- Customer Services

- Loans

- Repay a Policy Loan

Repay a policy loan

Follow our guide to repay a policy loan, including an Automatic Premium Loan (APL).

What is an APL?

An APL is automatically raised to keep your policy in force if the premium is 30 days past the grace period.

An APL uses the policy cash value to pay the unpaid policy premium. The deduction will continue until there is no more cash value, which will result in a policy lapse.

This allows us to continue extending the insurance coverage to you and, at the same time, add reversionary bonus to your policy as if the premium was paid.

We recommend that you continue to pay premiums instead of activating an APL, so your insurance coverage is not reduced or even terminated.

The interest charged on the APL is 6.0% per annum for SGD denominated policies and 6.5% per annum for USD denominated policies. The interest is calculated on a daily basis based on the outstanding APL amount.

Is my policy on APL?

We will send you quarterly APL notices if you are paying your premium monthly or quarterly. Otherwise, APL notices will be sent to you either on a half-yearly or yearly basis.

While under APL, you will be informed of the date the policy is expected to lapse before the cash value is completely depleted by the total indebtedness. Any policies on APL will last for as long as there is cash value remaining, which in turn depends on the actual bonus declared each year.

How to repay a loan

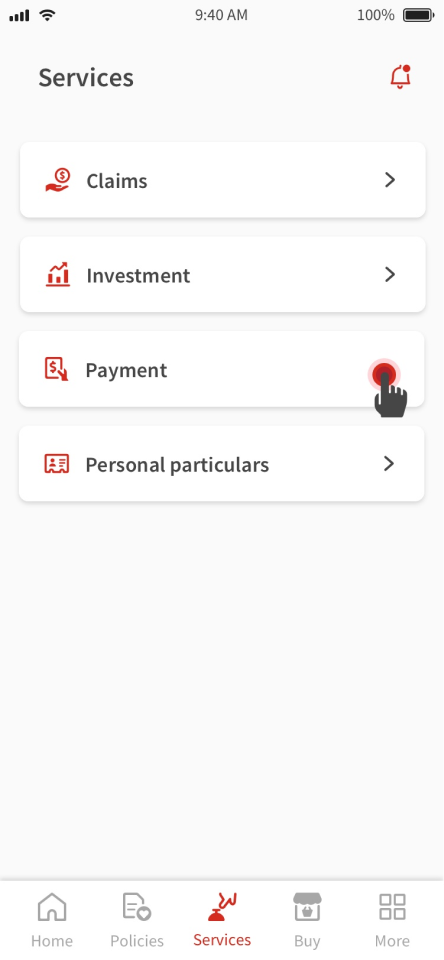

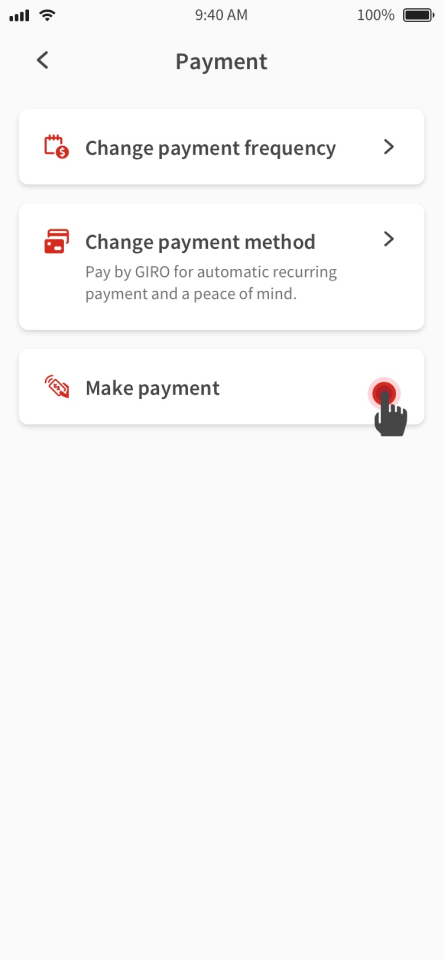

The simplest way to pay is to use the PayNow QR code in the Great Eastern App.

Alternatively, scan the unique PayNow QR code printed on your annual loan statement.

PayNow QR is only applicable for Great Eastern Life (10-digit) SGD policies.

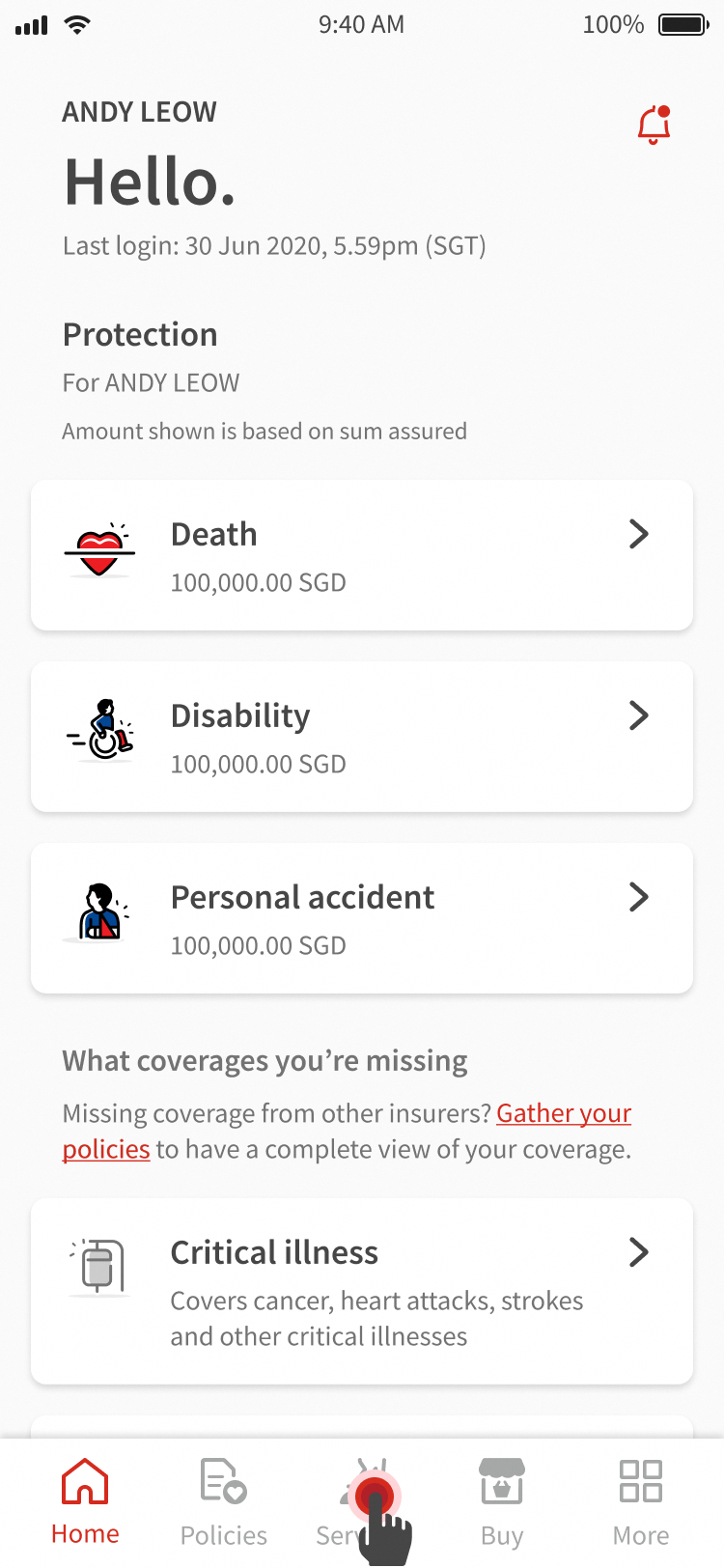

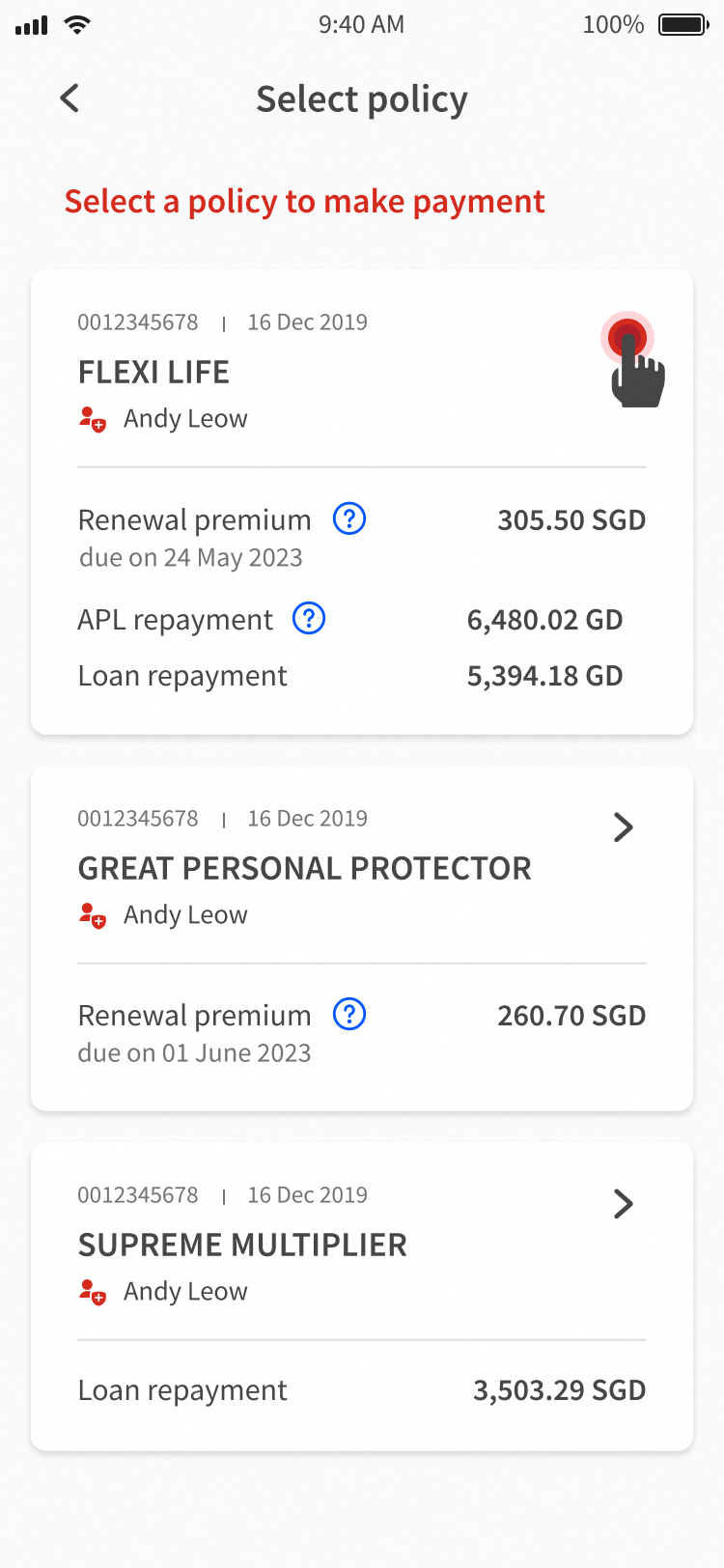

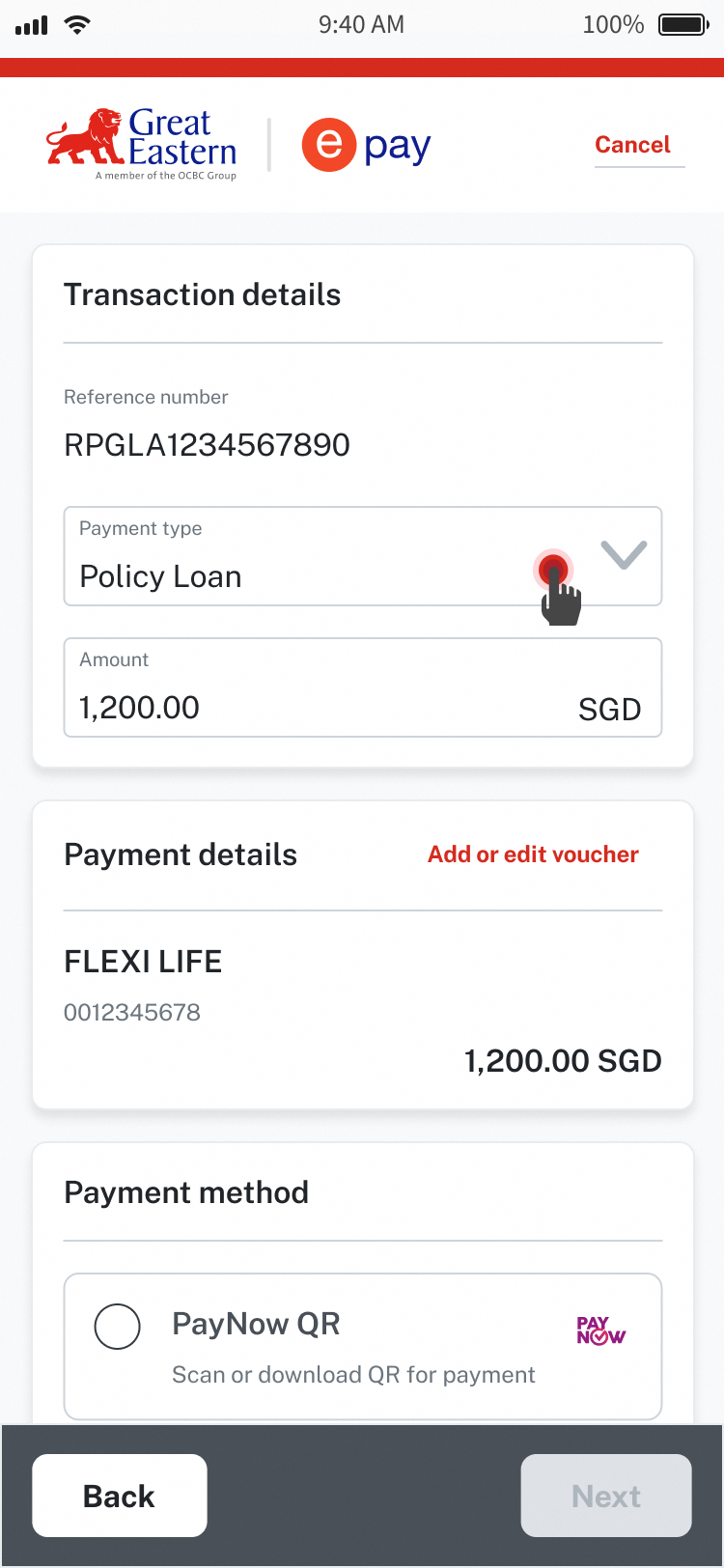

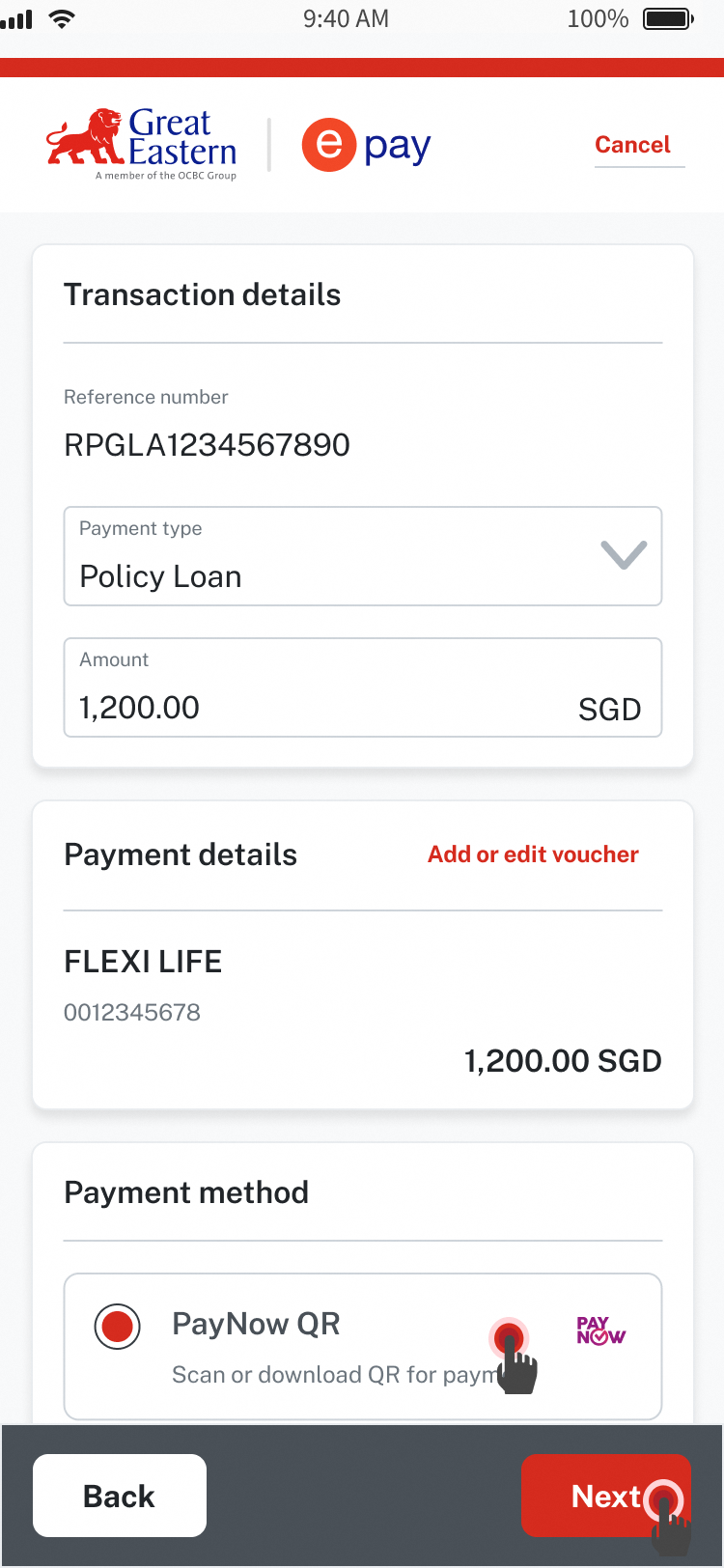

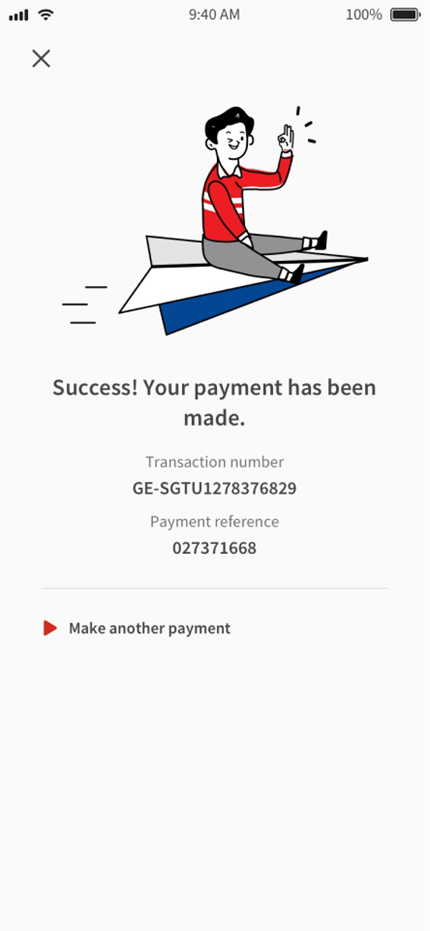

1. Great Eastern App

Upon successful payment, you will receive a payment notification from your bank. Once we receive your payment, we will send you a notification to confirm receipt of payment.

If you are banking with OCBC, DBS/POSB, UOB, HSBC, or Maybank, you can set a PayNow daily transfer limit of up to SGD200,000. You can do this via your mobile banking app or through internet banking before you proceed with your PayNow payment.

A summary of the transaction limits offered by each participating bank can be found the media release by The Association of Banks in Singapore.

2. Digital Channels

To pay by GIRO, you will need to download and complete the Application for APL / Loan repayment by GIRO form.

Notes:

- This payment method is only available to Great Eastern Life (10-digit) regular premium policies

- You must have an existing GIRO account with us

- If you do not have an existing GIRO arrangement with us, set up your GIRO payment arrangement before submitting the loan repayment form

- The loan repayment will be deducted from the same GIRO account as the used for premium payment

Once completed, you can visit us at our Customer Service Centre, or send the completed form to us by post.

Attention to: Customer Service Department

The Great Eastern Life Assurance Company Limited

1 Pickering Street

Great Eastern Centre #01-01

Singapore 048659

Pay using your policy number through any of the following:

- Any AXS machine

- AXS m-Station via your smartphone or tablet

- AXS e-Station via the AXS website

- Depending on your policy number, select Great Eastern Life (10 digits) or Great Eastern Life (8 digits) as your policy type.

- Select Policy loan or Automatic Premium Loan as your payment type.

- Enter your policy number, payment amount, name and contact number.

Allow at least 2 working days for your policy status to be updated after payment.

When making payment via AXS, you will need to make multiple transactions if your premium is above the transaction limit. Visit the AXS website to find out more about the available payment modes and transaction limit.

You can pay via the following banks, using your policy number:

- OCBC (Oversea-Chinese Banking Corporation, Limited)

- DBS/POSB (The Development Bank of Singapore Limited)

- UOB (United Overseas Bank Limited)

- SCB (Standard Chartered Bank (Singapore) Limited)

- Depending on your policy number, select Great Eastern Life (10 digits) or Great Eastern Life (8 digits) as the billing organisation.

- Enter your policy number in the bill reference.

- Click Pay Bills to complete the payment.

Allow at least 2 working days for your policy status to be updated after payment.

If your premium amount is above the transaction limit, you will need to make multiple transactions. If you have any queries, please contact your bank for assistance.

Do not transfer premiums to your Financial Representative’s bank account. This is to prevent the mixing of funds, and to ensure a clear separation of money belonging to you and your Financial Representative.

3. Cashier Counter at Customer Service Centre

Send a crossed cheque payable to “The Great Eastern Life Assurance Co. Ltd”.

- Write your policy number on the back of cheque.

- Mail your cheque to Great Eastern at:

The Great Eastern Life Assurance Company Limited

1 Pickering Street

Great Eastern Centre #01-01

Singapore 048659

You can also drop your cheque off at the contactless drop box marked “Cheque” at our Customer Service Centres.

You can pay by cash or NETS personally at any of our Customer Service Centres using your policy number.

Our counter servicing hours are 9.00am to 4.30pm, Mondays to Fridays (excluding public holidays).

Great Eastern Life Assurance Company Limited

1 Pickering Street #01-01

Great Eastern Centre

Singapore 048659

Great Eastern @ PLQ

2 Tanjong Katong Rd #13-01

Paya Lebar Quarter Tower 3

Singapore 437161

Effective from 1 March 2023, our Financial Representatives will no longer be accepting cash. Please make premium payments to us via other cashless payment methods such as PayNow QR, eGIRO, AXS, or bank transfer. Should you require cash payment services for your payment of premiums, please visit our cashier counter personally at Great Eastern Centre or our branches.