#Finance101: Achieve your financial aspirations

SMART goal setting to achieve financial freedom

Partner content: Content has been reproduced with the permission of, and is wholly owned by OCBC. Great Eastern does not own or claim to own any rights to the content shared.

If you only have a minute to spare:

- In life, we all have many goals and aspirations, be in short or long-term. However, becoming financially independent may not necessarily equate to us fulfilling our lifelong dreams.

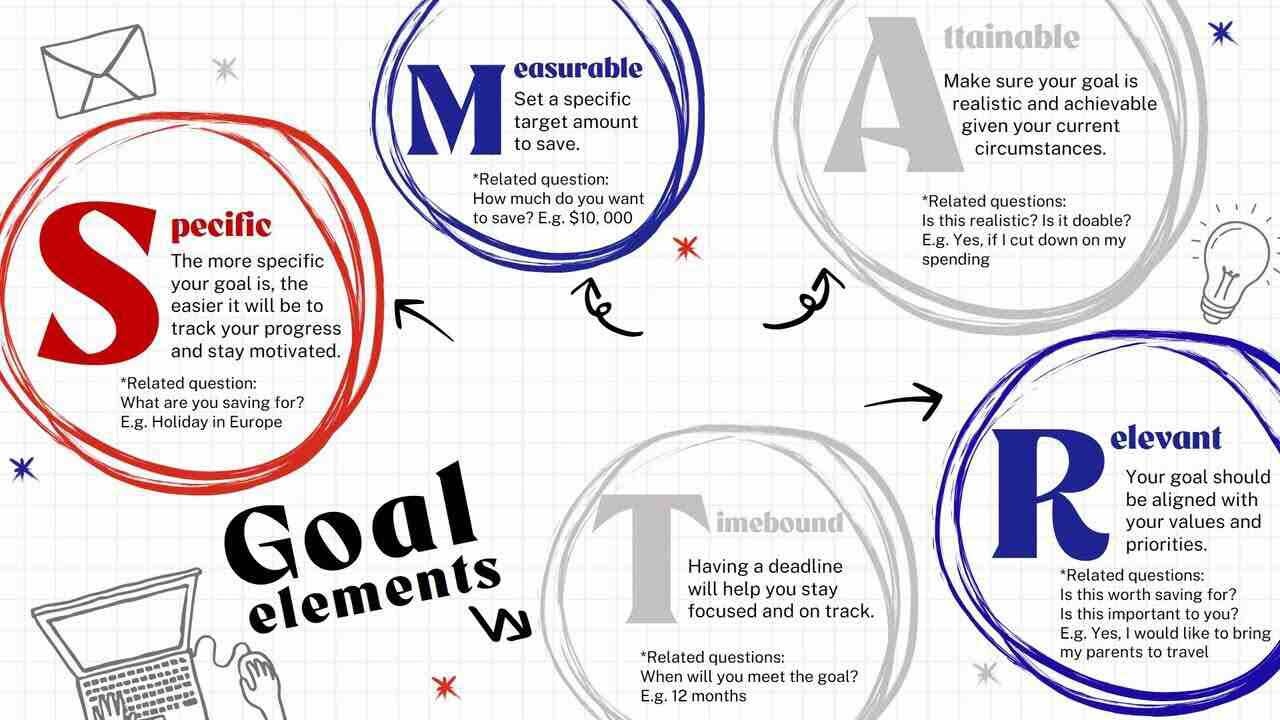

- Our priorities often shift as we enter a new life stage in life. To help us better achieve our financial aspirations and ideal future, it is thus critical for us to plan “SMART” – Specific, Measurable, Attainable, Relevant, Timebound.

An Exciting Time?

Stepping into the workforce is certainly exciting and thrilling. Not only does it mark the beginning of having a monthly income, but it also symbolises financial freedom i.e., no more constant nagging from your parents on how you choose to spend your money.

Going on an unforgettable vacation? Purchasing your dream car? Moving out and having a space of your own?

The possibilities are endless. Yet, this new beginning is not all roses. Rather, it comes with the extra responsibilities of footing your own bills, expenses, and most importantly, being accountable for your own personal finances while staying on track with your financial aspirations.

How You Can Plan “SMART”

Did you know that globally on average, 84% do not have any goals set, and among the remaining with goals, only 3% are reported to have achieved their goals .

But you can be different. Stay on track with your long-term financial goals by employing an effective goal-setting strategy i.e., SMART Goals.

To help you understand better, let us take the example of saving up for the purpose to realise your lifelong dream vacation to Europe.

Still hesitant on whether the SMART Goals is effective? It may help to know that the 3% reported to have achieved their goals have adopted a clear, written, specific, measurable and time-bounded approach. Most importantly, these people are known to accomplish ten times as much as those with no goals at all.

Conclusion

With a clear action plan, we can better identify the specific actions to take towards achieving our goals. Of course, the SMART goal strategy may not only be used for planning that dream holiday of yours.

You can easily adopt the same step-by-step strategy be it towards helping you to retire “SMART”, ensuring you can retire comfortably, or even in planning for longer-term aspirations such as building of your wealth.

Start your journey here.

Let us match you with a qualified financial representative

Our financial representative will answer any questions you may have about our products and planning.