visible problems or deformities, and even suffering a miscarriage,” shared Winston*, a first-time father to a seven-month-old boy. Other new mothers Andrea* and Melissa* shared that they were particularly concerned about contracting gestational diabetes, a condition where the mother’s body is unable to produce enough insulin to meet the extra needs of pregnancy which could lead to the baby having low blood sugar or risk of obesity and diabetes when they get older.

Above all, the new parents seemed the most concerned with the health and well-being of their baby. Three out of five parents expressed that they were primarily concerned with their baby being born with a congenital condition or requiring additional medical care after being born. With approximately 15 in 100 pregnancies resulting in complications, which could have long-lasting effects if not immediately addressed, it is understandable why this would be at the forefront of most new parents' minds.

Q: What measures did you take to protect yourself during pregnancy and childbirth?

With the rising cost of having and raising a child in Singapore, maternity insurance has become a consideration for many new parents. This sentiment was echoed by all the new parents we spoke to. They choose to purchase a maternity insurance plan as such plans offer a financial safety net against unexpected, and often mounting, medical costs associated with pregnancy and childbirth.

When asked about how they went about choosing their maternity insurance coverage, the new parents had differing approaches.

Some new moms Farah* and Andrea* prioritised “how extensive the coverage on pregnancy complications was” and picked plans based on their “coverage of common illnesses”. Other moms like Vivian* preferred fuss-free maternity coverage and preferred a standalone plan.

“I think we ended up picking one that could be converted into life insurance for the child after the delivery if there were no complications,” expressed new dad Sam*. This was seconded by other new parents, who mentioned that guaranteed life insurance coverage for their baby was a pull factor that led them to ultimately purchase their maternity insurance plans.

Introducing Great Eastern’s GREAT Maternity Care 2 – a plan to meet your maternity insurance needs

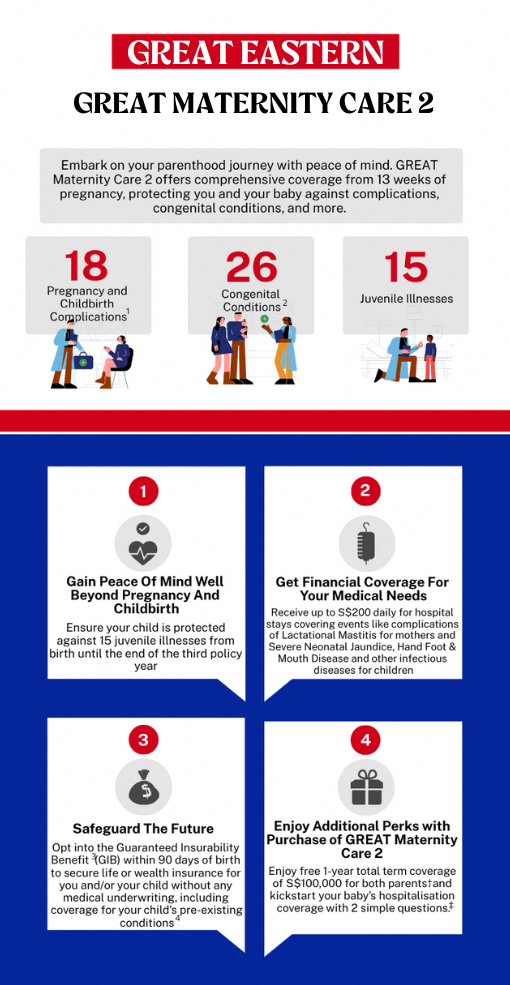

If you, too, are an expectant parent and shopping around for maternity insurance plans, look no further. Great Eastern’s GREAT Maternity Care 2 plan is one of the best plans available when it comes to maternity insurance coverage, as it covers 18 pregnancy and childbirth complications1 and 26 congenital conditions2 . The conditions covered include conditions like Gestational Diabetes and their related complications^, which new moms Andrea and Melissa previously expressed concern for.

On top of that, Great Eastern’s GREAT Maternity Care 2 plan insures against 15 juvenile illnesses, such as Addison’s Disease and Insulin Dependent Diabetes Mellitus from birth until the end of the third policy year, so you can have peace of mind that your child is adequately protected during their infancy and toddler years.

Besides coverage for pregnancy complications, GREAT Maternity Care 2 also offers hospital care benefits

Purchasing a maternity insurance plan can help to defray some of the unexpected costs that often come with childbirth.

“I was concerned about any unexpected medical expenses (to be incurred) during delivery or during my stay at the hospital,” expressed Vivian. Winston echoed this sentiment, stating that his main financial concern was the possibility of having a premature birth, which requires his baby to stay in the Neonatal Intensive Care Unit (NICU).

Thankfully, Great Eastern’s GREAT Maternity Care 2 plan has you covered under these circumstances.

The plan’s hospital care benefit allows parents to receive 2% of the sum assured for each day that either mother or baby is hospitalised due to covered hospitalisation events. These include any of the 18 pregnancy and childbirth complications, 26 congenital conditions and 15 juvenile illnesses as well as complications like surgical site infection following a C-section, or your baby needing to be admitted to the NICU.

“I was able to receive a payout from GREAT Maternity Care 2 when my baby was admitted into the NICU for 11 days,” Vivian shared, referring to the time when her baby had a condition called “wet lungs”. This cash payout can help parents alleviate some of the hospital expenses related to their baby’s hospital stay and take some of the mental load off when it comes to finances.

Protect your baby with life insurance coverage

On top of that, the GREAT Maternity Care 2 plan gives parents the option3 to purchase an eligible life or wealth insurance plan for the mother or the insured baby without any medical underwriting within 90 days from the birth of the child, a perk which many new parents have expressed interest in.

Under this option from GREAT Maternity Care 2, your child would be covered for any pre-existing conditions4 they may have been diagnosed with prior to purchasing the life insurance plan. In addition, you will even be eligible to receive up to S$100 cash reward§ when you sign up for selected insurance plans!

Take Advantage of the SG60 Family Campaign

Parenthood comes with many new baby-related errands and financial responsibilities.

“As we are first-time parents, there were many basic necessities for caring of the baby and postnatal care that we missed out on and rushed to buy online,” lamented new dad Sam.

Even on that front, Great Eastern has you covered. Sign up for the SG60 Family Campaign if you are expecting and take advantage of the campaign perks to make your transition to parenthood smoother. (You don’t even need to buy a Great Eastern GREAT Maternity Care 2 plan to participate!)

As part of the SG60 Family Campaign, you can enrol in the baby home vaccination programme at zero cost. Doing so will save you the hassle of going down to your doctor’s office to get your baby’s necessary vaccinations as you can get them done from the comfort of your home.

You will also get a 1-year family insurance coverage for you, your spouse and your newborn with an accidental death benefit of S$5,000 or medical reimbursement of $200 due to hospitalisation for Dengue or Hand, Foot and Mouth Disease.

The cherry on the cake is the slew of discounts for mummy and baby products and services you can get through the SG60 Family Campaign. Parents can receive S$400 in SG60 Family Gift Credits in total for each registered child aged 16 and below. Use your Gift Credits to offset 10% of your first premium payment on selected plans.

Find out more about the SG60 Family Campaign.

Conclusion

Maternity insurance can offer expectant parents peace of mind by providing financial security and alleviating worries about unexpected medical expenses. With its comprehensive coverage, Great Eastern’s GREAT Maternity Care 2 can empower parents-to-be to focus on their and their baby’s health and well-being, easing anxieties about pregnancy and ensuring a smoother transition into parenthood.

Learn more about the GREAT Maternity Care 2 plan today!

Footnotes:

* Names have been changed for privacy reasons.

^ GREAT Maternity Care 2 provides coverage on Gestational Diabetes resulting in Foetal Macrosomia and Neonatal Hypoglycaemia

1 The Pregnancy and Childbirth Complications Benefit is only payable once regardless of the number of foetuses.

2 If the mother is carrying twins, the Congenital Illness Benefit is payable once for each child respectively.

3 The Guaranteed Insurability Benefit (GIB) option can only be exercised once for the mother, and once for the newborn. GIB option must be exercised within 90 days from the birth of the child. The list of eligible plans, and the maximum sum assured limit per life per plan that can be purchased on the life of the mother and/or the newborn are subject to change as determined by Great Eastern. The list of eligible plans excludes all hospitalisation plans such as GREAT SupremeHealth and GREAT TotalCare. The precise terms and conditions of the insurance plan are specified in the policy contract.

4 If the insured child is diagnosed with a covered condition as a result of a pre-existing condition before he/she attains 6 years old, we will pay out the claim subject to an overall limit of S$30,000. Claim payout due to pre-existing conditions is only payable once, coverage (if any) will continue with reduced sum assured and premium.

‡ For simplified application of hospitalisation plans for GREAT Maternity Care campaign, terms and conditions of the campaign apply. Applicable to child born on/after 37 gestational weeks and be at least 15 days old and discharged from hospital but not more than 90 days old at the point of application. Any Pre-existing Condition from which the Life Assured is suffering prior to the effective date of the eligible plans will not be covered. Please refer to the precise terms and conditions of the eligible plans specified in their respective policy contracts.

§ Terms and conditions for New Parents 2024 Consumer Promotion and other promotions/campaigns for selected insurance plans can be referred to on Great Eastern's website.

Disclaimers:

Source: Content has been developed by ValueChampion. Great Eastern does not own or claim any rights to the content shared.

This post was written in collaboration with ValueChampion.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

The information presented is for general information only and does not have regard to the specific investment objectives, financial situation or particular needs of any particular person.

You may wish to seek advice from a financial adviser before making a commitment to purchase this product. If you choose not to seek advice from a financial adviser, you should consider whether this product is suitable for you.

As this product has no savings or investment feature, there is no cash value if policy ends or is terminated prematurely.

This policy is protected under the Policy Owners’ Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC). Coverage for your policy is automatic and no further action is required from you. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact us or visit the Life Insurance Association (LIA) or SDIC websites (www.lia.org.sg or www.sdic.org.sg).

Information correct as at 25 February 2025.

Let us match you with a qualified financial representative

Our financial representative will answer any questions you may have about our products and planning.