Making smart money decisions when you are young is essential if you want to retire early, and retire well. With GREAT Retire Income as part of your retirement planning, you can rest easy knowing you will have a steady stream of monthly income whenever you decide to stop working.

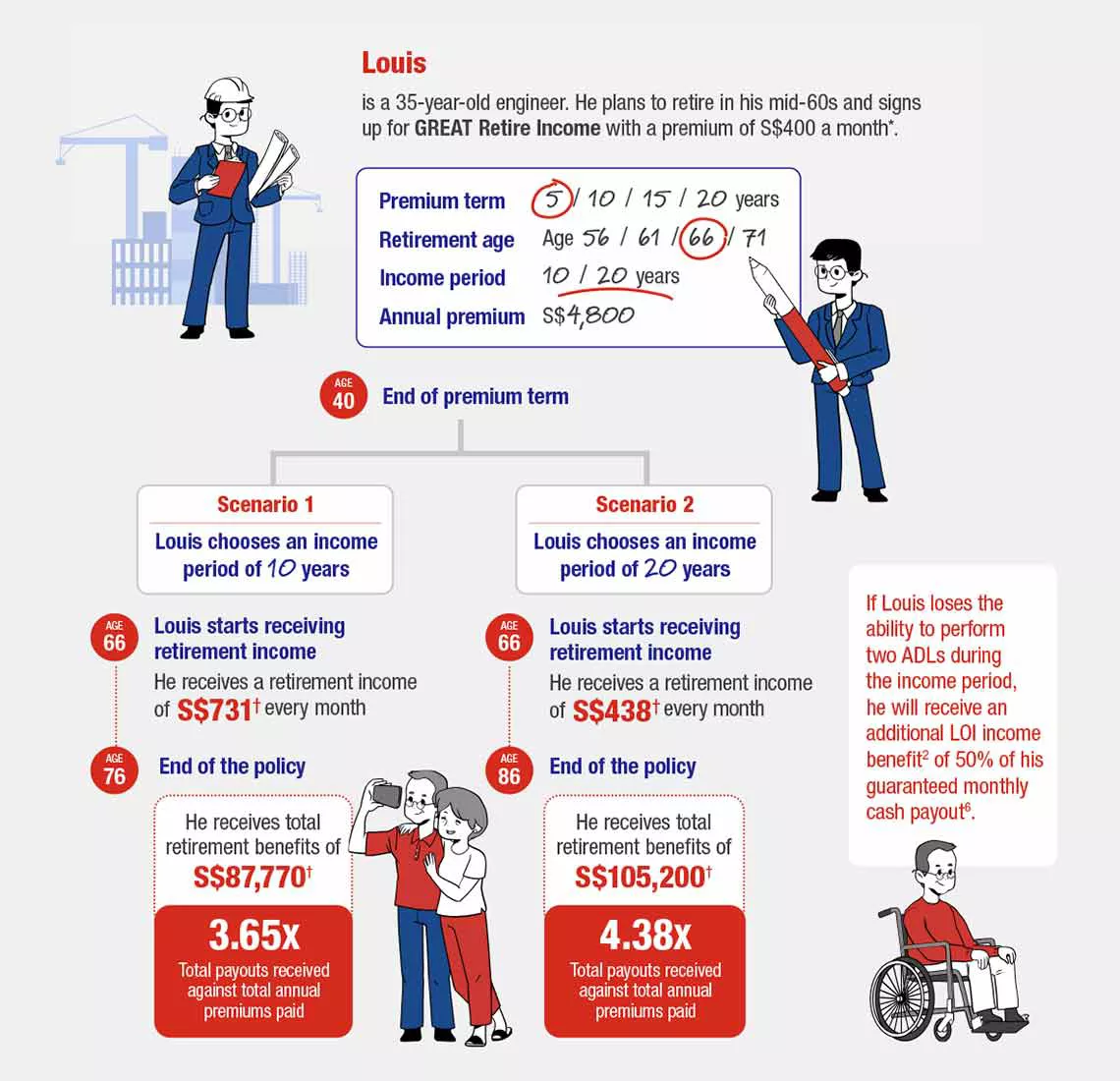

GREAT Retire Income, a participating endowment plan, gives you a cash payout plus a potential cash bonus every month. You can choose your premium term, retirement age, and how long you want to receive payouts for. Your capital is guaranteed at your selected retirement age1, plus you get coverage against Loss of Independence (LOI)2 during the income period for additional peace of mind. What’s more, you are protected against Death, Total & Permanent Disability3 and Terminal Illness.

Our premiums start from $150 a month4, with no medical assessment needed. It is an affordable way to start building your financial freedom, one dollar at a time.

Choose when you want to retire and get monthly cash payouts and potential bonuses when you reach your selected retirement age. The total retirement income benefits will potentialy reach 5X the total premiums paid5 at policy maturity.

Choose your desired premium payment term of 5, 10, 15 or 20 years; start payouts from age next birthday 56, 61, 66 or 71; and receive payouts for 10 or 20 years - this plan has flexibility at its core. You can change the income period anytime up to 6 months before the first payout.

Safeguard against life’s unwanted surprises with additional monthly payouts if you are unable to perform two or more Activities of Daily Living (ADLs) during the income period. Receive LOI income benefit2 of up to 100% of your guaranteed monthly cash payouts, capped at $5,000 a month6.

Talk to your Great Eastern distribution representative to see which insurance solutions are right for you. No Planner yet? Simply browse through our list of distribution representatives.

No. 17 & 18

Block B, Bangunan Habza

Simpang 150, Kampong Kiarong

Bandar Seri Begawan

Brunei Darussalam

1 Capital guarantee is on the condition that no policy alterations are made.

2 Loss of Independence (LOI) income benefit is payable if the Life Assured, as certified by a medical practitioner, is unable without the continual physical assistance of another person to perform 2 or more Activities of Daily Living (ADLs). ADLs include washing, dressing, feeding, walking or moving around and transferring.

3 Coverage for Presumptive Total and Permanent Disability (TPD) is only applicable up till Policy Anniversary where Life Assured reaches the selected retirement age, while coverage for other forms of TPD is up till Policy Anniversary which the Life Assured is age 65 next birthday or when the Life Assured reaches the selected retirement age, whichever is earlier. Presumptive TPD refers to a state of incapacity which is total and permanent and takes the form of total and irrecoverable loss of:

(a) the sight in both eyes;

(b) the use of two limbs at or above the wrist or ankle; or

(c) the sight in one eye and the use of one limb at or above the wrist or ankle.

Please refer to the product summary for details on other forms of TPD.

All figures in the above illustration are based on IIRR of the participating fund at 4.25% p.a. and are subject to rounding.

4 Based on a 20-year premium term, premium illustrated is rounded down to the nearest 10 dollar. Please refer to policy illustration for actual premium amount.

5 For a 35 year old male with a 20-year premium term, selected retirement of age 71 and income period of 20 years on accumulation option, at an Illustrated Investment Rate of Return (IIRR) of the Participating Fund at 4.25% p.a.. At IIRR of 3% p.a., the total retirement income benefits received is up to 2.7X of total premiums paid at policy maturity.

6 The Policyholder will receive (i) 50% of the Guaranteed Survival Benefits (capped at maximum LOI income benefit of S$2,500 per month) if the Life Assured is not able to perform 2 of the 6 ADLs; (ii) 100% of Guaranteed Survival Benefits (capped at maximum LOI income benefit of S$5,000 per month) if the Life Assured is not able to perform 3 (or more) of the 6 ADLs.

All figures in the above illustration are based on Illustrated Investment Rate of Return (IIRR) of the participating fund at 4.25% p.a. and are subject to rounding.

* This figure is rounded down to the nearest hundred. Please refer to the policy illustration for exact premium amount.

† The figure comprises guaranteed and non-guaranteed benefits. The non-guaranteed benefit is illustrated based on assumption that the IIRR of the participating fund is at 4.25% p.a..

In Scenario 1, based on IIRR of 3.00% p.a., the total retirement benefits received by Louis at age of 76 is S$58,990 (2.45X of the total annual premiums paid). It comprises Guaranteed Survival Benefit of S$295.49 per month and Non-Guaranteed Cash Bonus of S$196.22 per month over 10 years.

In Scenario 2, based on IIRR of 3.00% p.a., the total retirement benefits received by Louis at the age of 86 is S$68,020 (2.83X of premiums paid). It comprises Guaranteed Survival Benefit of S$156.71 per month and Non-Guaranteed Cash Bonus of S$126.75 per month over 20 years.

As the bonus rates used for the benefits illustrated are not guaranteed, the actual benefits payable may vary according to the future experience of the participating fund.

All ages specified refer to age next birthday.

All figures used are for illustrative purposes only and are subject to rounding.

The above is for general information only. It is not a contract of insurance. The precise terms and conditions of this insurance plan are specified in the policy contract.

As buying a life insurance policy is a long-term commitment, an early termination of the policy usually involves high costs and the surrender value, if any, that is payable to you may be zero or less than the total premiums paid.

In case of discrepancy between the English and Chinese versions, the English version shall prevail.

Protected up to specified limits by SDIC.

Information correct as at 22 February 2022.