Key benefits

-

Achieve wealth accumulation goals with a versatile plan

Invest and take advantage of growth opportunities with flexible premium payment options.

-

Adjust your portfolio according to your changing needs

With no minimum lock-in investing period, have full flexibility to make withdrawals without incurring partial withdrawal charge. Or fund switch at no additional cost1.

-

Invest in a future of potentially greater returns

Enjoy potentially greater returns with a well-diversified range of funds carefully customised for you and managed by award-winning fund managers2.

Let our Financial

Representative serve you

We are happy to help you.

Understand the details before buying

1 Subject to change at any time.

2 Past performance of the fund managers may not be indicative of their future performance.

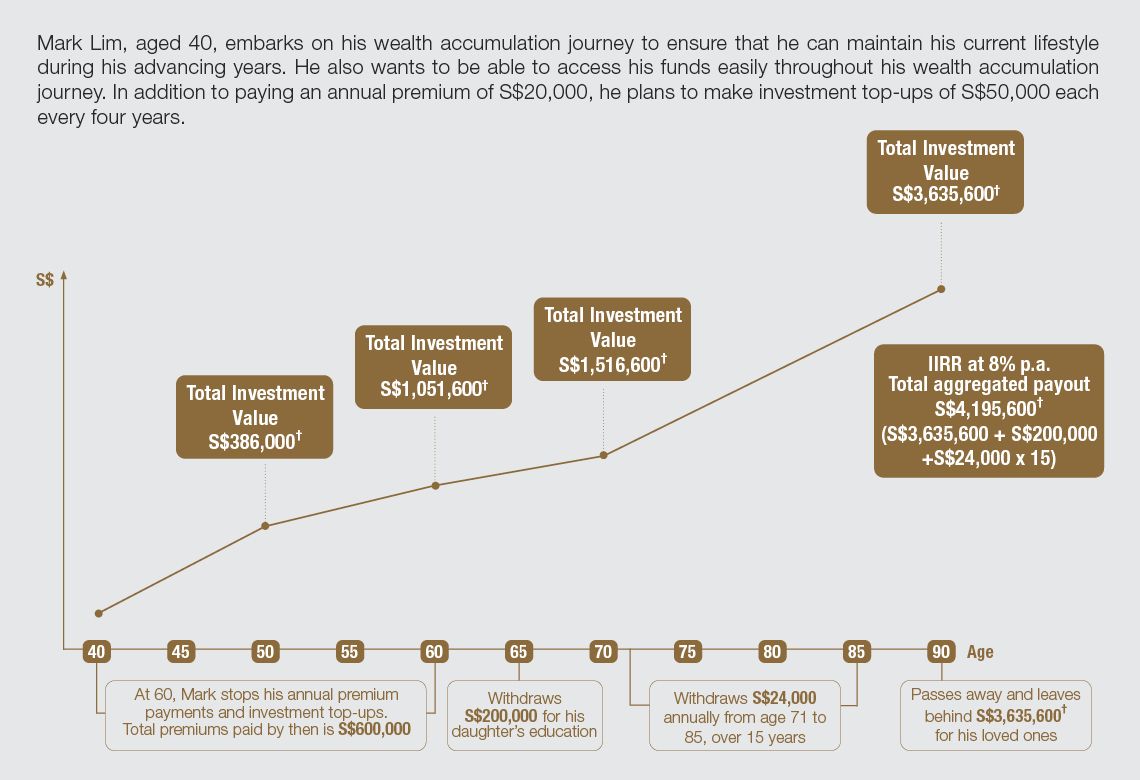

The above illustration is based on a Prestige Portfolio (Regular Premium) policy. All figures in the above illustration are based on Illustrated Investment Rate of Return (IIRR) at 8% p.a. and are rounded to the nearest hundred.

The above illustration is based on wrap fee of 1% p.a. on Total Investment Value and Premium Charge of 2% deducted from each payment of the annual premium and Investment Top-up(s).

* Partial withdrawal limits apply and for customers who have opted for dividend paying funds with cash payouts, in addition to the withdrawals, they may receive cash dividends.

† Potential payout is illustrated based on 50% LionGlobal Singapore Balanced Fund and 50% JPMorgan Investment Funds – Global Income Fund, at IIRR of 8% p.a,.The actual payout payable will depend on the actual performance of the underlying assets of the funds. The performance of the funds is not guaranteed and the surrender value may be less than the total premiums paid.

Based on an IIRR at 4% p.a., the Total Investment Value at age 50 is S$316,700, at age 60 is S$686,600, at age 70 is S$580,000, and at age 90 is S$347,900. The total aggregate payout is S$907,900 (S$347,900 + S$200,000 + S$24,000 x 15).

The two rates of return used (4% p.a. and 8% p.a.) are purely illustrative and do not represent upper and lower limits on the investment performance.

All ages specified refer to age next birthday.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

The above is for general information only. It is not a contract of insurance. The precise terms and conditions of this insurance plan are specified in the policy contract.

As buying a life insurance policy is a long-term commitment, an early termination of the policy usually involves high costs and the surrender value, if any, that is payable to you may be zero or less than the total premiums paid.

Investments in this plan are subject to investment risks including the possible loss of the principal amount invested. Please refer to the product summary, Fund Prospectus and Product Highlights Sheet for the specific risks of the Fund(s). Past performance is not necessarily indicative of future performance.

A product summary in relation to the Prestige Portfolio may be obtained through Great Eastern or its financial representatives. Potential investors should read the product summary before deciding whether to invest in the Prestige Portfolio. The value of the units in the underlying assets of the funds and the income accruing to the units, if any, may fall or rise.

This policy is protected under the Policy Owners’ Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC). Coverage for your policy is automatic and no further action is required from you. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact us or visit the Life Insurance Association (LIA) or SDIC websites (www.lia.org.sg or www.sdic.org.sg).

In case of discrepancy between the English and the Chinese versions, the English version shall prevail.

Information correct as at 1 October 2021.