Qualifying personal accident plans

All the protection you need to enjoy a more active lifestyle.

Key benefits:

- Up to S$3 million in coverage against accidents

- Boost coverage by up to 1.5 times with Benefit Booster1

- High medical expenses reimbursement

Peace of mind with global protection against accidents.

Key benefits:

- Reimbursement of up to S$15,000 for medical expenses

- Get daily income upon hospitalisation2

- Extra payout of up to S$8,000 for accidental fractures, dislocations or burns

- Additional 20% coverage for ladies3

Buy on the Great Eastern App >

Protect your golden years with financial assurance.

Key benefits

- Up to 3 times payout4 and up to S$200 daily hospital cash benefits6

- Comprehensive post-accident benefits

- Up to S$25,000 payout for fractures, dislocations or burns

- Get 25% off premiums on 2nd life assured

Safeguard your child against accidents wherever they are.

Key benefits:

- Up to 3x payout4 for Accidental Death or Permanent Disablement

- Receive daily hospital cash benefits5

- Up to S$9,000 reimbursement for accidental medical expenses

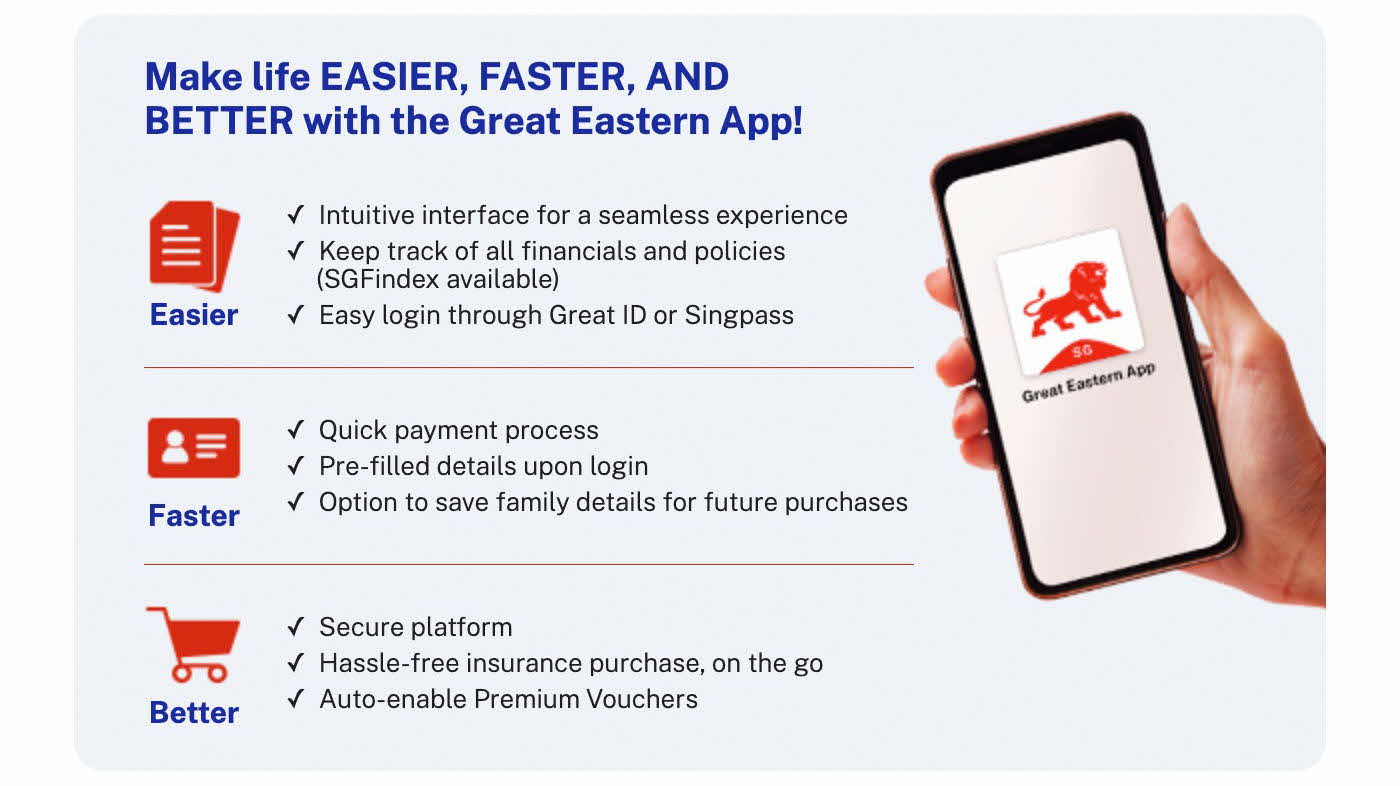

Why use the Great Eastern App?