- Customer Services

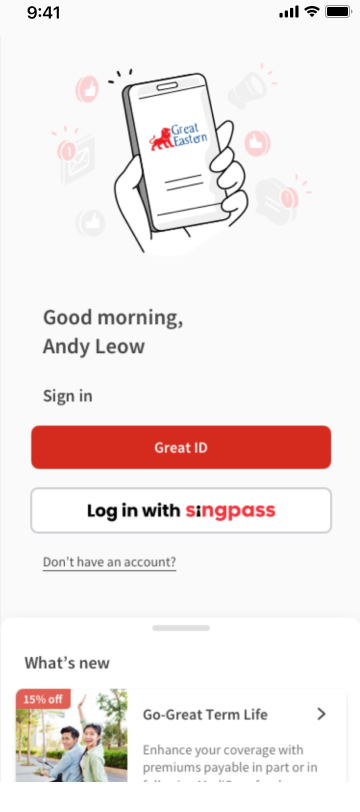

- Payment

- Make renewal or regular premium payments

Make renewal or regular premium payments

Follow our guide on how to pay for renewal or regular premiums for your Great Eastern policy.

We encourage you to make payment using the Great Eastern App, AXS, or internet banking as these are the fastest methods of payment. Payment processing for PayNow QR is immediate within working hours, and 2 working days for AXS and internet banking. Other methods of payment will require a longer processing time.

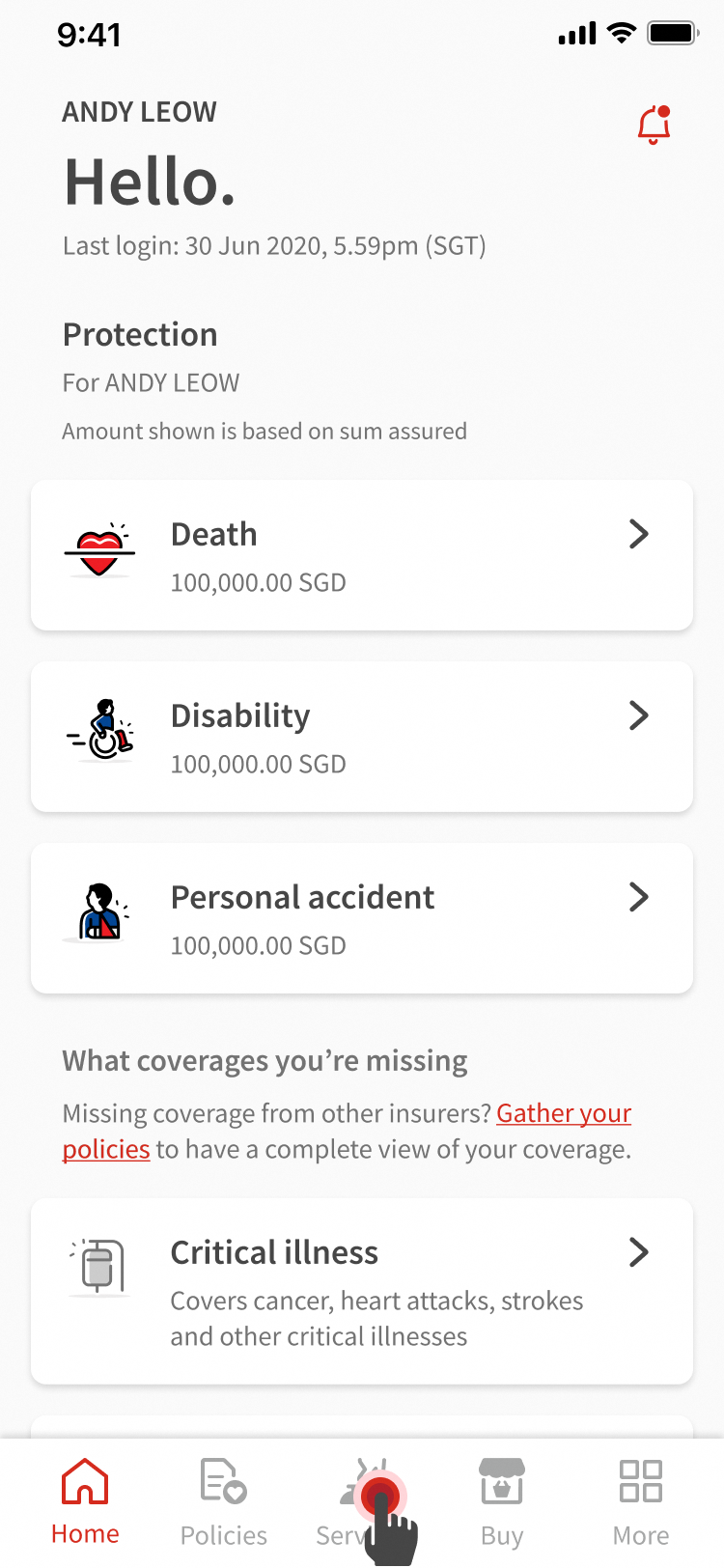

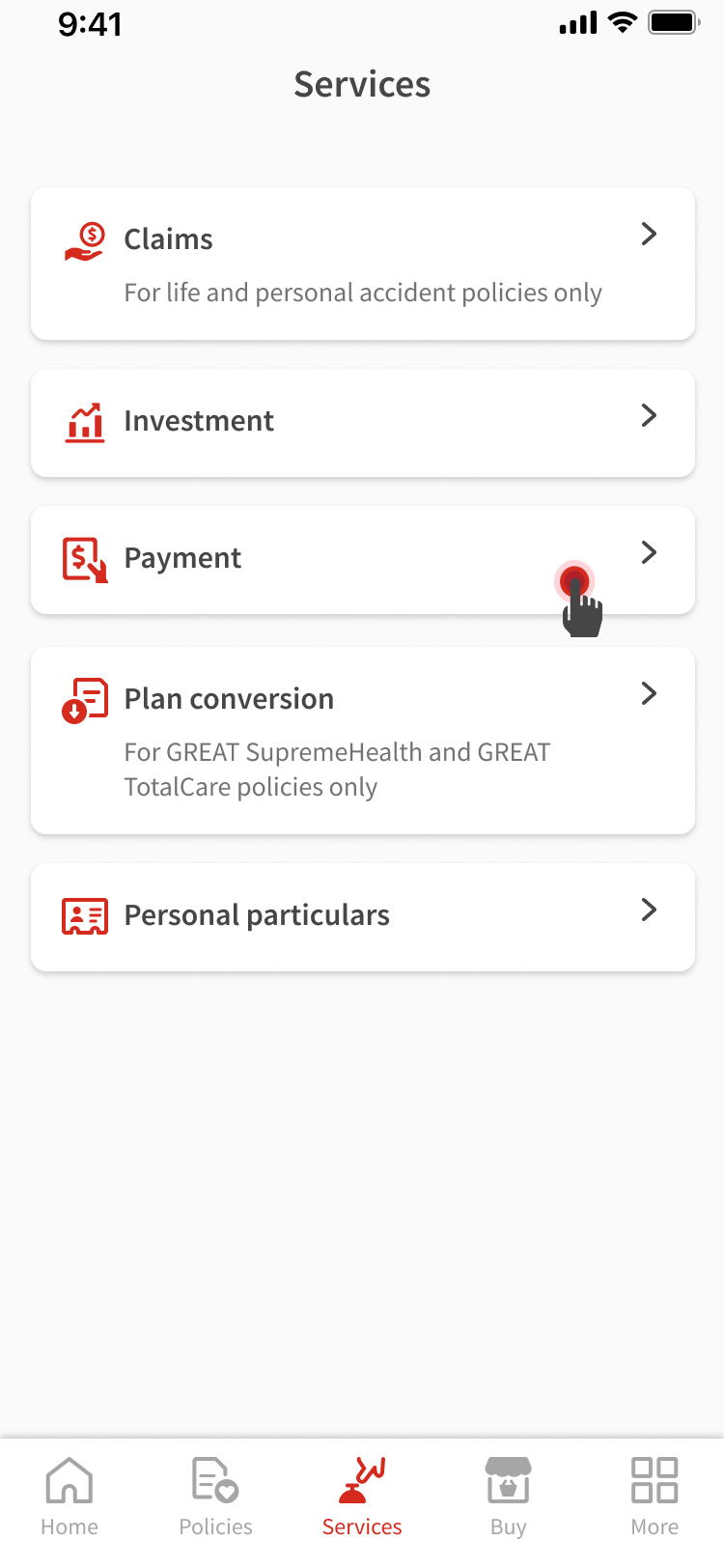

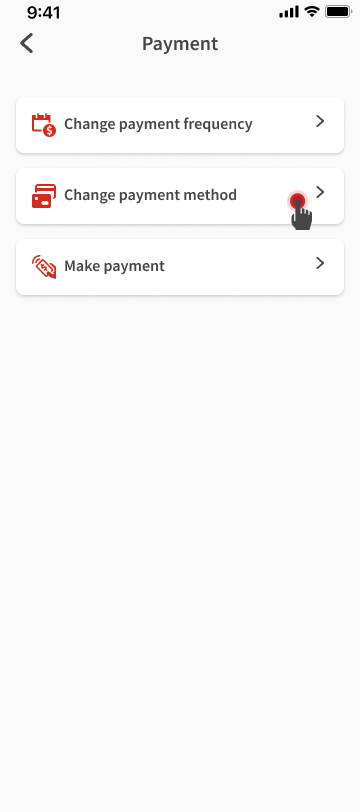

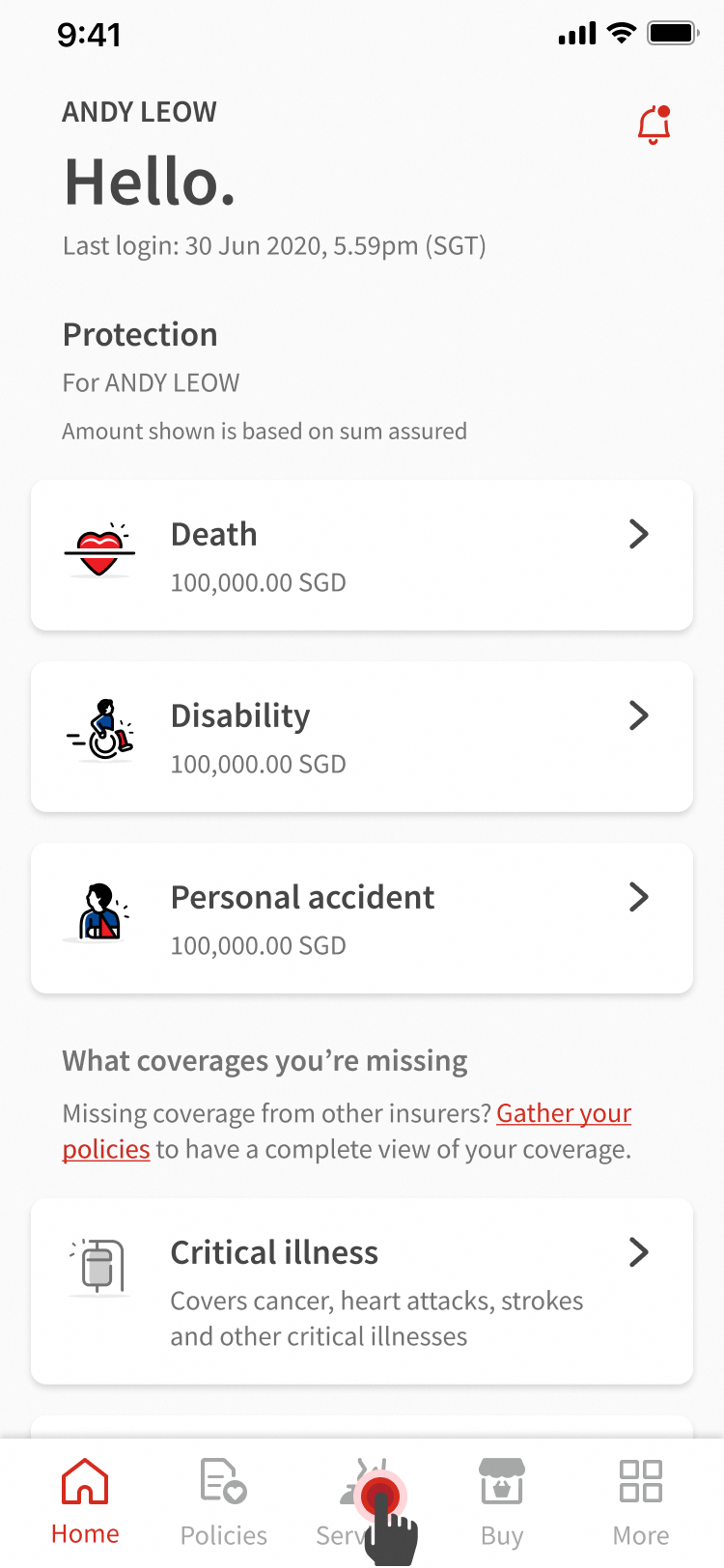

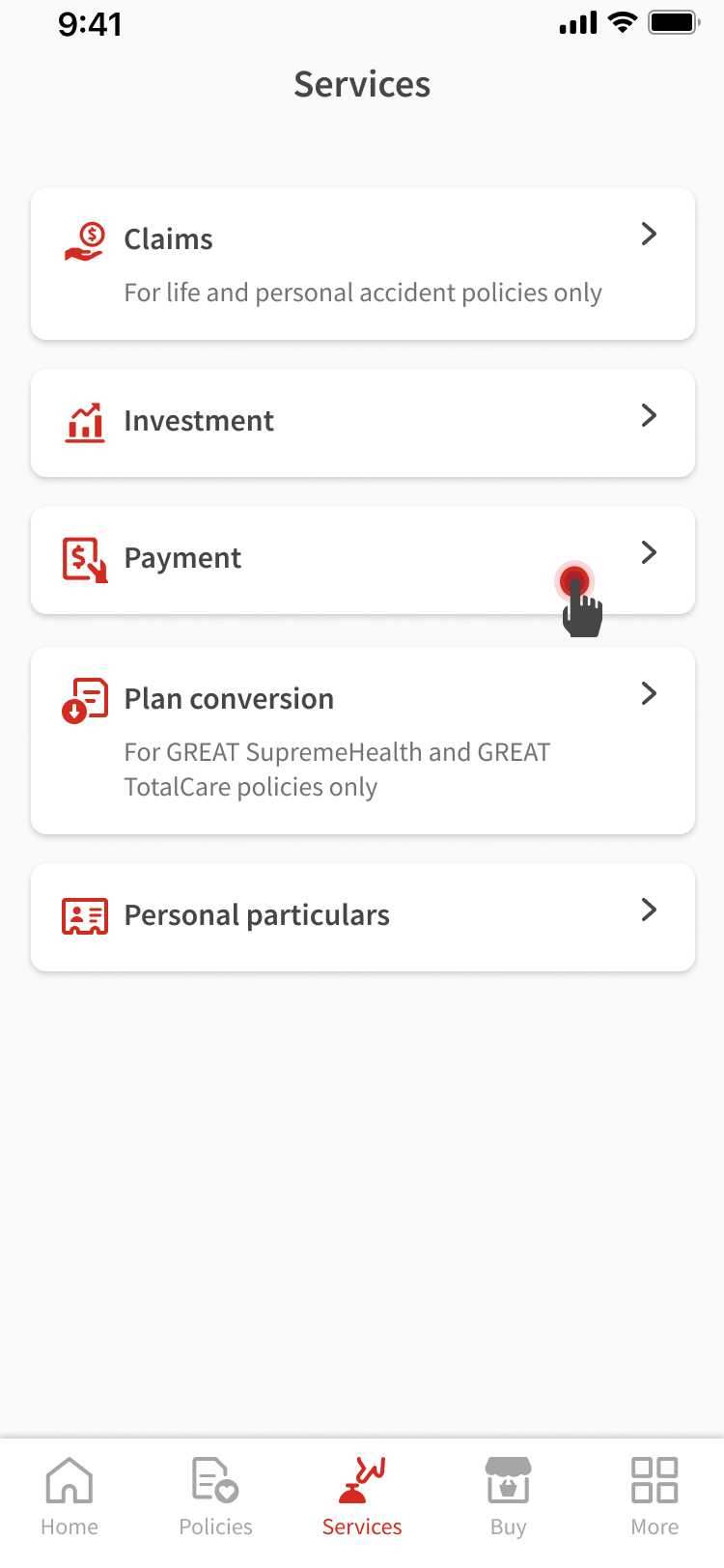

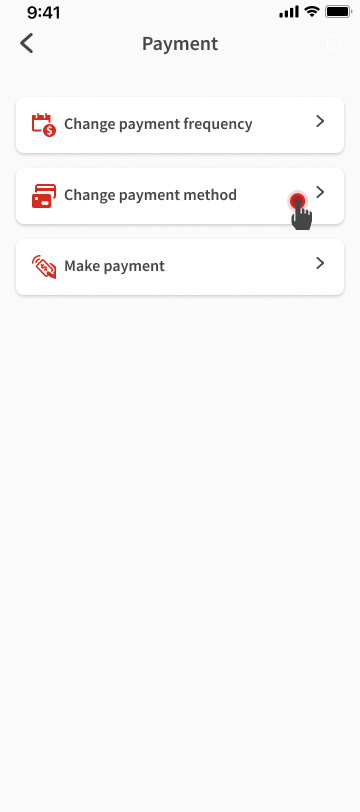

Alternatively, enroll for scheduled payments such as eGIRO for added peace of mind. We will deduct the premium automatically for renewals.

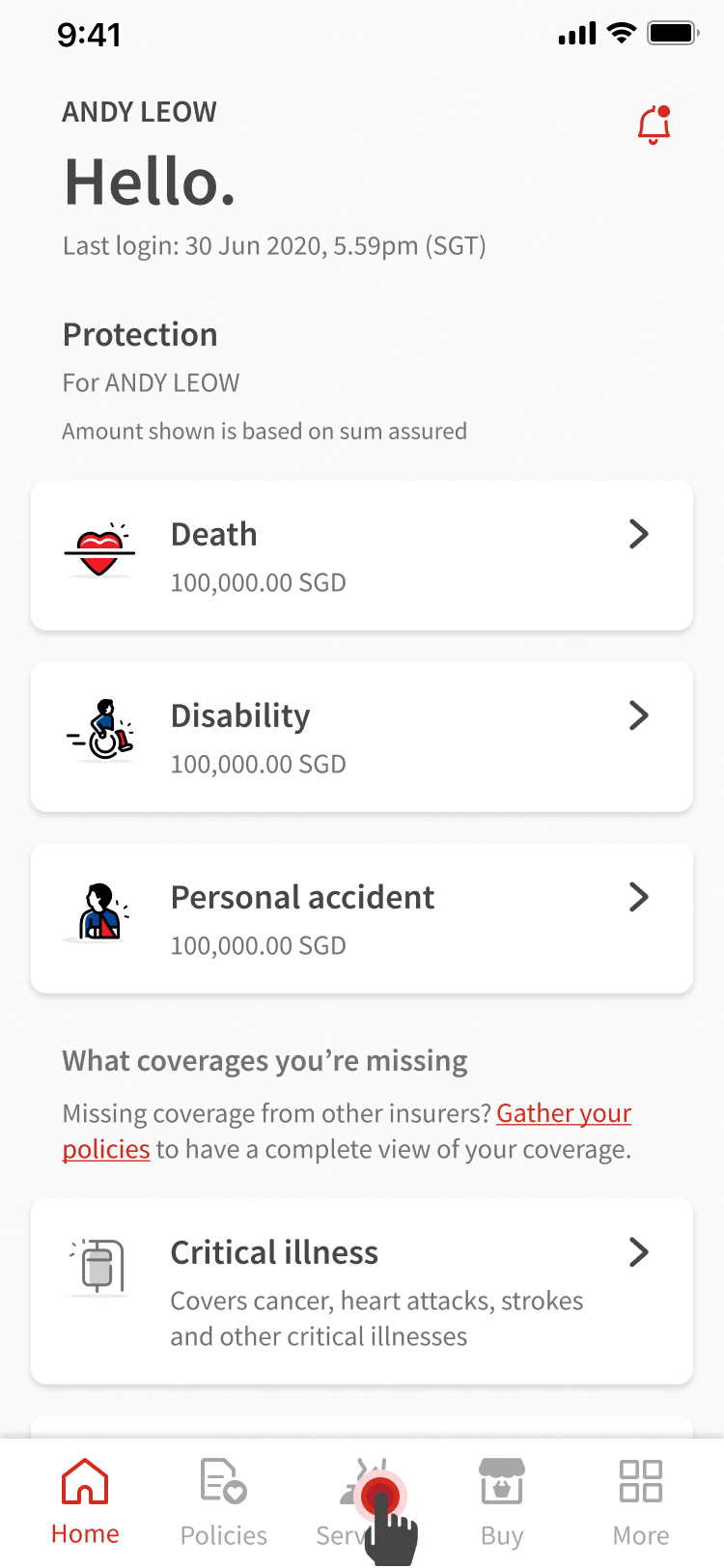

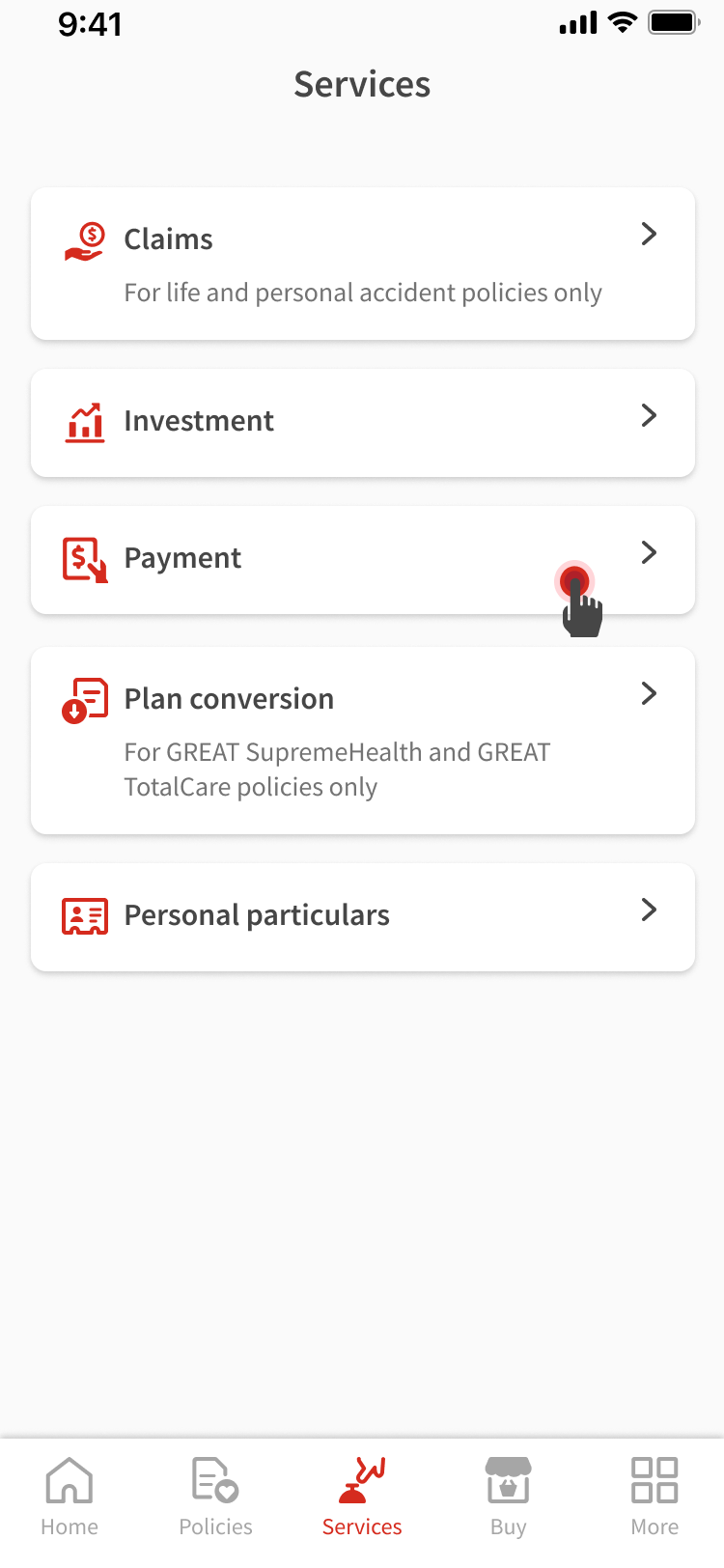

You can set up eGIRO easily with the Great Eastern App.

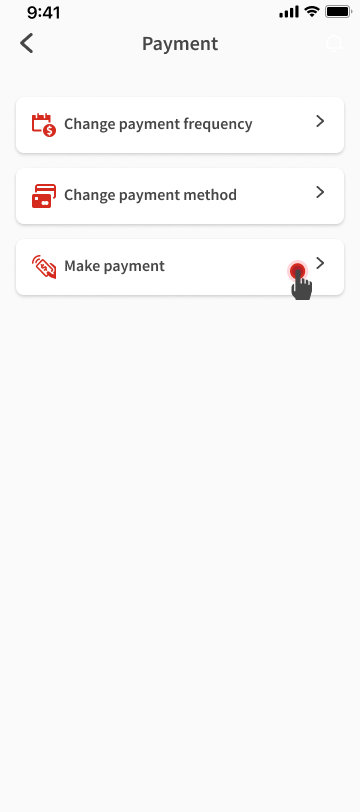

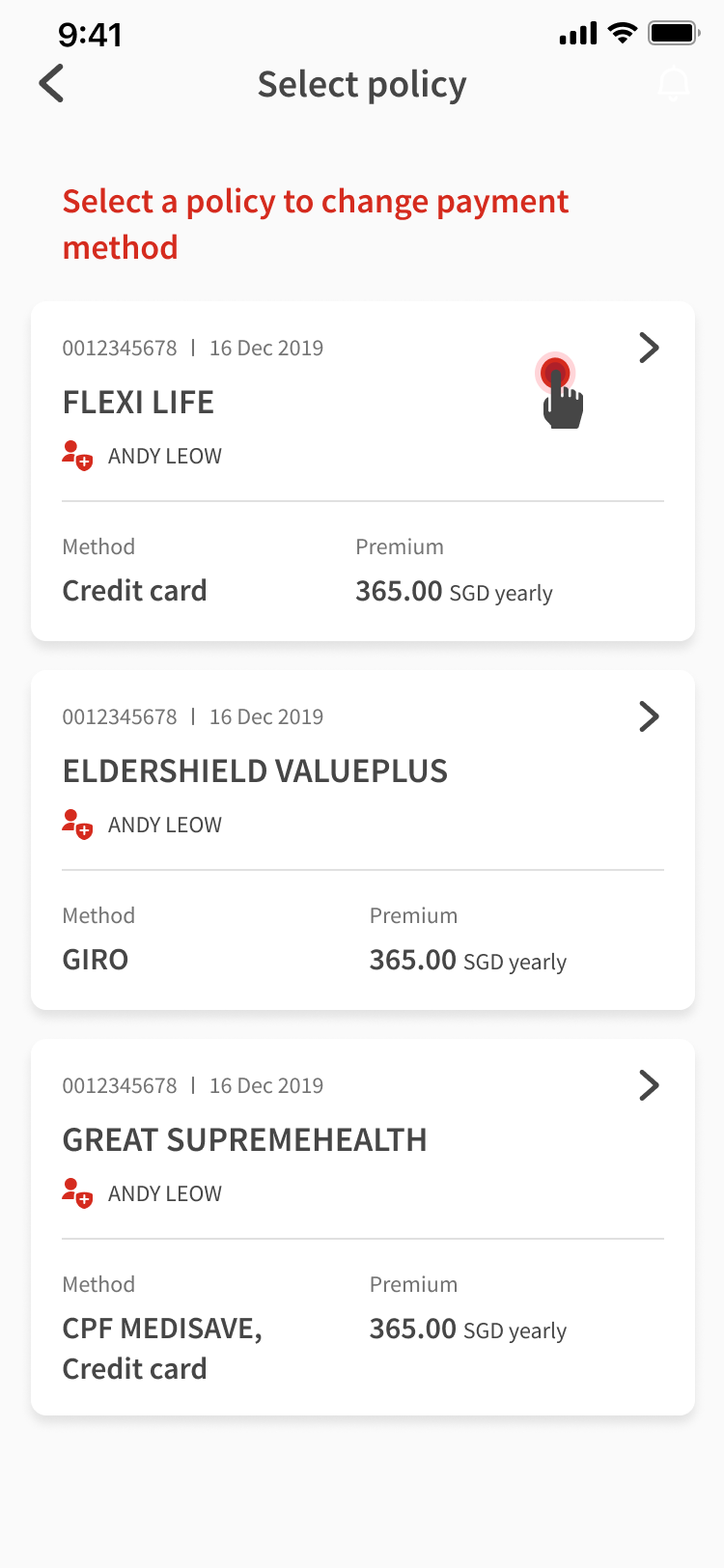

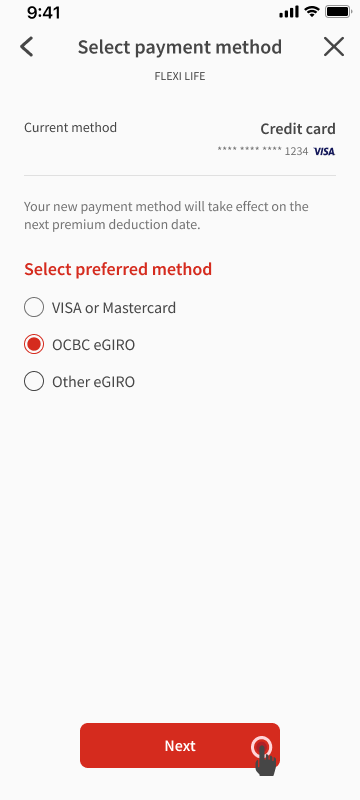

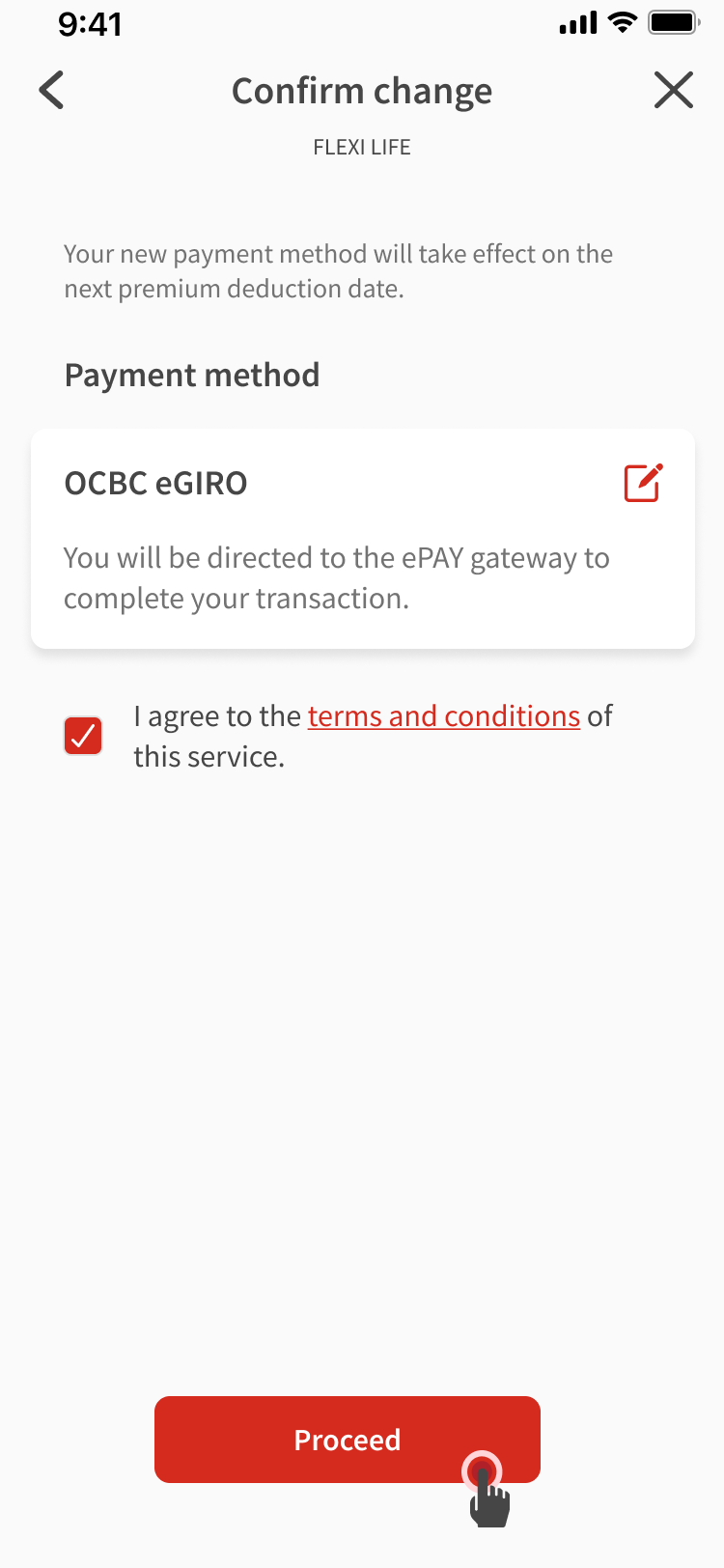

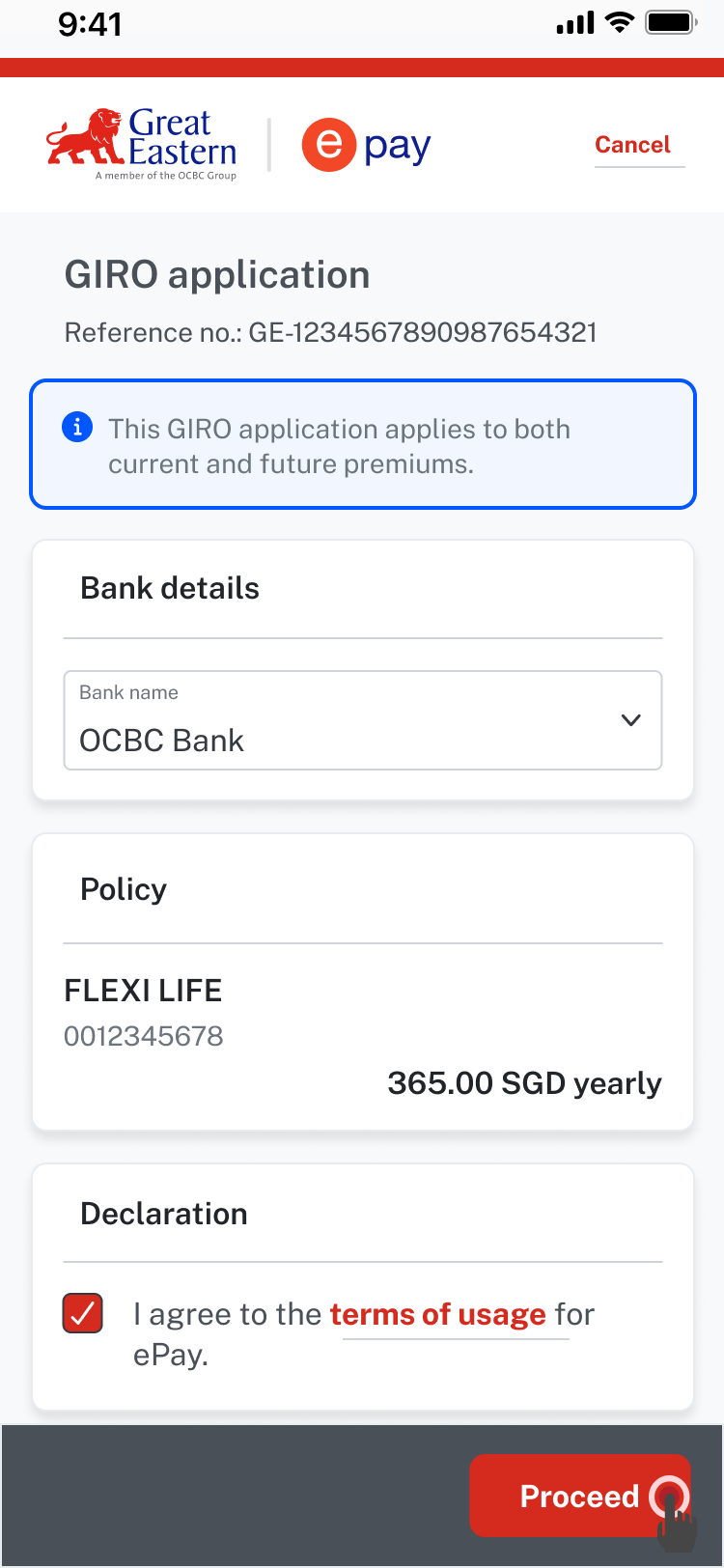

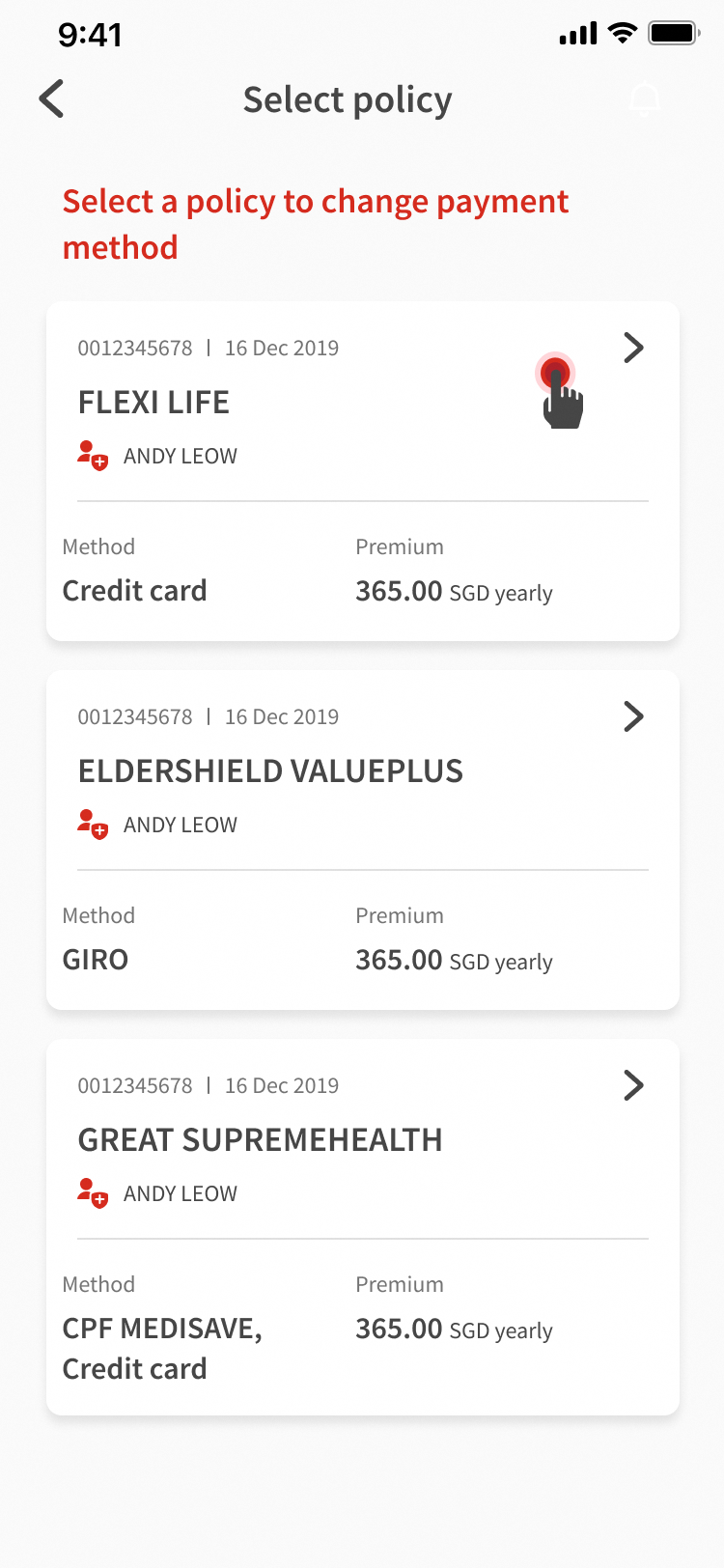

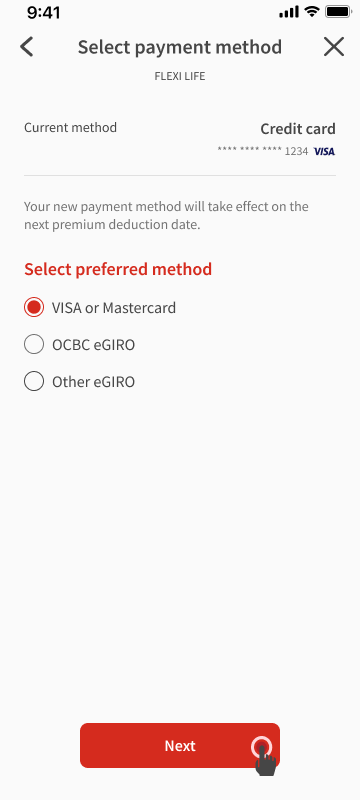

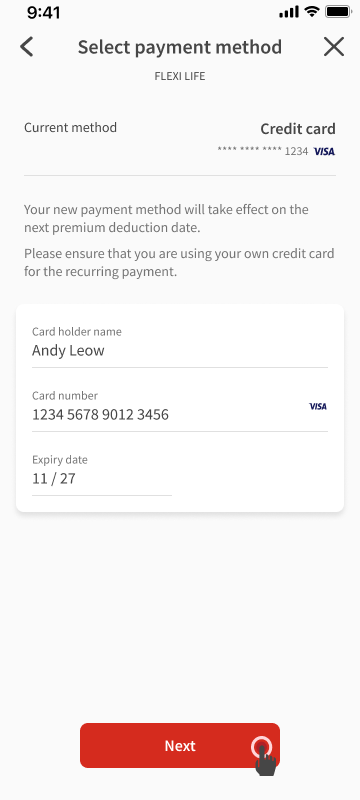

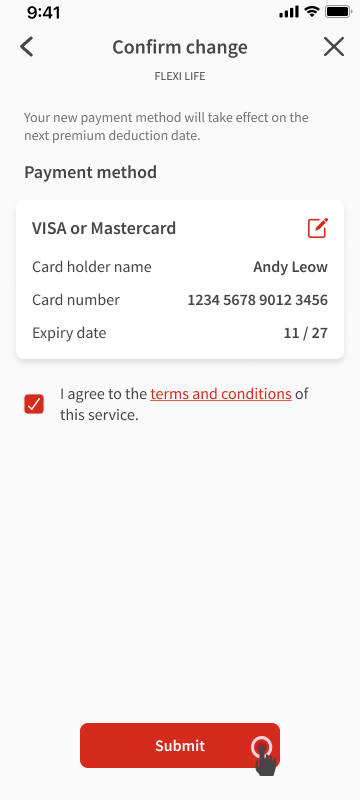

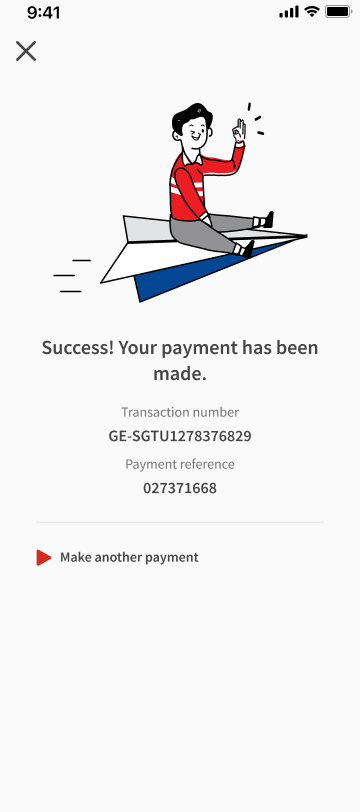

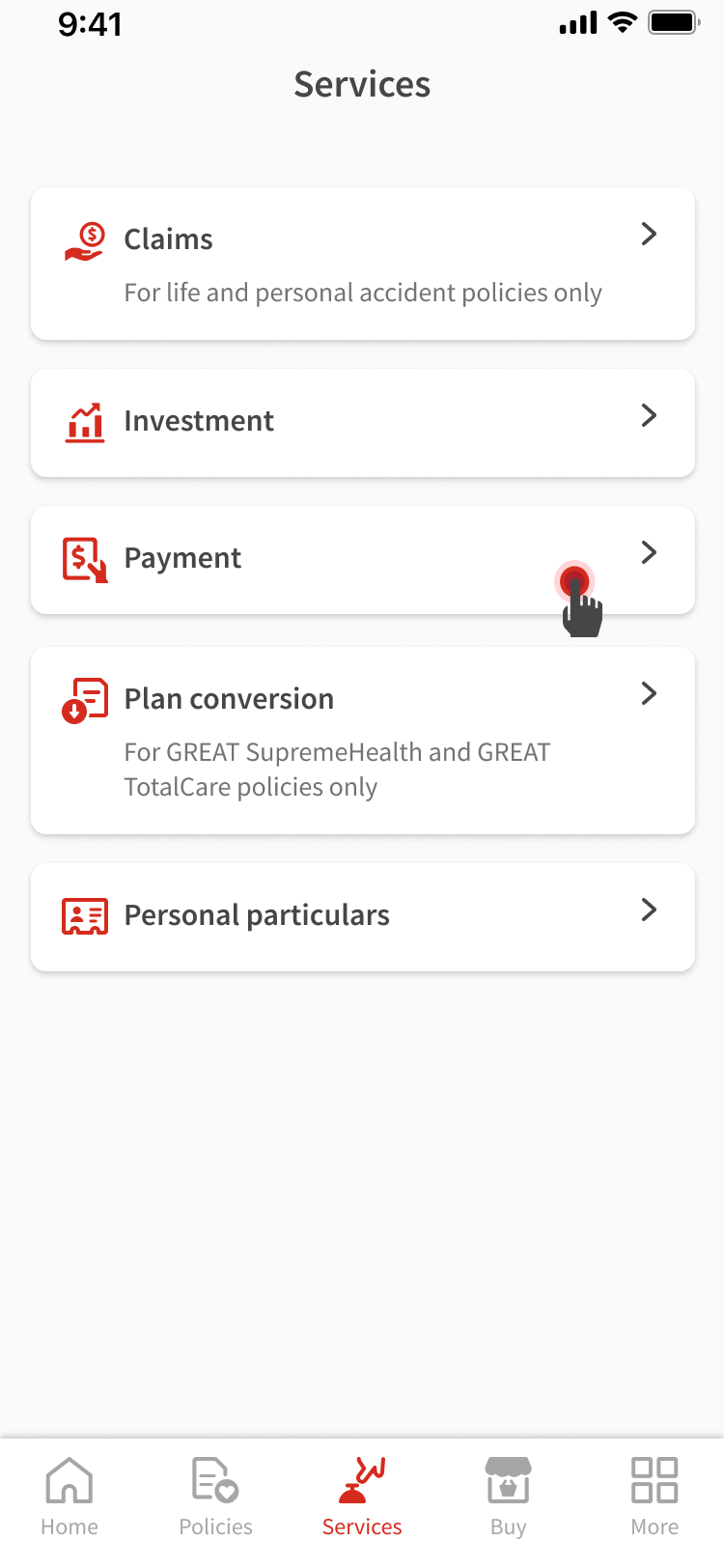

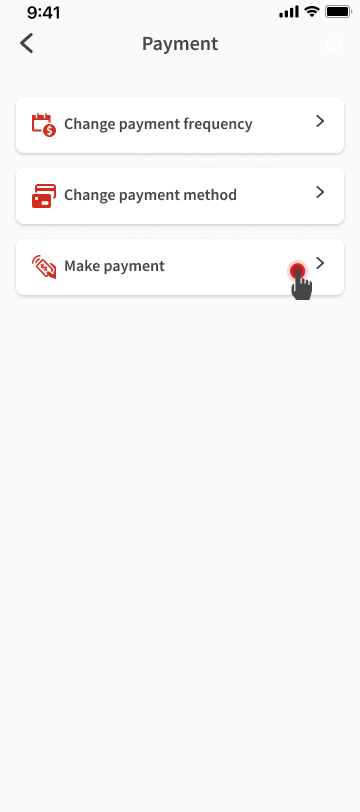

Go to Services > Payment > Change payment method.

For USD policies, you can only pay via funds transfer, telegraphic transfer, cheque, or bank draft.

For Brunei policies, visit the Customer Service page of Great Eastern (Brunei) for more information.

- Get ready your policy number prior to making payment.

- You can ask your Financial Representative for your policy number, or get in touch with our customer service at 1800 248 2888 or through email at wecare-sg@greateasternlife.com.

- Be sure to indicate the correct policy number when making payment to ensure that the payment is made for the correct policy.

- Do not make payment via methods not mentioned in this guide as it would require longer processing time. For example, payment to Great Eastern’s UEN without personalised QR code will entail a processing time of at least 10 working days.

- From 17 November 2024, official receipt will only be sent electronically via eConnect or the Great Eastern App once payment has been received and processed. You will receive an e-notification via SMS and/or email when the official receipt is ready for viewing in the ePortals. No official receipt will be issued for payment made via Credit Card, CPF and GIRO.

How to make payments

Payment via the Great Eastern App is not applicable to Dependants' Protection Scheme policies

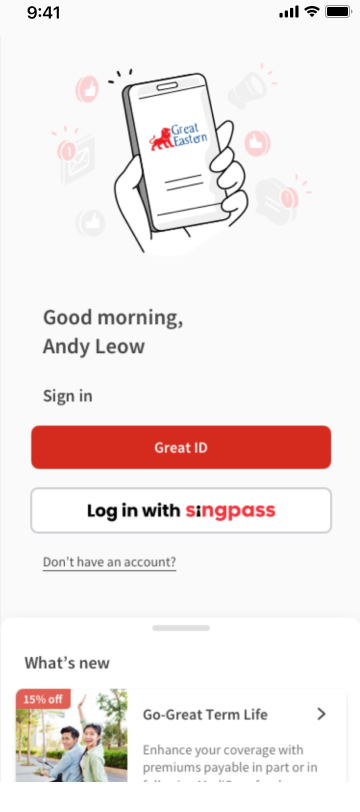

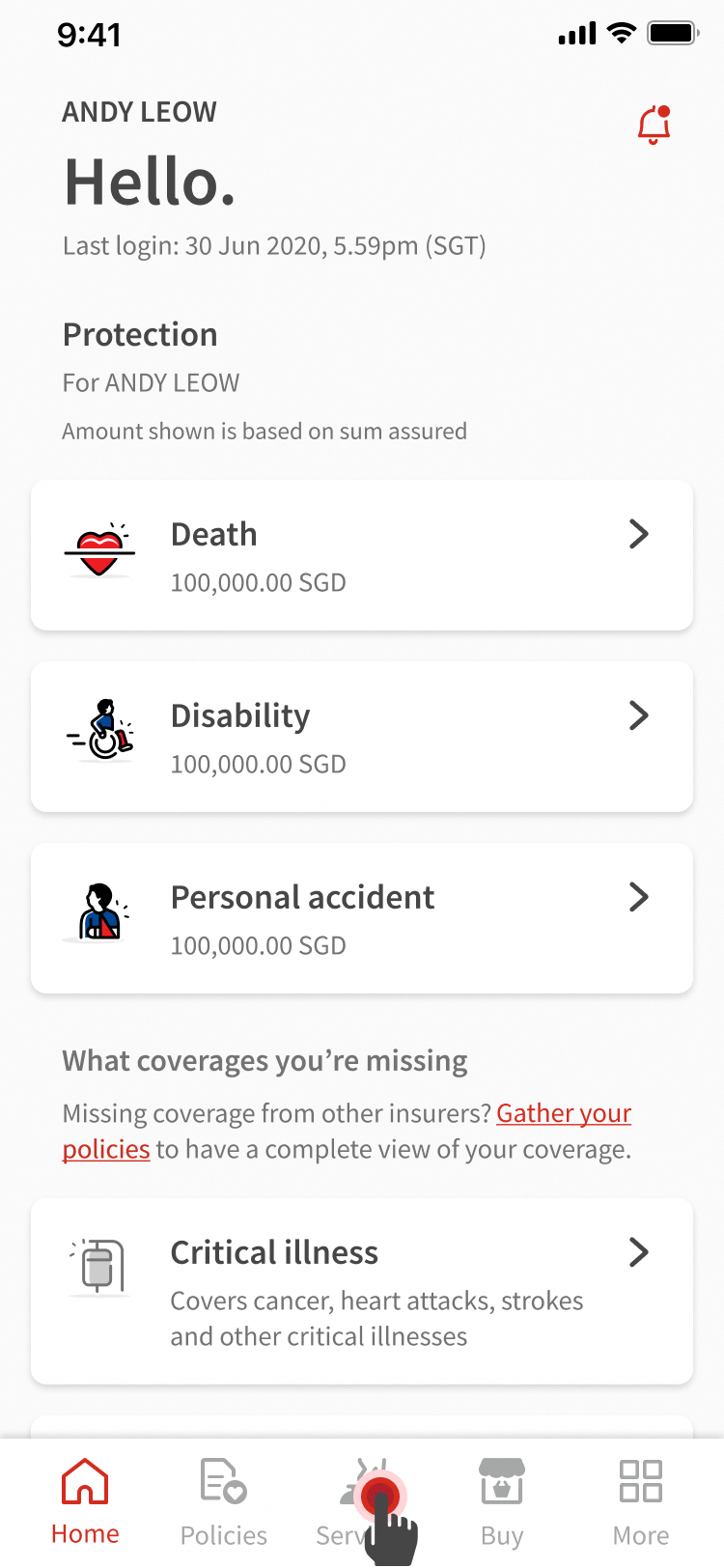

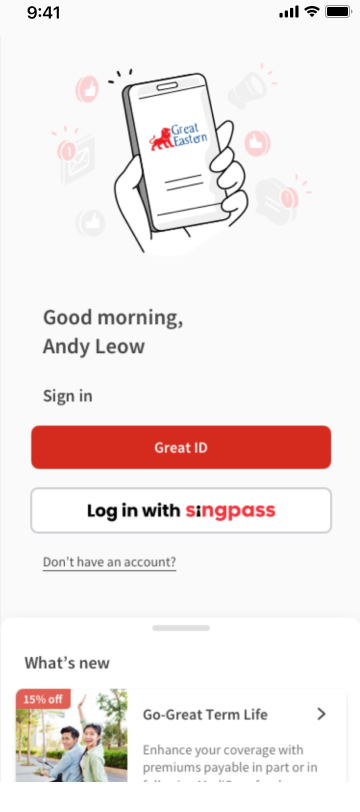

1. Great Eastern App

- PayNow QR

- eGIRO

- Credit card

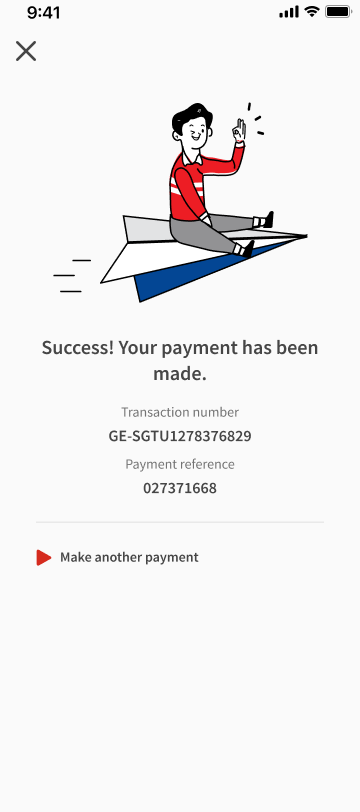

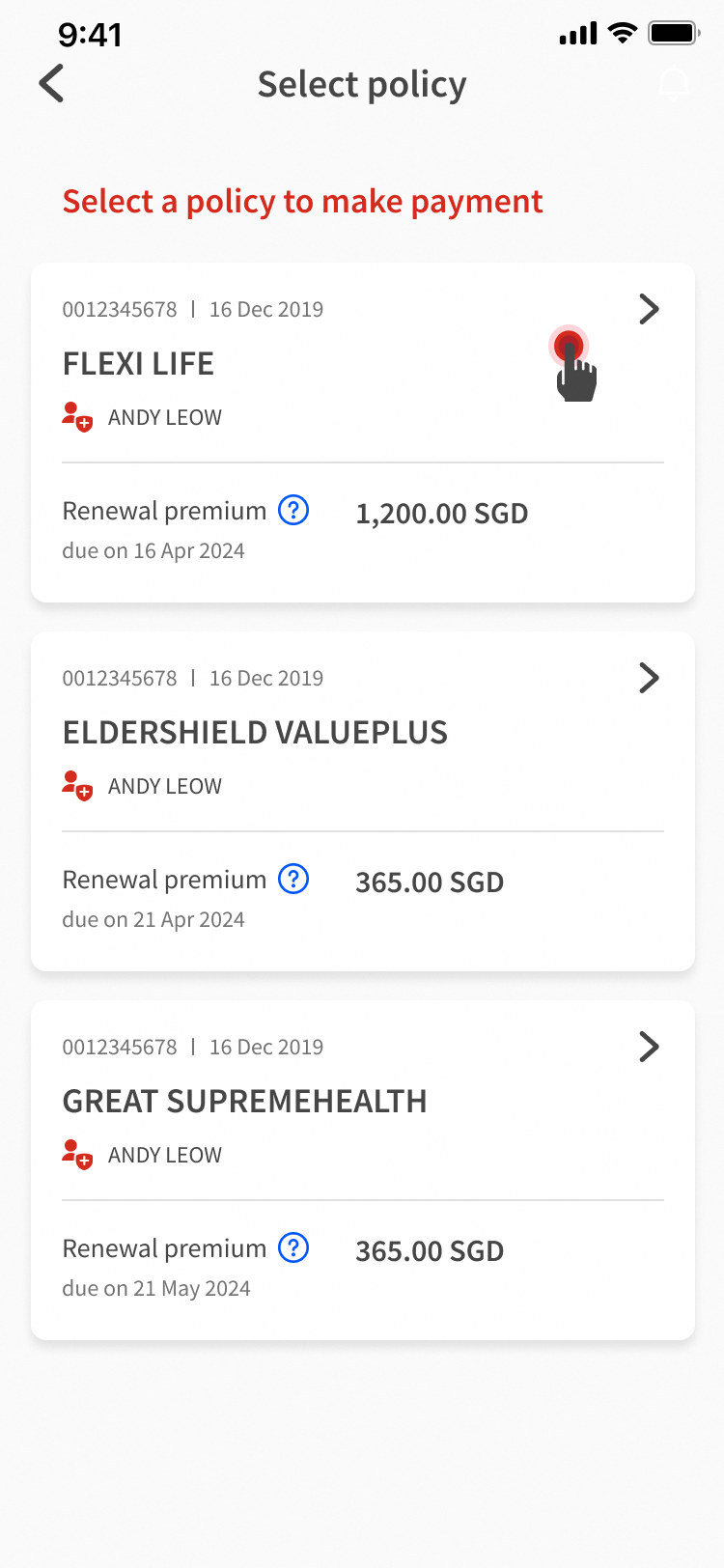

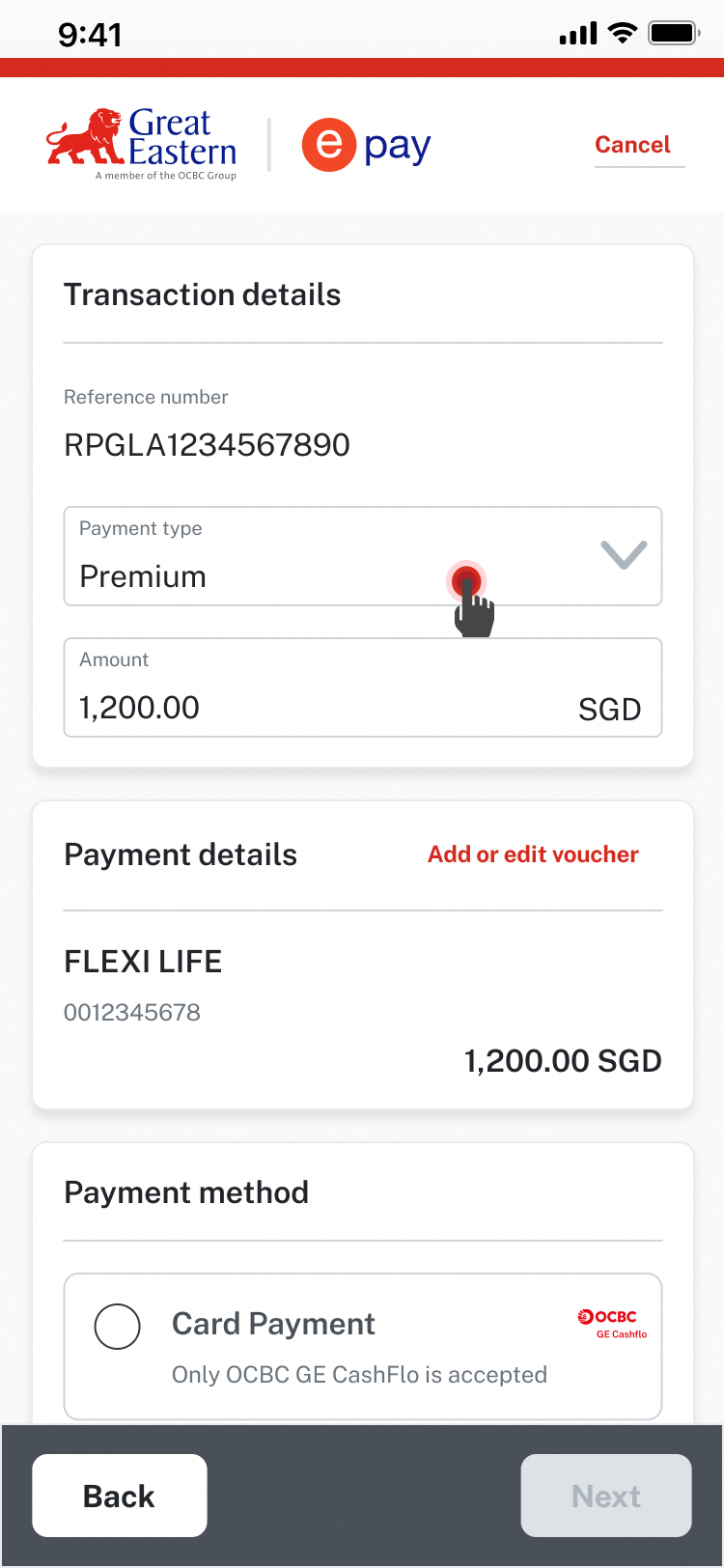

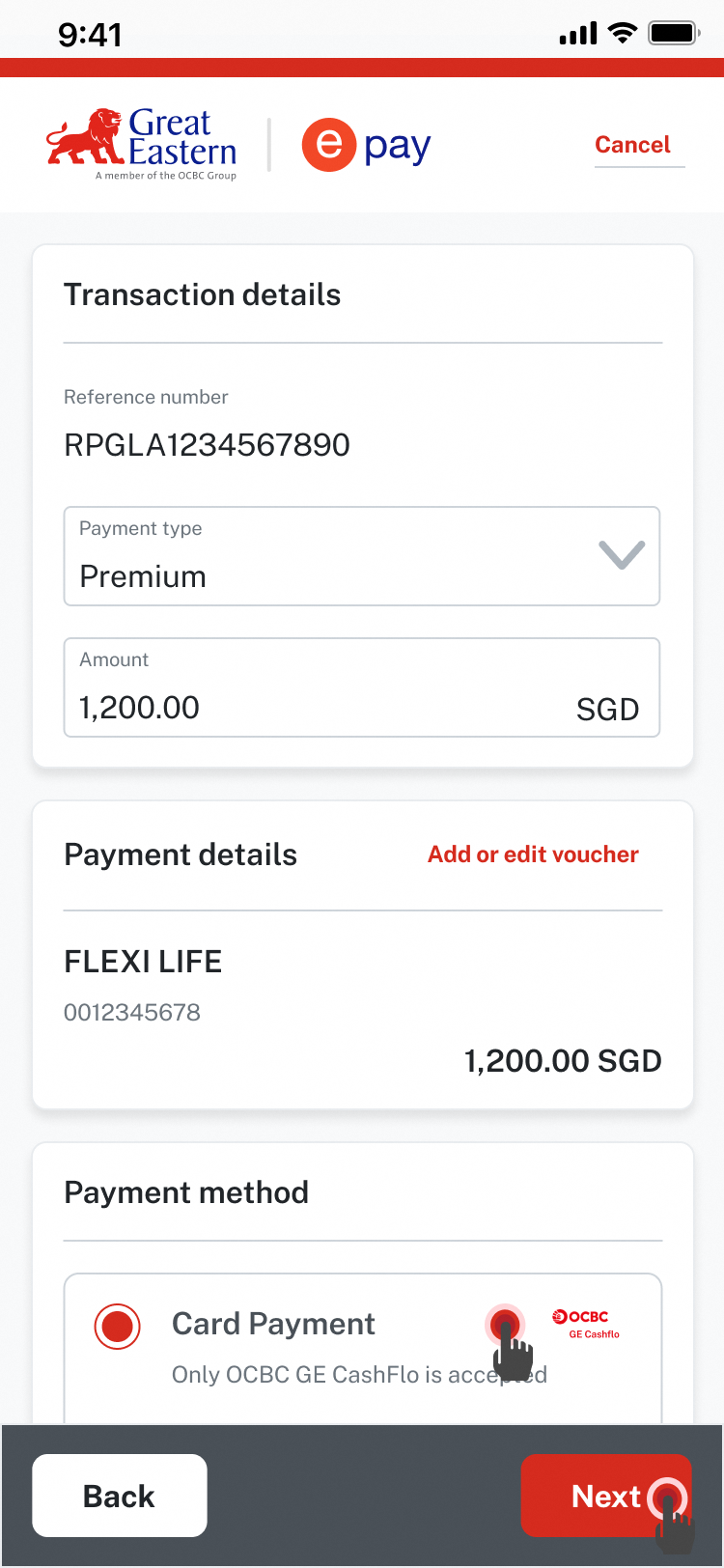

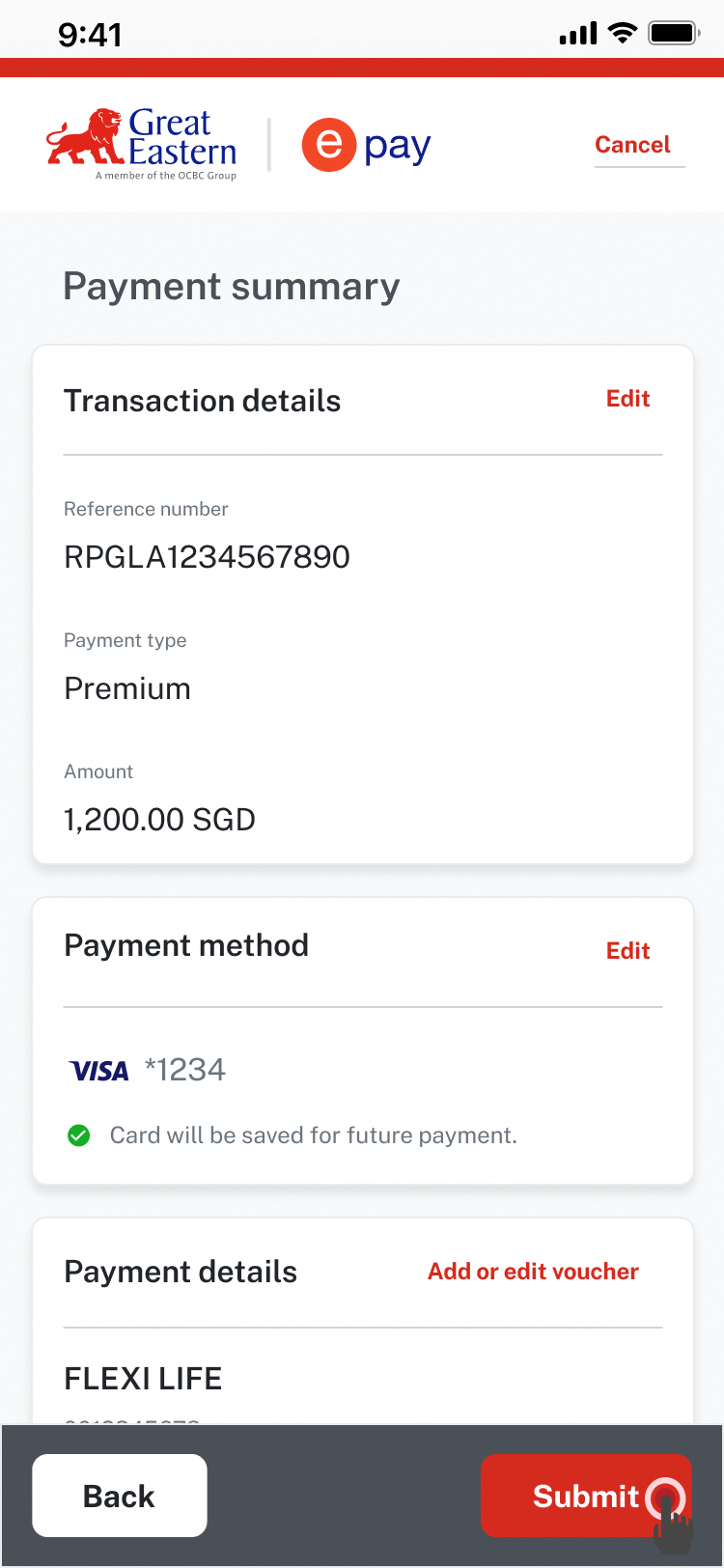

1. Great Eastern App

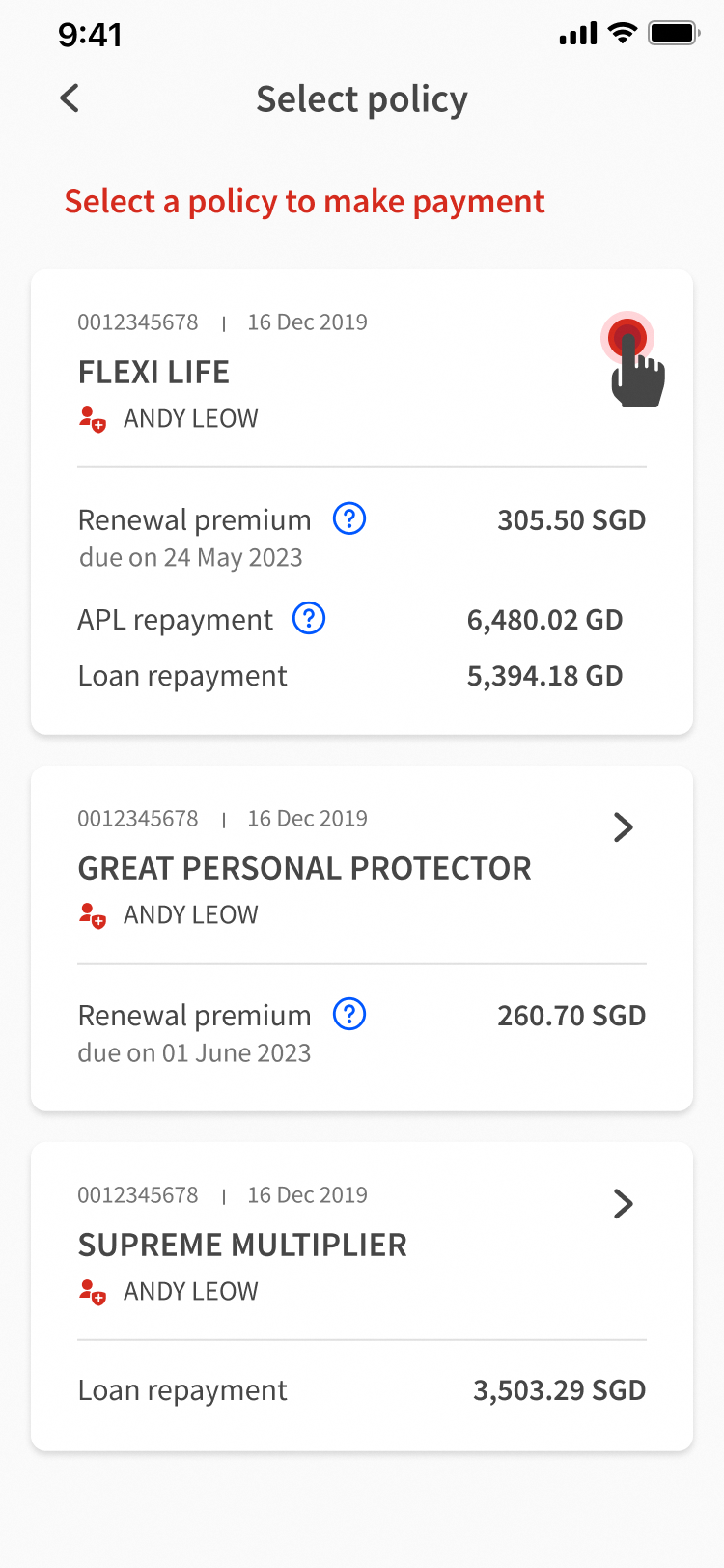

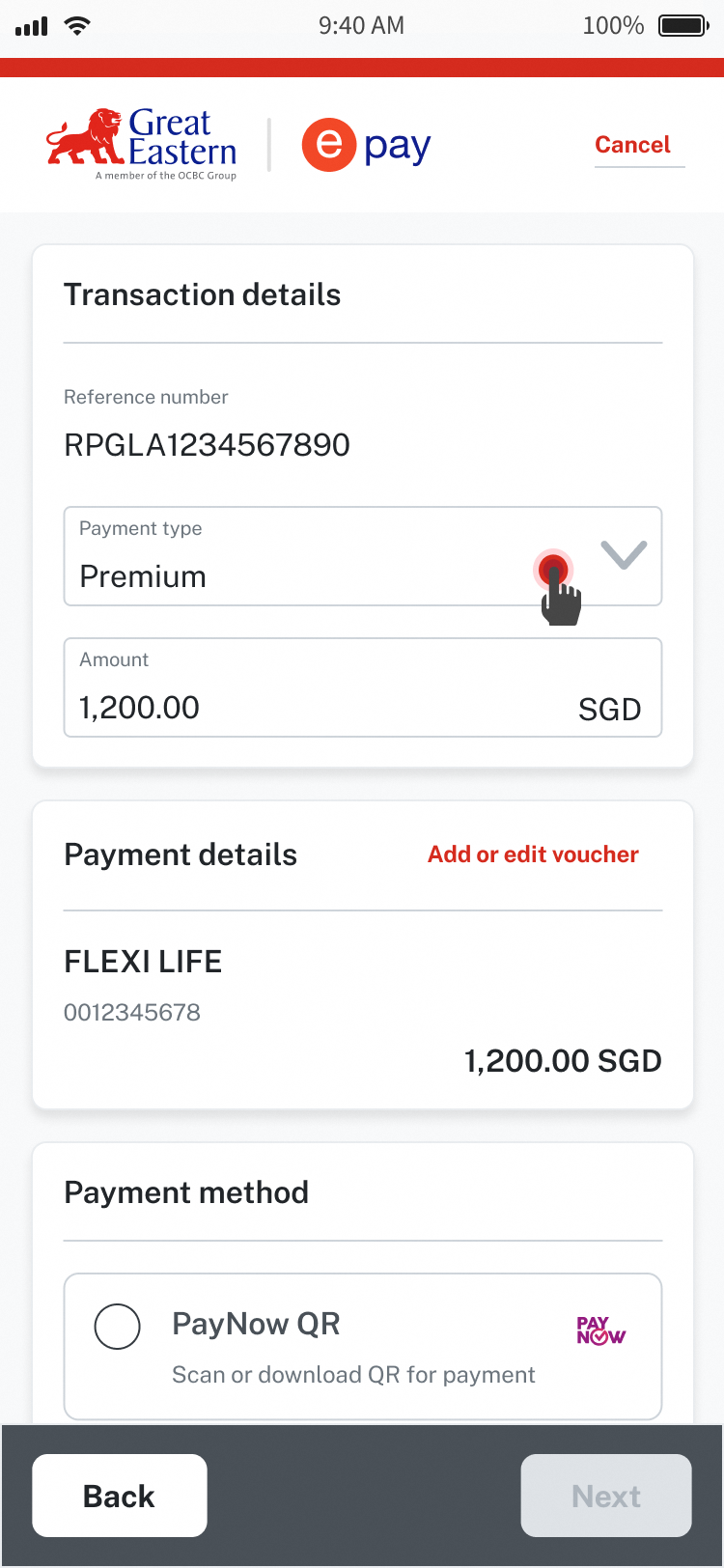

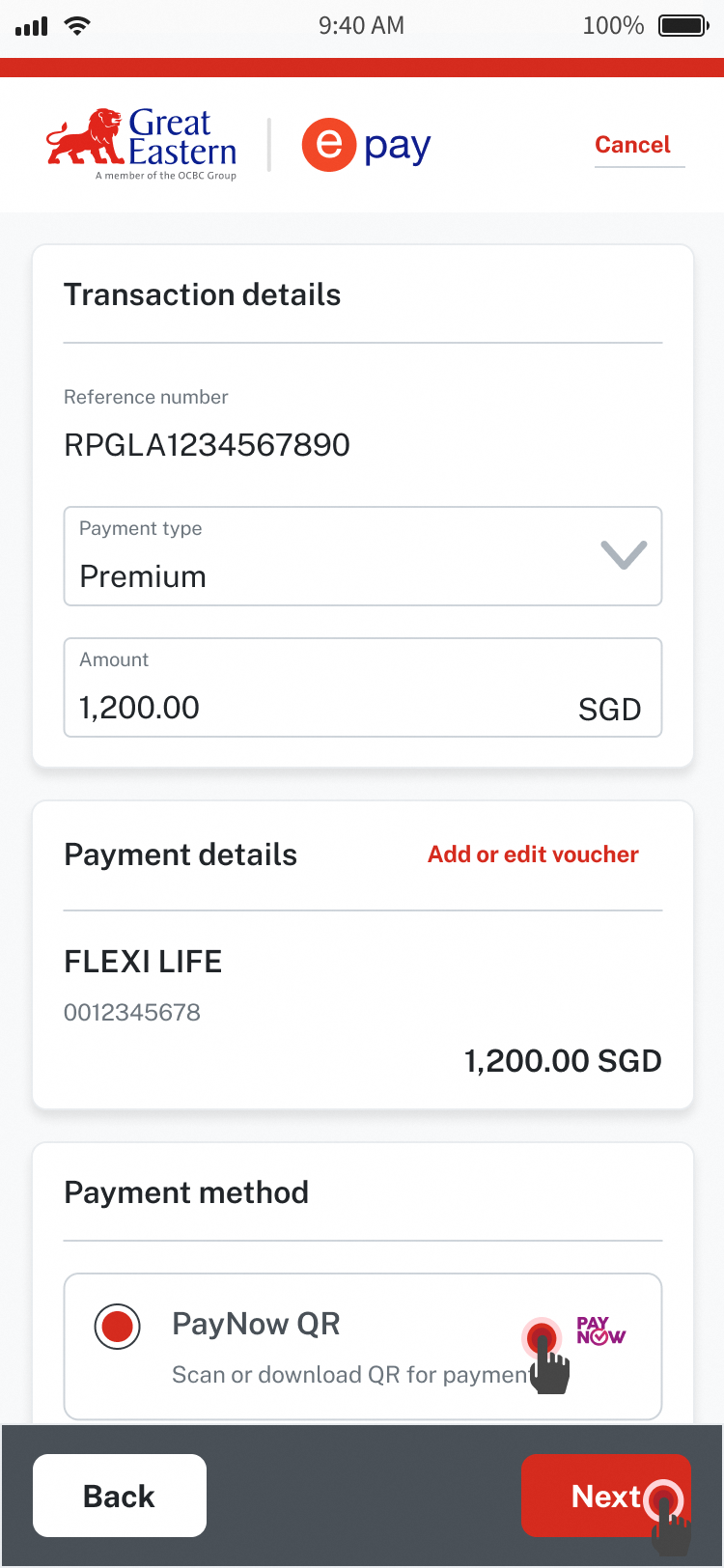

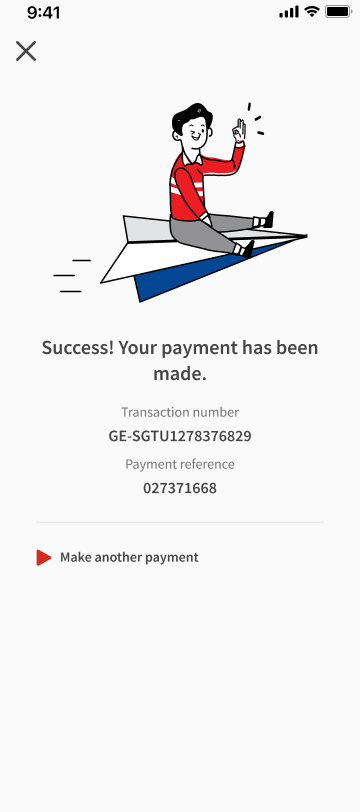

PayNow QR

- PayNow QR is only available for 10-digit SGD policies. Not applicable for Dependants' Protection Scheme policies.

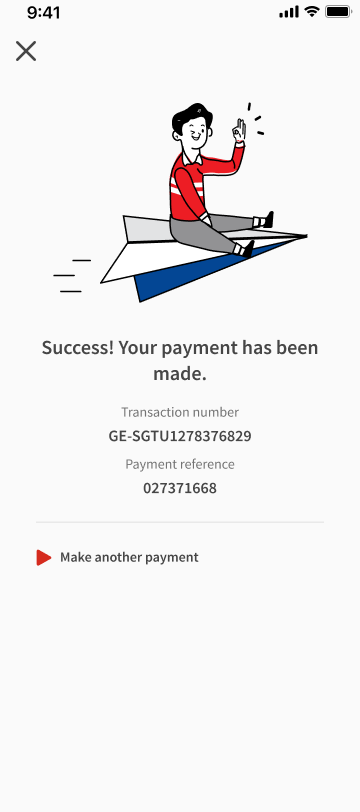

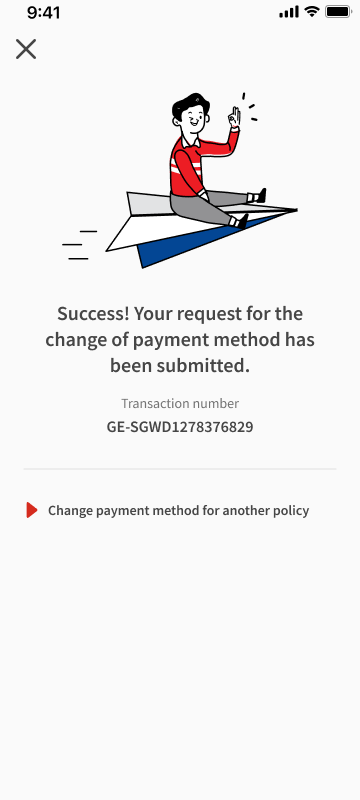

- Upon successful payment, you will receive a payment notification from your bank. Once we receive your payment, we will also send you a notification to confirm receipt of payment.

- If you are banking with OCBC, DBS/POSB, UOB, HSBC, or Maybank, you can set a PayNow daily transfer limit of up to SGD200,000. You can do this via your mobile banking app or through internet banking before you proceed with your PayNow payment.

- A summary of the transaction limits offered by each participating bank can be found in the media release by The Association of Banks in Singapore.

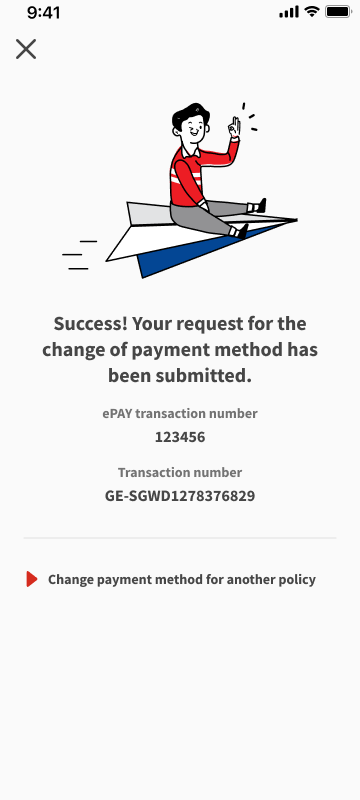

eGIRO

- Set up your eGIRO payment arrangement with one of the following participating banks.

- OCBC (Oversea-Chinese Banking Corporation, Limited)

- DBS/POSB (The Development Bank of Singapore Limited)

- UOB (United Overseas Bank Limited)

- SCB (Standard Chartered Bank (Singapore) Limited)

- HSBC (HSBC Bank (Singapore) Limited)

- MSL (Maybank Singapore Limited)

- Payment will be debited from your designated bank account on the preassigned payment date upon approval of the GIRO application.

- eGIRO is not applicable for Dependants' Protection Scheme policies.

a. Recurrent payment

b. One-time payment

- Credit card payment is available for all Accident and Health policies and new Singapore Dollar regular premium life policies submitted from 15 October 2020 onwards.

- For life policies launched from July 2014 and inforce by 14 October 2020, only the OCBC-Great Eastern Cashflo card can be used for payment.

- Payment by credit card is not applicable for regular Universal Life policies and Dependants' Protection Scheme policies.

2. Digital Channels

Pay using your policy number via billing organisation with the following banks:

- OCBC (Oversea-Chinese Banking Corporation, Limited)

- DBS/POSB (The Development Bank of Singapore Limited)

- UOB (United Overseas Bank Limited)

- SCB (Standard Chartered Bank (Singapore) Limited)

Accident and Health policies

- Sign in to your internet banking app.

- Follow the steps for your bank account:

- OCBC / DBS / POSB account holder: Based on your policy number, select Great Eastern Life (10 digits) as the billing organisation.

- UOB or SCB account holder: Select Great Eastern Life - Accident & Health policies as the billing organisation.

- Enter your policy number as the bill reference.

- Tap Pay Bills to complete the payment.

Life policies

- Sign in to your internet banking app.

- Based on your policy number, select Great Eastern Life (10 digits) as the billing organisation.

- Enter your policy number as the bill reference.

- Tap Pay Bills to complete the payment.

Allow at least 2 working days for your policy status to be updated after payment.

If your premium amount is above the transaction limit, you can either increase your transaction limit temporarily or make multiple transactions. You may wish to revert to the original lower transaction limit once this transaction has been completed. If you have any queries, please contact your bank for assistance.

Do not transfer premiums to your Financial Representative’s bank account. This is to prevent the mixing of funds, and to ensure a clear separation of money belonging to you and your Financial Representative.

Pay using your policy number through any of the following:

- Any AXS machine

- AXS m-Station via your smartphone or tablet

- AXS e-Station via the AXS website

- Based on your policy number, select Great Eastern Life (10 digits) or Great Eastern Life (8 digits) as your policy type.

- Select Premium as your payment type.

- Enter your policy number, payment amount, payor’s full name, and contact number.

For quicker payment, you may scan the personalised QR code on the letter from Great Eastern and enter the payor’s full name and contact number to proceed with payment.

Allow at least 2 working days for your policy status to be updated after payment.

You will need to make multiple transactions if your premium is above the transaction limit. Visit the AXS website to find out more about the available payment methods and transaction limit.

Perform a fund transfer to Great Eastern Life’s OCBC bank account with the following details:

- Bank: Oversea-Chinese Banking Corporation Ltd

- Account number: 501-036925-001 (Singapore Dollar policy); or 501-009492-201 (US Dollar policy)

Enter your proposal or policy number in the payment description or comments.

Allow at least 3 working days for your policy status to be updated after payment.

You may use telegraphic transfer for SGD policies (pay in SGD) and USD policies (pay in USD) if you are residing overseas.

Use your local bank’s internet banking app or visit a branch to carry out a telegraphic transfer. The following details are needed:

- Full name of policyholder

- Policy number

- Name of payee: The Great Eastern Life Assurance Co. Ltd

- Name and address of bank: Oversea-Chinese Banking Corporation, 65 Chulia Street, OCBC Centre, Singapore 049513 (SWIFT code: OCBCSGSG)

- Great Eastern Life bank account number (OCBC): 501-036925-001 (Singapore dollar policy) or 501-009492-201 (US dollar policy)

All bank charges related to the remittance will be borne by you.

Allow at least 10 working days for your policy status to be updated after payment.

3. Assisted by Financial Representative

Not applicable to Dependants' Protection Scheme policies

You can obtain a personalised QR code from your Financial Representative, and then make your premium payment via mobile banking.

- Open and sign in to your mobile banking app.

- Scan or upload a screenshot of the personalised QR code on the letter from Great Eastern.

- All information will be auto-populated. Verify the company name and payment amount.

- Confirm the payment.

Upon successful payment, you will receive a payment notification from your bank. Once we receive your payment, we will also send you a notification to confirm receipt of payment.

As payment by PayNow QR is immediate, we encourage you to use PayNow QR.

If you are banking with OCBC, DBS/POSB, UOB, HSBC, or Maybank, you can set a PayNow daily transfer limit of up to SGD200,000. You can do this via your mobile banking app or through internet banking before you proceed with your PayNow payment.

A summary of the transaction limits offered by each participating bank can be found in the media release by The Association of Banks in Singapore.

Not applicable to Dependants' Protection Scheme policies

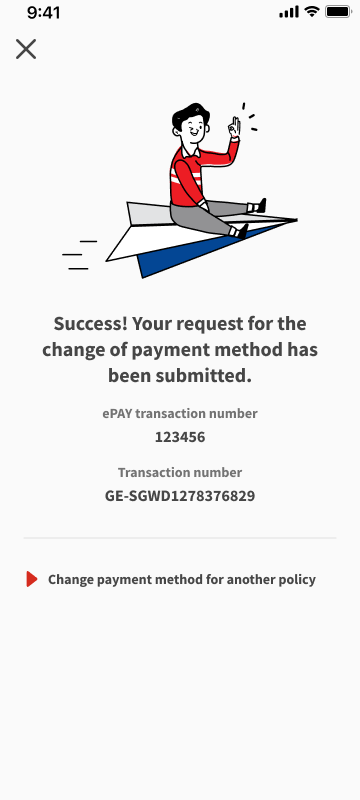

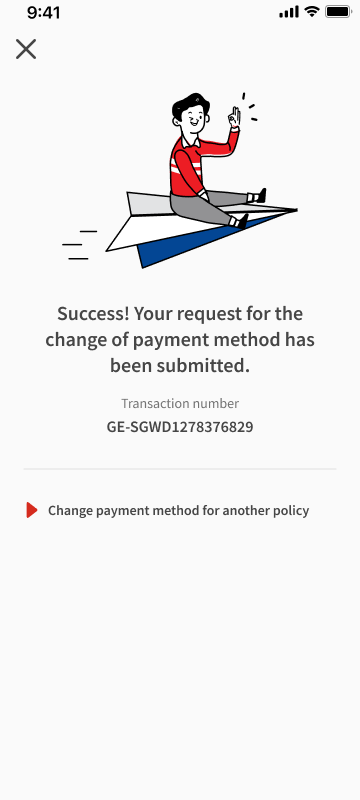

Your Financial Representative will trigger an email (via ePay) to you. You can use the email to sign up for eGIRO with one of the following participating banks:

- OCBC (Oversea-Chinese Banking Corporation, Limited)

- DBS/POSB (The Development Bank of Singapore Limited)

- UOB (United Overseas Bank Limited)

- SCB (Standard Chartered Bank (Singapore) Limited)

- HSBC (HSBC Bank (Singapore) Limited)

- MSL (Maybank Singapore Limited)

Payment will be debited from your designated bank account on the preassigned payment date upon approval of the GIRO application.

Not applicable to Dependants' Protection Scheme policies

You can meet up with your Financial Representative, who will be able to assist if you would like to make the payment for your premium via credit card.

You can meet up with your Financial Representative, who will be able to assist if you would like to make the payment for your premium via cheque.

- Prepare a crossed cheque payable to “The Great Eastern Life Assurance Co. Ltd”.

- Write the policyholder’s full name and policy number on the back of the cheque.

- Pass your cheque to your Financial Representative.

- Your Financial Representative will provide you with a payment reference number.

4. Post

You may pay via cheque for SGD policies (pay in SGD) and USD policies (pay in USD).

- Prepare a crossed cheque payable to “The Great Eastern Life Assurance Co. Ltd”.

- Write the policyholder’s full name and policy number on the back of the cheque.

- Mail your cheque to:

The Great Eastern Life Assurance Company Limited

1 Pickering Street

Great Eastern Centre #01-01

Singapore 048659

Allow at least 3 working days for your policy status to be updated upon receipt of payment.

You may pay via bank draft for SGD policies (pay in SGD) and USD policies (pay in USD) if you are living overseas.

- Prepare a bank draft payable to "The Great Eastern Life Assurance Co. Ltd".

- Write the policyholder’s full name and policy number on the back of the bank draft.

- Mail the bank draft to:

The Great Eastern Life Assurance Company Limited

1 Pickering Street

Great Eastern Centre #01-01

Singapore 048659

5. Cashier Counter at Customer Service Centre

- Prepare a crossed cheque payable to “The Great Eastern Life Assurance Co. Ltd”.

- Write the policyholder’s full name and policy number on the back of the cheque.

- Drop off your cheque at the contactless drop box marked “Cheque” at any of our Customer Service Centres.

Visit any of our Customer Service Centres and pay using your policy number.

Do not make cash payment to your Financial Representative. This is to prevent the mixing of funds, and to ensure a clear separation of money belonging to you and your Financial Representative.

From 1 September 2024, cash payments at our counter will only be accepted if payments are made by the policyholder or life assured in person. The policyholder or the life assured are to bring along valid photo identification documents for verification.