Key benefits

-

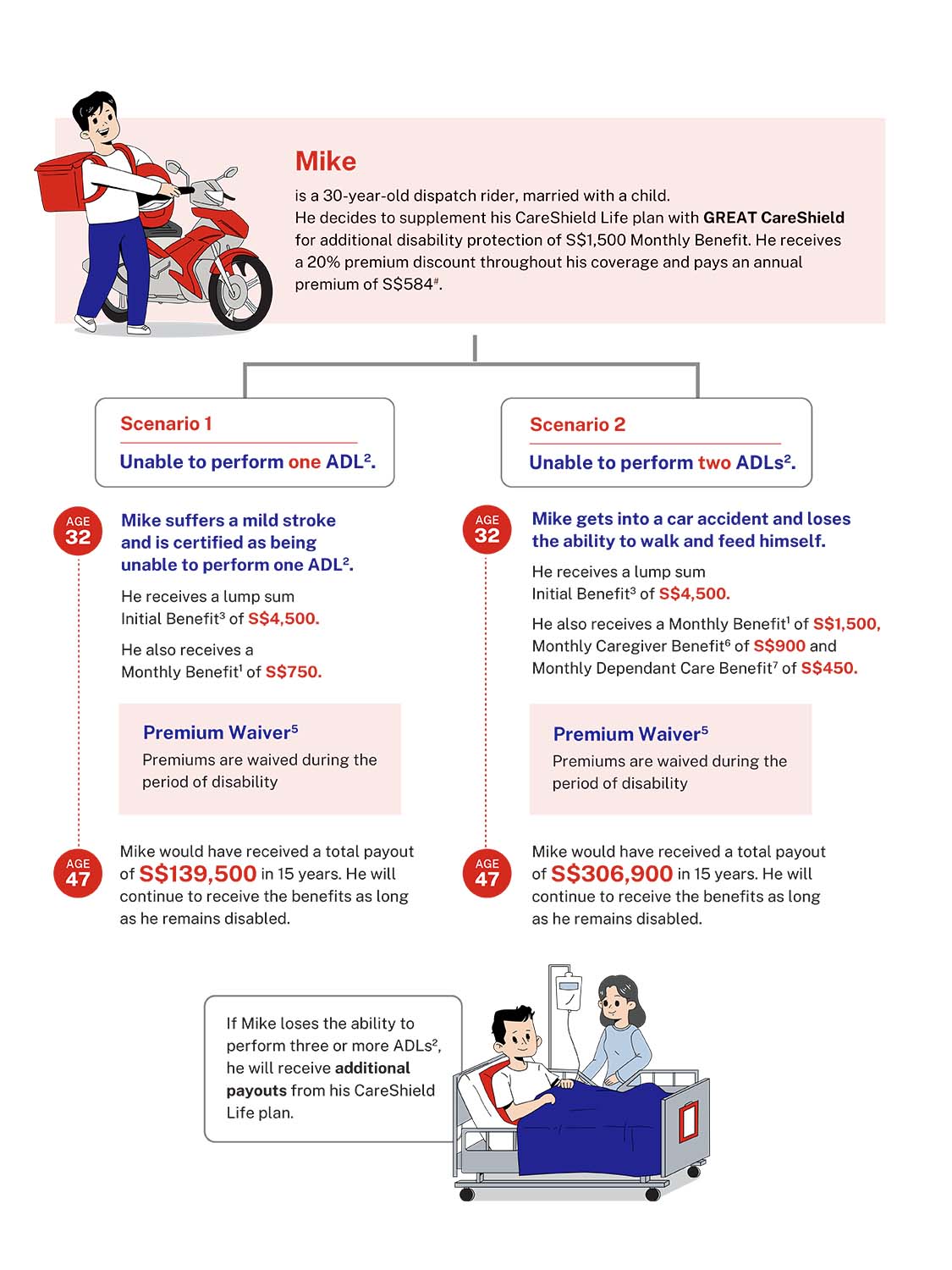

Disability financial support starts from the inability to perform any ADL

Receive monthly payouts and a lump sum Initial Benefit3 of up to S$15,000 to support your daily expenses and long-term care. Your future premiums will also be waived5.

-

Get up to 90% more in monthly benefits for caregiver's and children's expenses

Upon the inability to perform at least 2 ADLs, you will receive an additional 60% of the Monthly Benefit in monthly payouts for caregiving support6 and an additional 30% of the Monthly Benefit in monthly payouts to provide for your child7.

-

Utilise your MediSave funds4 for enhanced coverage

No additional cash premium top-ups may be needed as GREAT CareShield can be paid with your MediSave funds, up to a limit of S$600 per calendar year per insured person. Whilst you are still young, start your disability coverage with lower premium rates8 that will not increase with age.

What you need to know about Disability

Your questions answered

1. What is GREAT CareShield?

GREAT CareShield is a MediSave-approved supplementary plan to your CareShield Life or ElderShield scheme aimed to provide additional long-term care coverage in the event of a disability. It provides payouts and benefits starting from as early as the inability to perform just 1 Activity of Daily Living (ADL).

To check your CareShield Life or ElderShield coverage and premium, please visit www.careshieldlife.gov.sg

2. What is the Monthly Benefit that I can purchase?

You may select a Monthly Benefit from S$300 to S$5,000# (in multiples of S$10).

This amount is in addition to the benefits under your CareShield Life or ElderShield.

# Please note the maximum Monthly Benefit per Life Assured aggregated across your existing LifeSecure and/or ElderShield Comprehensive plan(s), if any, including your GREAT CareShield, shall not exceed S$5,000.

3. Will my premiums increase with age?

No, your premiums are level throughout the premium payment term chosen and do not increase as you get older. However, the premiums rates are not guaranteed and may be adjusted based on future experience of the plan.

4. How long does GREAT CareShield cover me for?

GREAT CareShield provides coverage for life as long as your premium obligations are being fulfilled.

5. Do I need to be covered under the CareShield Life scheme in order to purchase GREAT CareShield?

Yes. In order to be eligible to purchase GREAT CareShield, you will need to be insured under one of the following schemes:

- CareShield Life; or

- ElderShield 400/ElderShield 300.

6. Do I need to go for a medical examination to be covered under GREAT CareShield?

You do not need to go for a medical examination if your selected Monthly Benefit is S$3,000 and below. For Monthly Benefit between S$3,100 and S$5,000, you will be required to undergo a medical examination#.

# If you hold other Great Eastern long-term care products such as LifeSecure and ElderShield Comprehensive and the aggregated Monthly Benefit for GREAT CareShield and LifeSecure and/or ElderShield Comprehensive exceeds S$3,000, you will be required to undergo medical examination.

7. I have previously opted out of ElderShield 400/ElderShield 300. Can I purchase GREAT CareShield as a standalone plan?

No. GREAT CareShield may only be purchased if you have an existing CareShield Life or ElderShield 400/ElderShield 300.

To find out how you can get covered under CareShield Life scheme, please visit www.careshieldlife.gov.sg/careshield-life/about-careshield-life.html

8. I have an existing ElderShield supplement. Can I still purchase GREAT CareShield?

Yes, you can purchase GREAT CareShield to top-up your existing ElderShield supplement coverage.

If you intend to use MediSave funds to pay the premiums of GREAT CareShield, you need to be aware that the Additional Withdrawal Limit of S$600 per insured person per calendar year is shared across all ElderShield and CareShield Life supplementary plans.

9. How long do I have to pay premiums for?

The premiums for GREAT CareShield are payable on an annual basis. Depending on your entry age (at last birthday), the selectable premium terms are as follows:

If you are 30 to 47 (age last birthday) when you purchase GREAT CareShield -

Up to and including the Policy Anniversary when you are 67 or 95 (age last birthday)

If you are 48 to 64 (age last birthday) when you purchase GREAT CareShield -

Up to and including the Policy Anniversary when you are 95 (age last birthday) or 20 Years

10. How can I pay for GREAT CareShield?

The premiums for GREAT CareShield may be made payable either using MediSave funds and/or credit card, debit card, GIRO#, cash# or cheque/banker's order#.

For usage of MediSave funds, there is an Additional Withdrawal Limit (AWL) of S$600 per insured person per calendar year. The AWL is shared across any ElderShield and CareShield Life supplementary plans.

# Not available on the online sales portal. Please approach your Financial Representative for these payment options. GIRO payment method is for renewal premiums only.

11. If I do not have sufficient funds in my MediSave, can I use the MediSave of one of my family members?

Yes, you may use the MediSave funds of any of your following family members to pay for your GREAT CareShield premiums#:

- Spouse

- Parents

- Siblings;

- Children; or

- Grandchildren.

# You can only use your own MediSave funds if you purchase GREAT CareShield via the online sales portal. If you wish to use the MediSave funds of your spouse, parents, children, or grandchildren, please approach your Financial Representative. You must be a Singapore Citizen or Permanent Resident.

Please note the following on Additional Premium Support (APS):

- Anyone who pays for, or is insured under GREAT CareShield is not eligible for Additional Premium Support (APS) from the Government*.

- If you are currently receiving APS to pay for your MediShield Life and/or CareShield Life premiums, and you choose to be insured under GREAT CareShield, you will stop receiving APS. This applies even if you are not the person paying for GREAT CareShield.

- In addition, if you choose to be insured under GREAT CareShield, the person paying for GREAT CareShield will stop receiving APS, if he or she is currently receiving APS.

*APS is for families who need assistance with MediShield Life and/or CareShield Life premiums, even after receiving premium subsidies and making use of MediSave funds to pay these premiums.

12. My premium is more than the S$600 MediSave Additional Withdrawal Limit (AWL). How can I pay the balance in excess of the AWL?

If your premium is more than S$600 and you have chosen MediSave as one of your premium payment options, you will be prompted and offered other options to pay the balance:

- Credit card;

- Debit card;

- GIRO^;

- Cash^; or

- Cheque/banker's order^.

^ Not available on the online sales portal. Please approach your Financial Representative for these payment options. GIRO payment method is for renewal premiums only.

13. When does my policy coverage commence?

Depending on your mode of payment, the commencement date of your policy will vary:

By using MediSave funds as your payment option:

- The review of your application will take up to 3 working days. Your policy will commence once approved.

- Thereafter, we will proceed to deduct the premium from your MediSave account which may take up to 4 weeks from your purchase date.

- If your MediSave funds and withdrawal limit are sufficient to cover your annual premiums, the policy document will be sent to you.

- If your MediSave funds and/or withdrawal limit are insufficient to cover your annual premiums and if you have not selected another payment option, we will send you instructions, by mail, on how to settle any remaining balance. Once full payment is received, the policy documents will be sent to you.

- If full payment is not received, your policy will lapse according to the terms of the policy.

By credit card, debit card, GIRO, cash or cheque/banker’s order only:

- The review of your application will take up to 3 working days. Your policy will commence once approved.

- Thereafter, we will process your payment. Once full payment is received, the policy documents will be sent to you.

- If full payment is not received, your policy will lapse according to the terms of the policy.

Please note that:

- You may receive your policy documents after the commencement date.

- Subject to the terms and condition of the policy, in the event that you are diagnosed with a disability after the commencement date of your policy but before we have received full payment of your first annual premiums, we will not pay any benefits until the full payment of your first annual premiums is received.

14. I’m currently utilizing S$600 from my MediSave account for my ElderShield supplementary plan. Can I utilize an additional S$600 from my MediSave account to fund my GREAT CareShield purchase?

No, the MediSave annual withdrawal limit of S$600 per calendar year is shared across all supplementary plans for CareShield Life and ElderShield.

Note: If you purchase GREAT CareShield (before your ElderShield supplementary plan renewal) using your MediSave funds, your renewal premium on your ElderShield supplementary plan may not be successfully deducted from your MediSave account.

15. I have medical conditions that are not highlighted in the Health Declaration. How do I go about declaring my medical conditions?

To declare your medical conditions, you can either contact your Financial Representative or leave your contact details here.

16. Can I change my premium payment term (for e.g. from “Pay till 67 years” to “Pay till 95 years”) after my policy has commenced?

No, you will not be able to change your premium payment term after your policy coverage has commenced.

17. Are there any condition(s) not covered under the plan?

Yes. The Company will not pay any benefits for any Disability resulting from:

(a) The Life Assured’s deliberate acts that endanger his/her life, such as self-injury, suicide or attempted suicide, while sane or insane;

(b) Alcoholism or drug addiction;

(c) War (whether declared or not), invasion, rebellion, revolution, civil war or any warlike operations; and

(d) Pre-existing Conditions.

“Pre-existing Condition” refers to:

(a) Any illness, disease, disability, defect or impairments (“Condition”) from which the Life Assured was suffering prior to the Cut-Off Date#; or

(b) Any Condition of which signs or symptoms had existed in the 12 months immediately preceding the Cut-Off Date#, for which:

(i) the Life Assured has sought or received medical advice or treatment, prescription of drugs, counselling, investigation or diagnostic tests, surgery, hospitalization; or

(ii) an ordinarily prudent person would have sought medical advice or treatment, prescription of drugs, counselling, investigation or diagnostic tests, surgery, hospitalization,

unless such Condition was declared to the Company and no exclusion of the same was imposed by the Company, regardless of whether any claim had previously been made in respect of such Condition.

# “Cut-Off Date” refers to (1) the Commencement Date, (2) date of reinstatement of the Policy or, (3) date of change of benefits under this Policy, whichever is applicable.

18. If I need to make a claim, what should my family member(s) do?

In the event of a claim, please get your family member(s) to visit here to have a guided process.

19. GREAT CareShield plan offers varying payouts at different severities of disability.

If I suffer from a mild disability (i.e. inability to perform 1 Activity of Daily Living) and it progresses to a moderate disability (i.e. inability to perform 2 Activities of Daily Living), does my family member(s) have to arrange for my medical assessment?

Depending on the severity of disability, Great Eastern will review medical information available and advise you or family member(s) to arrange for periodic assessment/review, where applicable.

If the disability has worsened from the inability to perform 1 Activity of Daily Living (ADL) to the inability to perform 2 ADLs, you will receive start receiving 100% of the Monthly Benefit (instead of 50% of the Monthly Benefit under 1 ADL), the Caregiver Benefit and Dependant Care Benefit (if relevant conditions are met).

20. Will my GREAT CareShield lapse due to non-payment of renewal premiums?

Yes. However, once you have reached the age of 61 years (age last birthday) on a policy anniversary, and your GREAT CareShield has been in force for a period of at least 10 years, the policy shall not lapse for non-payment of a renewal premium. Instead, your policy will be converted into a paid-up policy with a reduced Monthly Benefit and without the need for you to pay any more premiums.

Otherwise, the policy shall lapse for non-payment of a renewal premium.

21. Can I cancel the policy if the plan is not suitable for me?

You may cancel the policy by submitting a written notice of cancellation to us. This policy will end on the date of cancellation as advised in your notice of cancellation or date of our receipt of the notice of cancellation, whichever is later (“Effective Date of Cancellation”).

If the Effective Date of Cancellation falls within 60 days after you receive the policy which first informs you of the commencement date (“Free-Look Period”), we will refund you the premiums you have paid, less any medical fees and other expenses, such as payments for medical check-ups and medical reports, incurred by us. If the Effective Date of Cancellation falls after the Free-Look Period, you will lose all of your premiums paid.

Let our Financial

Representative serve you

We are happy to help you.

Understand the details before buying

1 Subject to Deferment Period. Payouts of Monthly Benefit are payable for as long as the Life Assured suffers from the applicable number of disabilities, up to a lifetime.

2 The 6 Activities of Daily Living (ADLs) are: washing, toileting, dressing, feeding, walking or moving around and transferring.

3 The Initial Benefit is a lump sum payment equivalent to 3 times of the Monthly Benefit. In the event the Life Assured fully recovers from the disability, the Initial Benefit may be paid again for subsequent episodes of inability to perform at least 1 ADL. However, it is not payable if such subsequent disabilities arise from or are related to the cause of disability(ies) for which there was a previous claim for Initial Benefit.

4 Subject to cap of S$600 per calendar year per insured person.

5 Subject to Deferment Period, and for as long as the Life Assured continues to suffer from the disability.

6 Caregiver Benefit is subject to Deferment Period and payable for up to a maximum of 12 months (whether consecutive or not) per Policy Term.

7 Dependant Care Benefit is applicable if the Life Assured has a Child who is below 22 years old (age last birthday) as at the Claim Date; subject to Deferment Period and payable for up to a maximum of 48 months (whether consecutive or not) per Policy Term.

8 Premium rates are not guaranteed and they may be adjusted from time to time based on future experience.

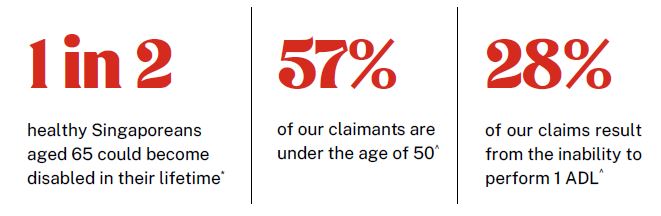

* Source: https://www.careshieldlife.gov.sg/careshield-life/about-careshield-life.html

^ Great Eastern's GREAT CareShield claims data (10 Oct 2021 – 19 Jan 2023).

∆ The promotion is available till 31 October 2025. The 40% first-year premium discount is applicable with a minimum qualifying premium of S$1,000, excluding premium loadings (if any) and the prevailing rate of GST. Please refer to the full terms and conditions of the Consumer Promotion for information.

# Up to and including Policy Anniversary when the Life Assured is age 95 last birthday. Premium includes the prevailing rate of GST. The prevailing rate of GST is subject to change.

‡ Based on a 180-month period (15 years) after the Deferment Period ends.

All ages specified refer to age last birthday.

Figures illustrated are rounded down to the nearest dollar.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

The above is for general information only. It is not a contract of insurance. The precise terms and conditions of this insurance plan are specified in the policy contract.

GREAT CareShield can be purchased by CareShield Life or ElderShield policyholders. All Supplements are regulated under the CareShield Life and Long-Term Care Act 2019.

This is only product information provided by us. You may wish to seek advice from a qualified adviser before buying the product. If you choose not to seek advice from a qualified adviser, you should consider whether the product is suitable for you. Buying health insurance products that are not suitable for you may impact your ability to finance your future healthcare needs. If you decide that the policy is not suitable after purchasing the policy, you may terminate the policy in accordance with the free-look provision, if any, and the insurer may recover from you any expense incurred by the insurer in underwriting the policy.

This policy is protected under the Policy Owners’ Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC). Coverage for your policy is automatic and no further action is required from you. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact us or visit the Life Insurance Association (LIA) or SDIC websites (www.lia.org.sg or www.sdic.org.sg).

In case of discrepancy between the English and Chinese versions, the English version shall prevail.

Information correct as at 23 May 2025.