Choose your preferred type of hospital when hospitalisation is required

Let our Financial

Representative serve you

We are happy to help you.

Your questions answered

1. What is MediShield Life?

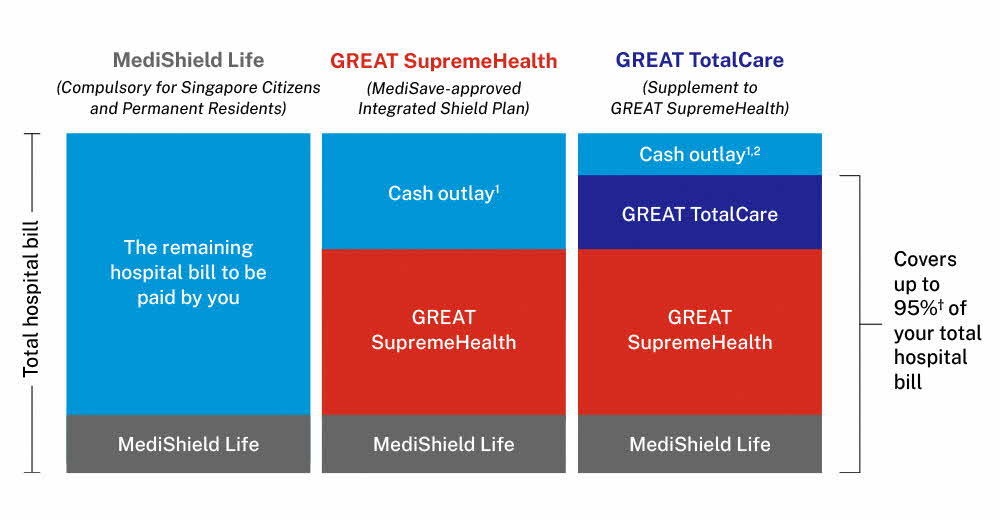

MediShield Life is a compulsory basic health insurance plan, administered by the Central Provident Fund (CPF) Board, that provides Singapore Citizens and Permanent Residents with universal and lifelong protection against large hospital bills and selected costly outpatient treatments, such as dialysis and chemotherapy for cancer, regardless of age or health condition.

MediShield Life is sized for subsidised Class B2/C bills in public hospitals and pegged at B2/C-type wards. Hence if you choose to stay in a higher hospital ward class such as A/B1-type ward or in a private hospital, MediShield Life payout will cover only a proportion of your bill and you would need to draw on your MediSave funds and/or cash to pay the balance.

2. What is GREAT SupremeHealth?

GREAT SupremeHealth is an Integrated Shield Plan that provides higher coverage and benefits that are not included under MediShield Life.

GREAT SupremeHealth is made up of 2 components:

- MediShield Life portion managed by the Central Provident Fund (CPF) Board, and

- An additional private insurance coverage provided by The Great Eastern Life Assurance Company Limited.

By purchasing GREAT SupremeHealth, you will enjoy the combined coverage of MediShield Life and GREAT SupremeHealth. Your GREAT SupremeHealth premium includes both the MediShield Life premium and the additional private insurance coverage premium.

3. Do I still need to buy GREAT SupremeHealth if I am already covered under MediShield Life or company’s medical insurance?

You can consider getting GREAT SupremeHealth to complement your MediShield Life coverage or company’s medical insurance if you prefer higher benefit limits and hospital ward class.

Your company’s medical insurance coverage might cease too when you leave your job but with GREAT SupremeHealth, you will be covered for a lifetime.

4. When is an appropriate time to buy GREAT SupremeHealth?

It will always be useful to get coverage as early as possible. The younger you are, the more likely you are to be in good health and able to buy GREAT SupremeHealth without exclusions on any pre-existing medical conditions.

Even with a healthy lifestyle, unexpected events such as an accident that leads to a hospital stay may deplete your savings. Thus, getting GREAT SupremeHealth would help to cover your medical bills to protect your hard-earned savings.

5. Which GREAT SupremeHealth plan should I consider purchasing?

You should consider your medical care preferences before making a plan purchase, that includes ward preferences, ability to choose your preferred doctors or hospitals and the affordability of premiums over the longer-term. Please speak to our Financial Representative who will be able to share more about your options.

6. Can MediSave funds be used to pay for GREAT SupremeHealth?

GREAT SupremeHealth is a MediSave-approved Integrated Shield plan and premiums are payable using MediSave funds up to the Additional Withdrawal Limits based on age. Any premium excess would need to be paid in cash. You may refer to the Ministry of Health of Singapore’s website for the prevailing MediSave Additional Withdrawal Limits.

7. MediShield Life covers me regardless of my health conditions, will GREAT SupremeHealth cover my pre-existing conditions too?

Universal healthcare coverage provided by MediShield Life protects Singapore Citizens and Permanent Residents for life, regardless of pre-existing conditions. Such costs of covering pre-existing conditions are shared with the community with the Government supporting the cost of extending MediShield Life coverage to all Singapore Residents.

Unlike MediShield Life, Integrated Shield Plans such as GREAT SupremeHealth do not provide coverage for pre-existing conditions. Hence, these pre-existing conditions will continue to be excluded from the additional private insurance coverage portion under your GREAT SupremeHealth plan.

2. Which GREAT TotalCare plan should I consider if I have a GREAT SupremeHealth plan?

GREAT SupremeHealth Plan Type |

Corresponding GREAT TotalCare Plan Type |

P Plus |

P Signature |

P Prime |

P Prime |

A Plus |

A; or |

B Plus |

B; or |

3. Can I use my MediSave to pay for GREAT TotalCare?

1. What is the pro-ration factor?

Our Integrated Shield plans (IPs) are designed to provide coverage based on the policyholder’s intended ward class, while offering the flexibility to use the plan for higher or lower ward classes, if needed.

If a policyholder of our restructured hospital plans chooses to be admitted to a higher class of wards/ hospitals than what his/her plan type was intended to cover, a pro-ration factor will apply.

The original bill amount will be adjusted by applying a pro-ration factor, which is based on a projected difference between the cost of a higher ward class that one is in, and what his/her plan was intended to cover. The pro-rated bill will approximate what it would have been, if one had received the treatment according to his/her intended plan coverage.

2. How do we apply such pro-ration factor?

To derive the proportion of the original bill that would be considered for IP claims payout, the original bill amount will be multiplied by the pro-ration factor. Thereafter, we will deduct the Deductibles (where applicable) from the bill, and reduce it proportionately by the Co-insurance. The balance of the bill will be subject to the applicable benefit limits and annual benefit limit.

3. What is the pro-ration factor applicable for admission to higher wards / hospitals than plan entitlement?

| For new business | on and from 1 October 2024 onwards | |

| Plan Type | A PLUS | B PLUS |

| Ward Class Entitlement | Restructured Hospital, Class A Wards & lower | Restructured Hospital, Class B1 Wards & lower |

| Expenses incurred in Private Hospital / private Community Hospital / private Inpatient Palliative Care Institution / private medical clinic | 35% | 25% |

| Expenses incurred in Restructured Hospital - Class A ward / government-funded Community Hospital - Class A ward / government-funded Inpatient Palliative Care Institution - Class A ward | NA | 70% |

| Expenses incurred in non-subsidised Short-stay Ward / day Surgery / outpatient treatment in Restructured Hospital | NA | 70% |

Note: Please refer to the policy document for full terms and conditions on the pro-ration factors.

What are the drivers of premiums for GREAT SupremeHealth and GREAT TotalCare plans?

Your premiums are used to pay for commissions, claims and other expenses involved in administering your policy†. Please refer to the table for details.

| 2019 | 2022 | |

| Claims^ | 80% | 73% |

| Commissions and distribution* | 16% | 13% |

| Management expenses# | 8% | 5% |

†Based on all long-term accident and health plans, including Integrated Plans and riders.

^Claims refers to gross claims settled divided by gross premiums.

*Commissions and distribution refers to the sum of commission expenses and other distribution expenses divided by gross premiums.

#Management expenses refers to management expenses divided by gross premiums.

The cost of claims would change depending on the claim size and number of claims submitted by policyholders. In the past 3 years, the average bill size has increased by 2% and 20% in public and private healthcare institutions respectively. The number of claims submitted per policyholder had increased by 3%.

Community Hospital is categorised as public healthcare institution. Hospice Care Institution is categorised as private healthcare institution.

Where can I find the comparison of Integrated Shield Plans (IPs) across all insurers?

You may refer to MOH’s website (go.gov.sg/moh-compare-ip) for a comparison of IPs across all insurers, including the estimated premiums you have to pay for an IP over your lifetime.

Understand the details before buying

† Applicable when the GREAT SupremeHealth is attached with either: a) GREAT TotalCare A or GREAT TotalCare B and for bills incurred at Restructured Hospitals of the respective ward class entitlement; b) GREAT TotalCare P Signature and for bills incurred at Panel Providers and/or at Restructured Hospitals; or c) GREAT TotalCare P Prime and for bills incurred at RestructuredHospitals.

1 Cash outlay includes deductibles, co-insurance and any amounts in excess of applicable Benefit Limits. Deductible is the amount which must be borne by the policyholder before any benefit becomes payable under GREAT SupremeHealth. Co-insurance is the proportion of the expenses that needs to be borne by the policyholder after the deduction of the deductible (where applicable).

2 Up to 95% of the deductible is covered under selected GREAT TotalCare plan types. Please refer to the Benefit Table in the policy contract for more information on coverage of the deductible under the different GREAT TotalCare plans.

Terms and conditions apply.

The maximum entry age for GREAT SupremeHealth P Plus, P Prime, A Plus, B Plus and GREAT TotalCare is age 75 years next birthday.

GREAT TotalCare is not MediSave-approved Integrated Shield plans and premiums are not payable using MediSave. GREAT TotalCare is designed to complement the benefits offered under GREAT SupremeHealth.

The above is for general information only. It is not a contract of insurance. The precise terms and conditions of this insurance plan are specified in the policy contracts.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

These policies are protected under the Policy Owners’ Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC). Coverage for your policy is automatic and no further action is required from you. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact us or visit the Life Insurance Association (LIA) or SDIC websites (www.lia.org.sg or www.sdic.org.sg).

In case of discrepancy between the English and the Chinese versions, the English version shall prevail.

Information correct as at 1 October 2025.