Invest with your SRS funds

A Supplementary Retirement Scheme (‘SRS’) account can be opened with any of the 3 local banks and this is the start towards a journey to save for your retirement. At the same time, contributions towards the SRS account provide dollar-for-dollar tax relief, capped at S$15,300 for Singaporeans and Permanent Residents, and S$35,700 for foreigners. While there is enough information out there to explain why it is important to open a SRS account, there probably isn’t enough that touts the importance of investing your SRS funds. Do you know that it is also possible to invest your SRS funds such that it may potentially grow to an adequate amount for retirement besides consistent contributions itself?

How To Make Your SRS Funds Work Harder For You

Most of us envisage a certain lifestyle during retirement and to protect your dreams, it is important to ensure that your money works harder for you. Viewed from this perspective, SRS funds as a pool of money really should be treated no differently. Unlike CPF contributions (2.5% to 4% interest rate annually), SRS funds earn a 0.05% interest rate. It is therefore important to invest your SRS funds to ensure:

1. Current phenomenon of runaway inflation does not erode your standard of living during your golden years.

2. Power of compounding works in your favour by starting your investment journey as early as possible.

You can invest your SRS funds into a variety of financial instruments depending on your risk appetite and time horizon. Eligible investment products that can be invested using SRS funds include low-risk instruments such as fixed deposits to more volatile asset classes such as stocks and ETFs. For those who wish to diversify beyond shares and unit trust funds, another alternative that can be considered is an insurance endowment plan.

GREAT Prime Rewards

GREAT Prime Rewards by Great Eastern is one such insurance endowment plan that can be purchased using SRS funds. This single premium participating endowment plan gives you a steady stream of annual cash payouts that can help secure your financial future. Upon reviewing its brochure, noteworthy benefits are:

• Flexibility to choose how long you wish the annual income stream to last - 10, 15, 17 or 20 years - to best suit your financial needs and goals

• You can also choose to accumulate the cash payouts to earn additional interest.

• 100% capital guarantee1 from the end of policy year 5 so that you can save with assurance

• Guaranteed issuance as no medical assessment is needed

• Coverage against Death, Total & Permanent Disability and Terminal Illness

Diagram 1 illustrates how Ann takes full advantage of the flexibility accorded by GREAT Prime Rewards (5+15) policy with an accumulation period of 5 policy years and payout period of 15 policy years.

1Capital guarantee at the end of the 5th policy year is on the condition that no policy alterations are made.

The above figures are based on an Illustrated Investment Rate of Return (IIRR) at 4.25% per annum under the accumulation option. Based on an IIRR at 3.00% per annum, the total surrender value and accumulated payouts at end of policy year 1, 5, 10 and 20 are S$12,852, S$15,950, S$17,307, and S$21,567 respectively.

The prevailing accumulation interest rate is 3.00% per annum based on an IIRR at 4.25% per annum and 1.50% per annum based on an IIRR at 3.00% per annum. This rate is not guaranteed and can be changed from time to time.

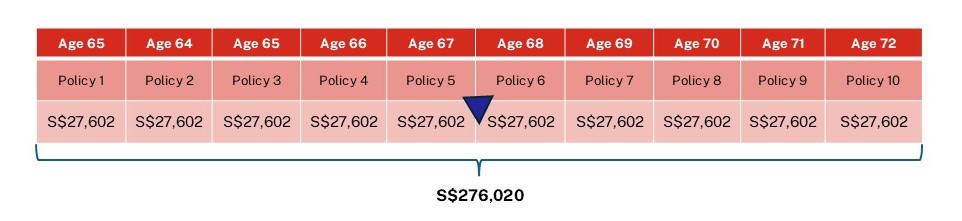

To expand on Ann’s example further, if she chooses to purchase a GREAT Prime Rewards (5+15) policy every year for the next 9 years, she can look forward to receiving an annual lump sum payout from age 63 to 72 as shown in Diagram 2, based on an IIRR at 4.25% p.a. under the accumulation option. The total premiums paid would be S$153,000 based on (S$15,300 X 10 years) whereas the cumulative illustrated payouts would be S$276,020 instead (S$27,602 X 10 years). This annual cashflow can be a key pillar of income to supplement her retirement payouts.

(Note: policyholder can withdraw the funds from her SRS account upon the retirement age)

The above figures are based on an IIRR at 4.25% p.a. under the accumulation option. Based on an IIRR of 3.00% p.a. under the accumulation option, the potential annual payout from age 63 to 72 would be S$20,810.

Diagram 2: 10 consecutive matured policies of GREAT Prime Rewards (5+15)

To summarise, buying GREAT Prime Rewards with SRS funds not only allows you to save with assurance, it also secures your financial future during retirement with a regular stream of income.

What You Need To Know When You Withdraw Your SRS Funds

As your SRS funds grow, here are some important rules that you need to know as you begin to enjoy the fruits of your labour.

1) Only withdraw your SRS funds after the statutory retirement age

If withdrawals are made after the statutory retirement, a 5% penalty on the amount withdrawn will not be applicable over 10 years starting from the date of your first withdrawal. In addition, only 50% of amount withdrawn is subject to tax. On the contrary, the entire amount withdrawn before the statutory retirement age will be subject to tax and a 5% penalty.

2) Withdraw a maximum of S$40,000 a year over 10 years

According to the current IRAS tax structure, the first S$20,000 of chargeable income will not be taxed. You can potentially withdraw S$40,000 a year (assuming you have reached the statutory retirement age and have no other reported income for that financial year) over the next 10 years without paying any income tax as only 50% of the withdrawn amount will be chargeable.

Even if the SRS member has endowment policies at the end of the 10-year withdrawal period, there is no need to close the SRS account nor to surrender the policy. The surrender value determined by the insurance company will be deemed to have been withdrawn and added to the policyholder’s chargeable income for that year.

Conclusion

SRS can help to instil investment discipline and a long-term investing mindset since early withdrawals are penalised. We can invest our SRS funds in Single Premium Insurance Products such as GREAT Prime Rewards to stave off inflation and protect our retirement dreams. At the same time, as we edge closer to retirement, we should also plan our post-retirement SRS withdrawals properly to enjoy tax-free withdrawals. Doing both elements well will lead to a better retirement outcome for you!

*Disclosure: This article is written in collaboration with Great Eastern. It is for information only and reflects my opinion and not that of Great Eastern.

Footnotes and Disclaimers:

All ages specified refer to age next birthday.

All figures used are for illustrative purposes only and are subject to rounding.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

The above is for general information only. It is not a contract of insurance. The precise terms and conditions of this insurance plan are specified in the policy contract.

As buying a life insurance policy is a long-term commitment, an early termination of the policy usually involves high costs and the surrender value, if any, that is payable to you may be zero or less than the total premiums paid.

The information presented is for general information only and does not have regard to the specific investment objectives, financial situation or particular needs of any particular person.

You may wish to seek advice from a financial adviser before making a commitment to purchase this product. If you choose not to seek advice from a financial adviser, you should consider whether this product is suitable for you.

Protected up to specified limits by SDIC.

Information is correct as at 15 November 2024

Let us match you with a qualified financial representative

Our financial representative will answer any questions you may have about our products and planning.