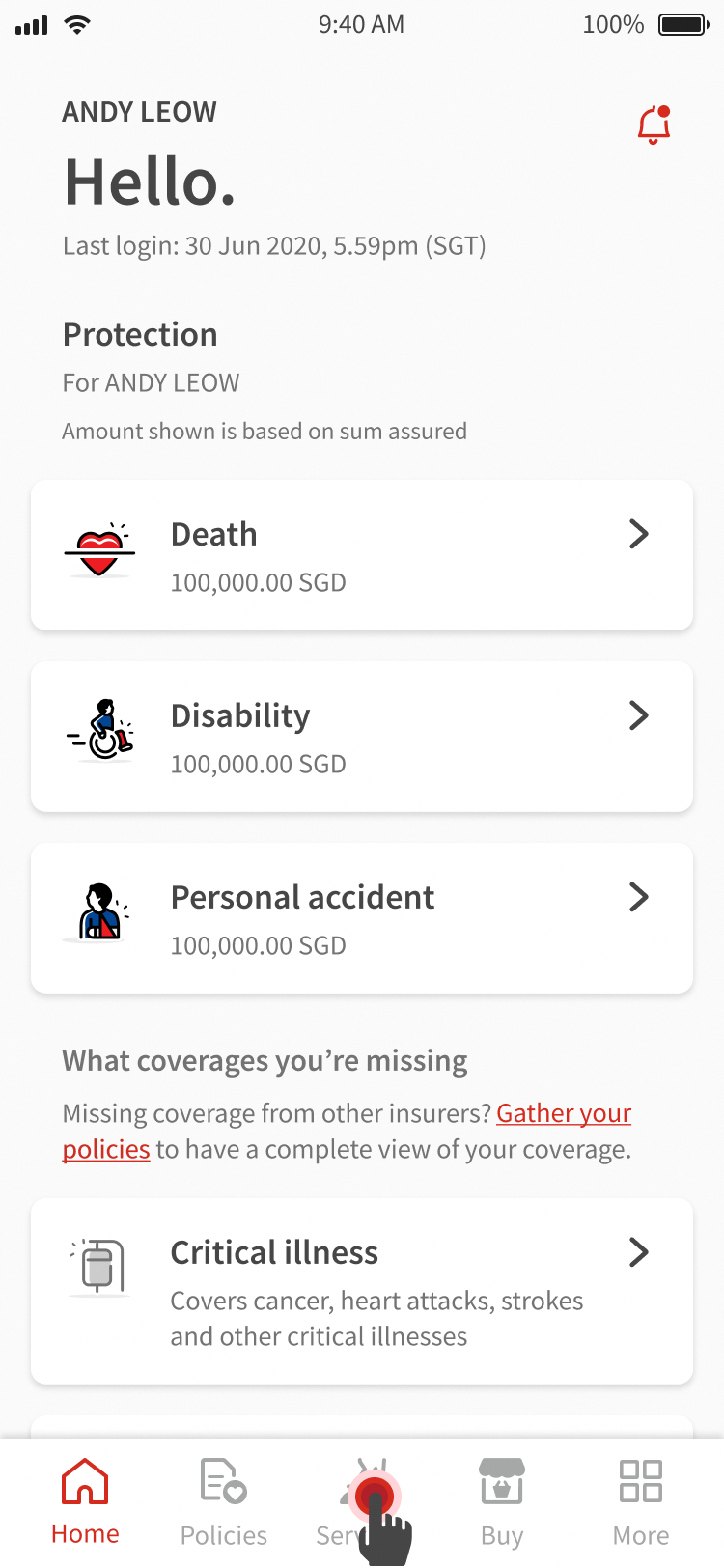

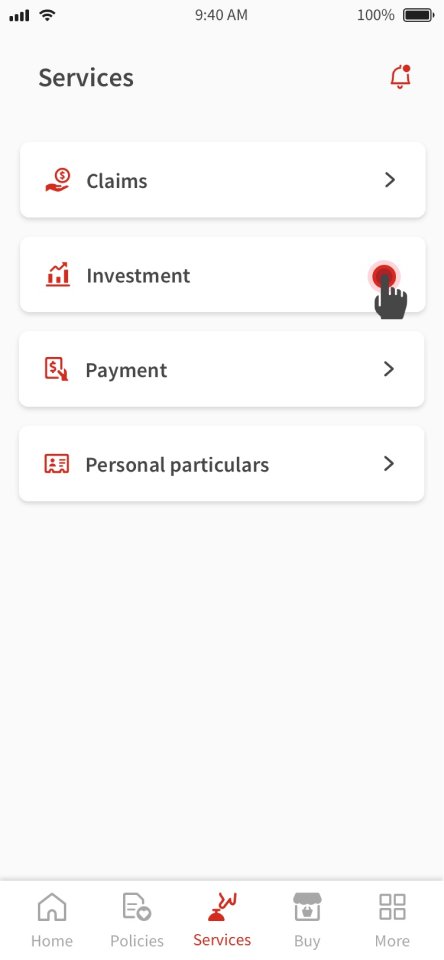

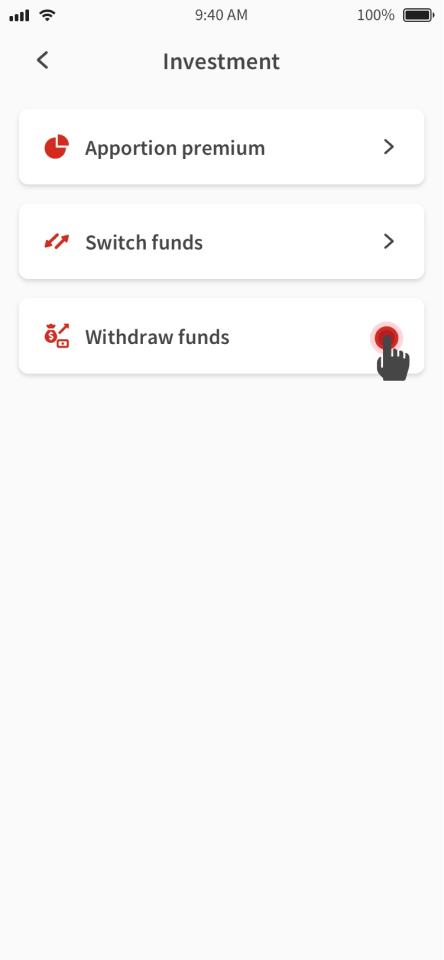

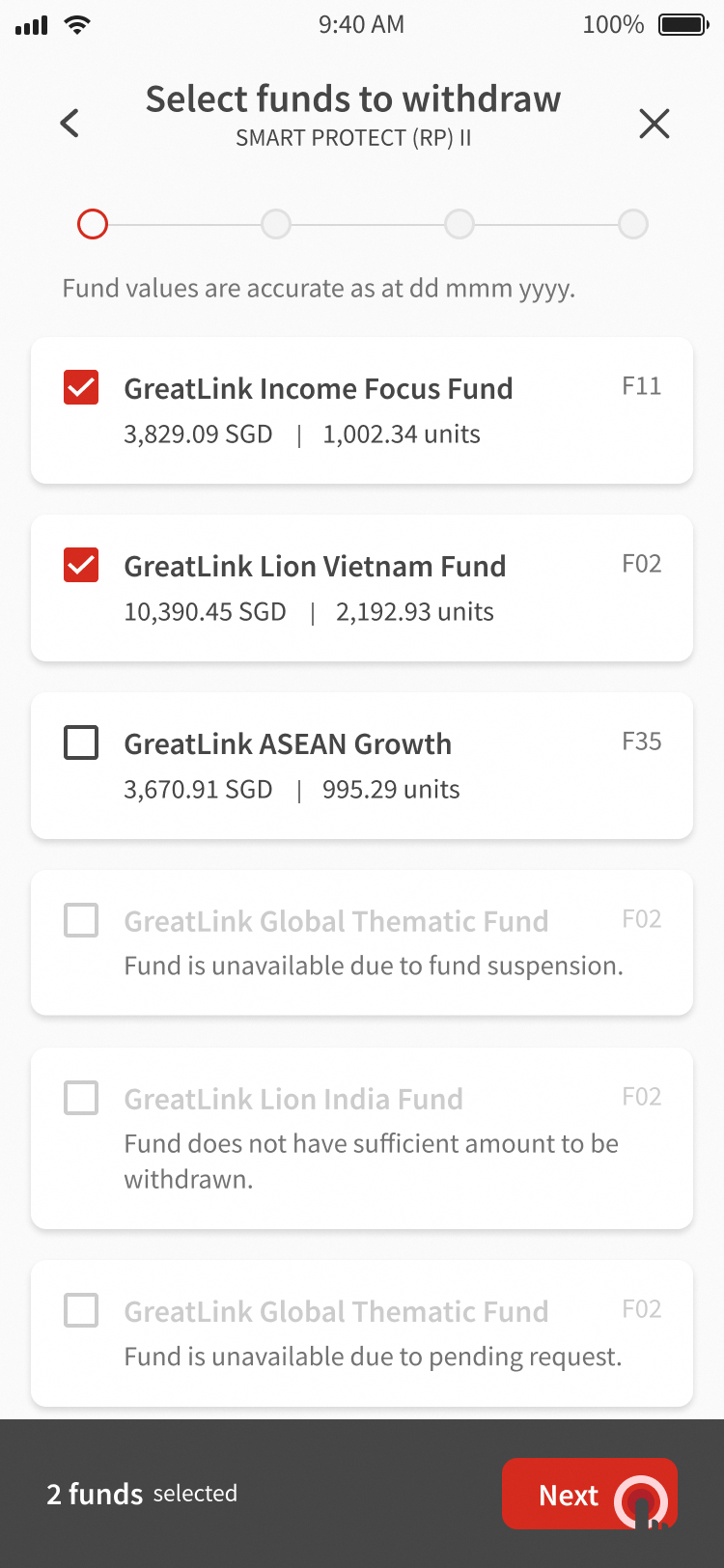

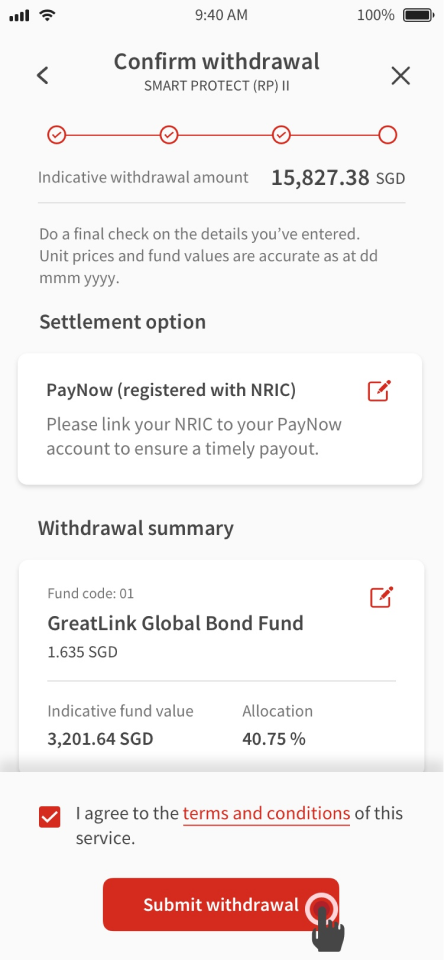

Withdraw funds from investment-linked plan

Follow our guide to withdraw funds from your investment-linked plans (ILP).

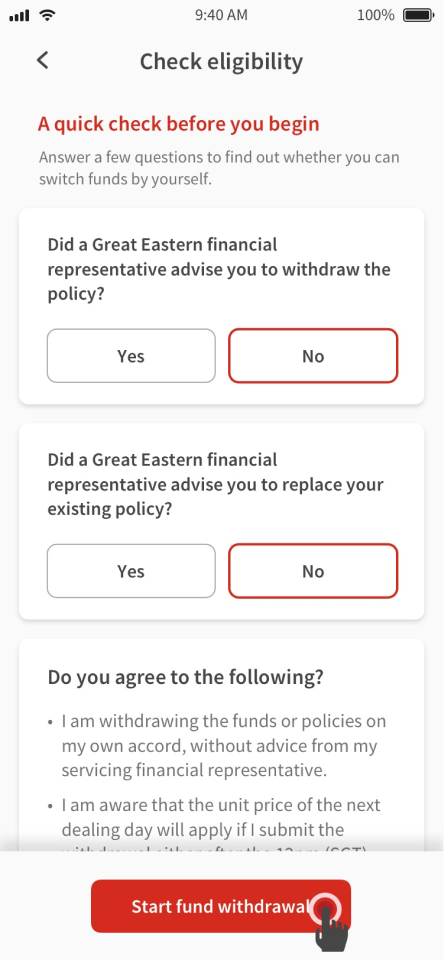

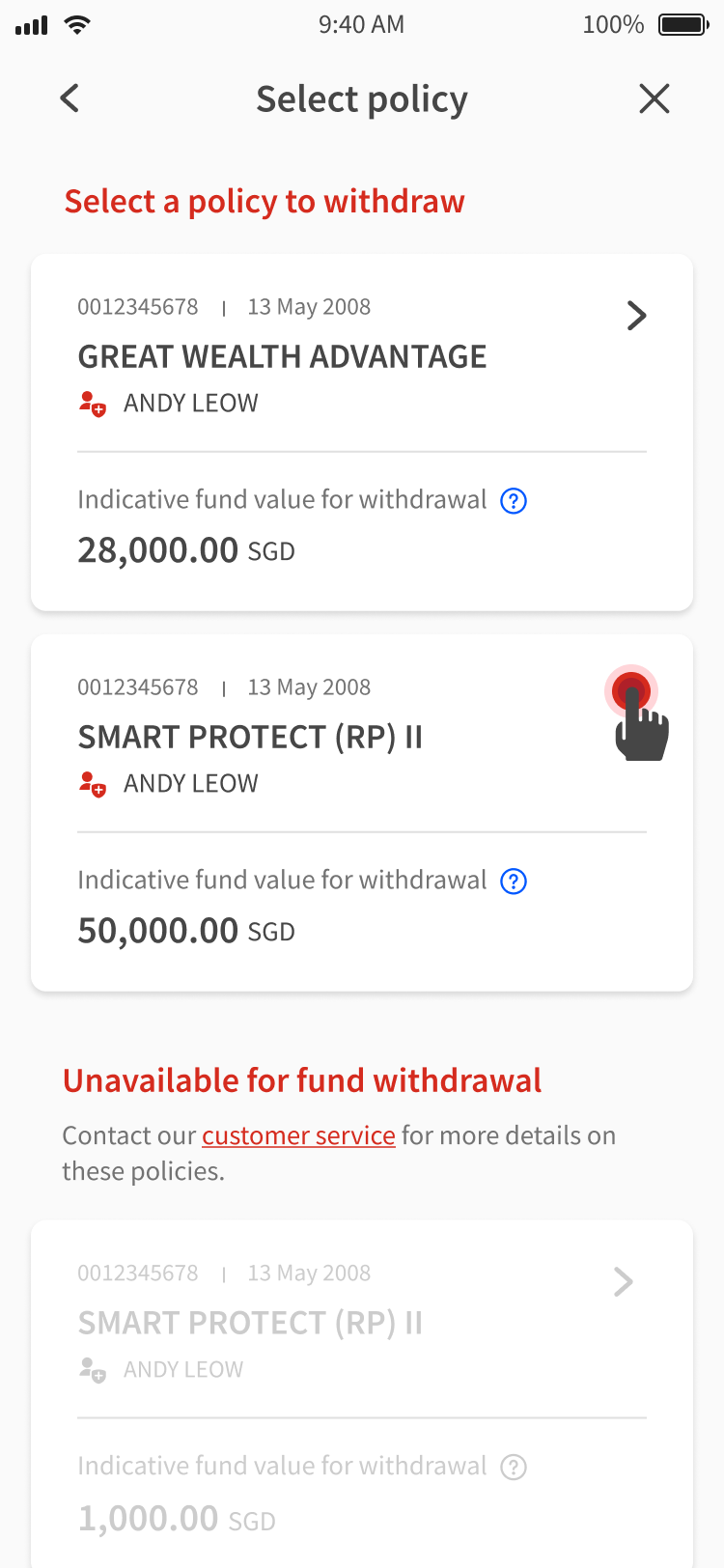

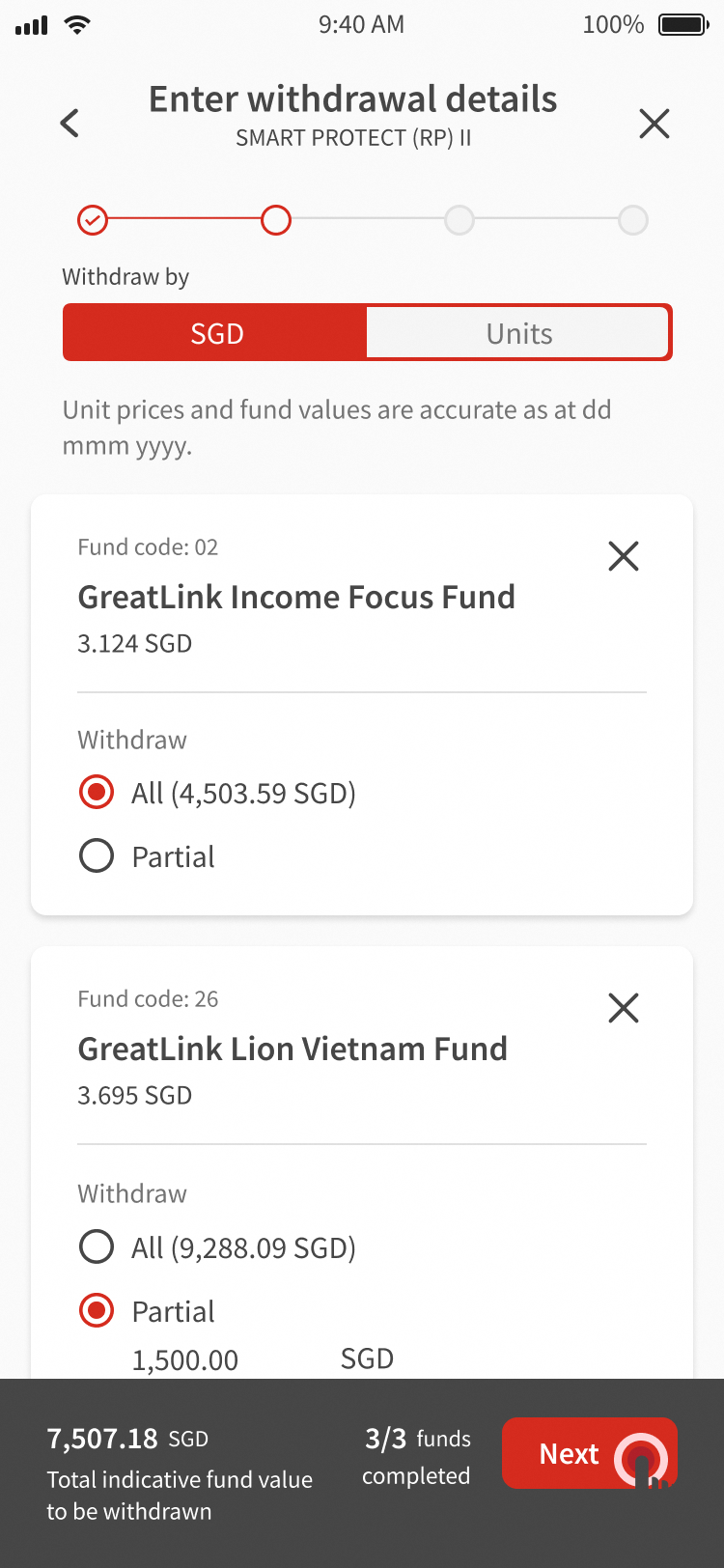

You can withdraw funds from your ILP at any time. Please refer to your policy for the surrender charge that may be levied for each withdrawal.

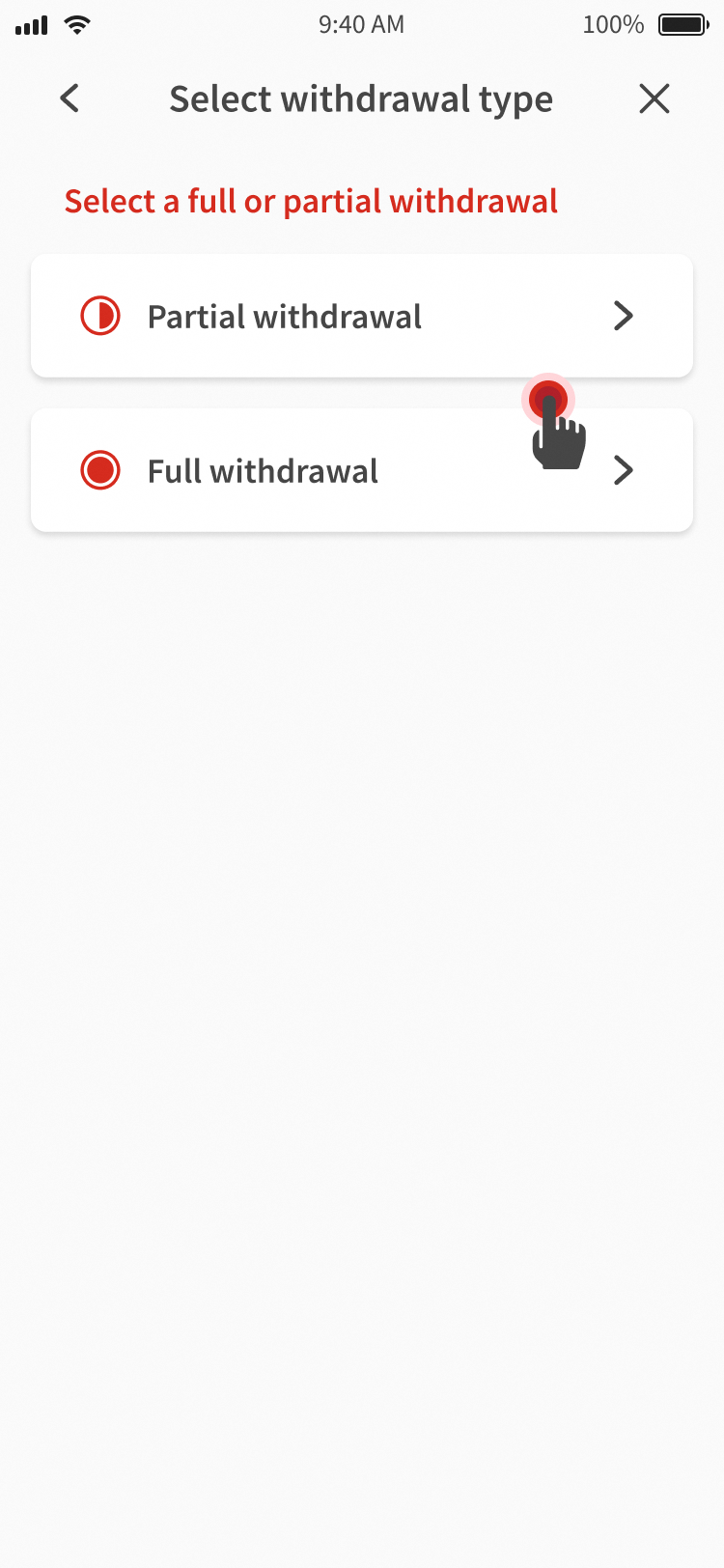

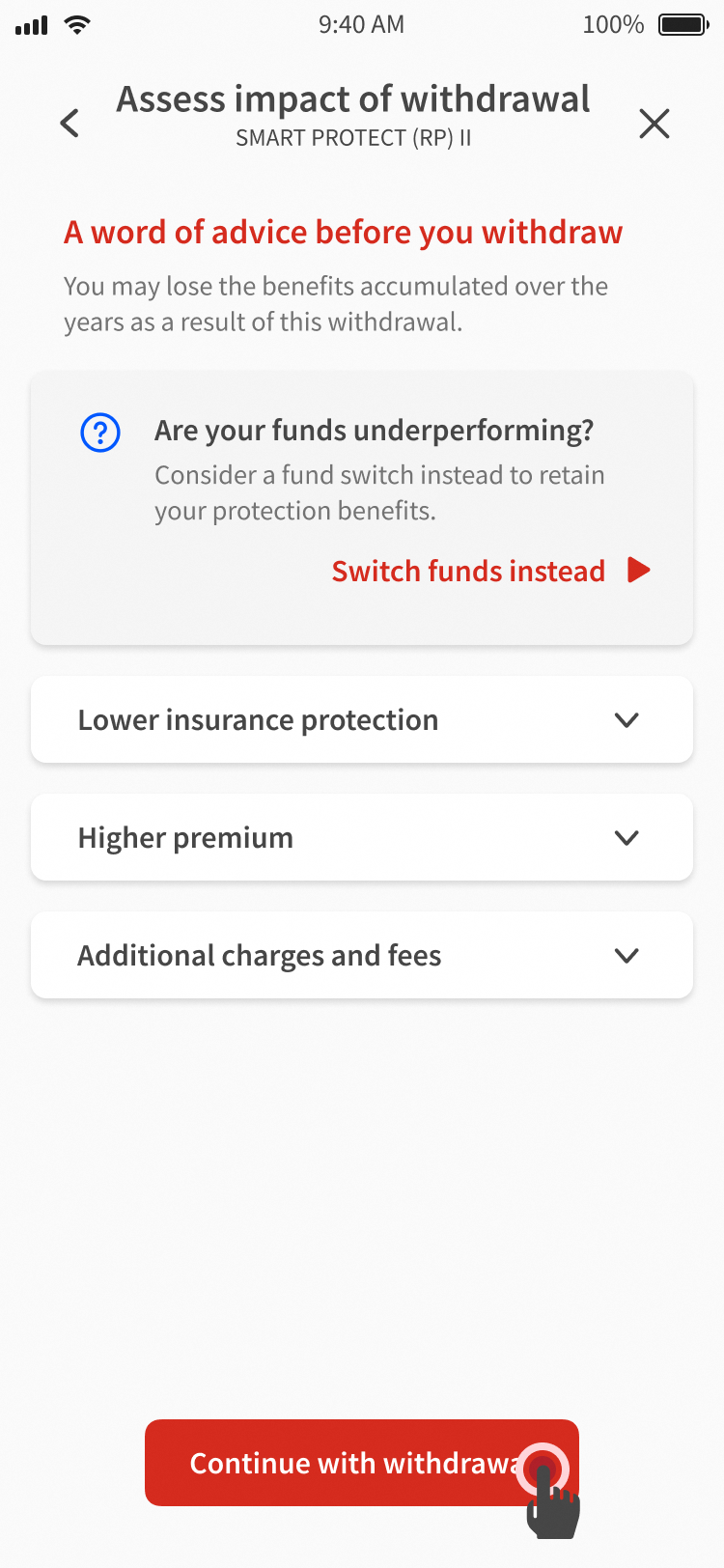

Once all the funds from an ILP have been withdrawn, the policy will be cancelled and no longer in be inforce. Any protection coverage under the ILP will also end. As such, consider carefully before requesting for fund withdrawal from your ILP.

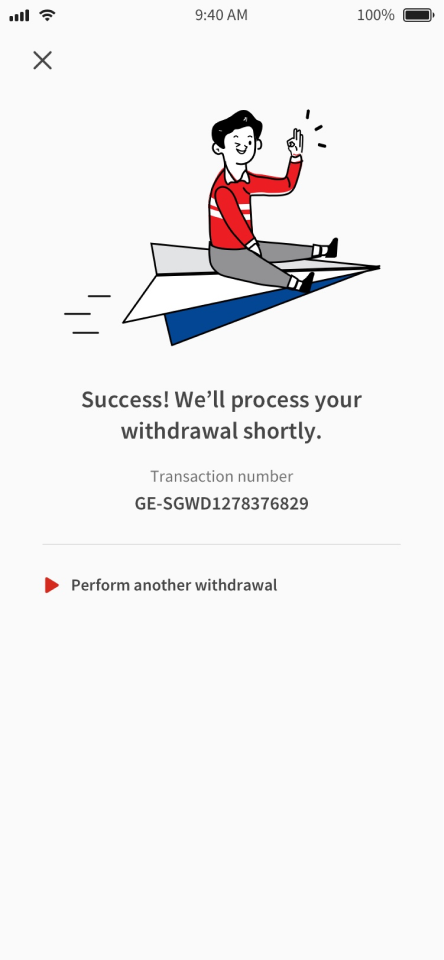

Withdrawals cannot be reversed or cancelled.

If you had previously withdrawn funds from your ILP, and subsequently wish to return it to the ILP, this can only be done through a top-up or new purchase. Top-ups and new purchases which is subject to existing rules, one of which is a minimum sum for top-up.

For some ILPs, the sum assured will decrease in proportion to the amount withdrawn. If you wish to maintain the same sum assured, please indicate as such in the Great Eastern App when making the fund withdrawal.

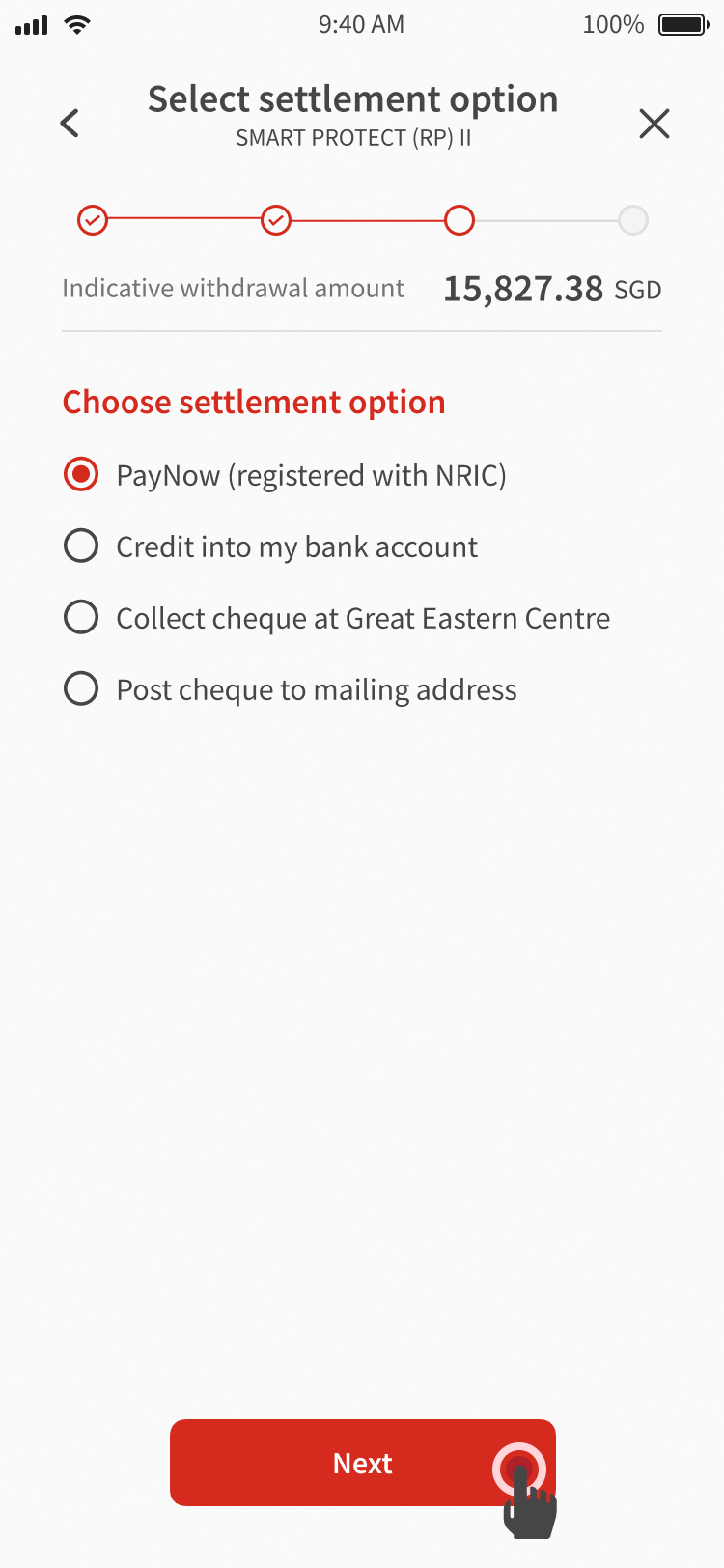

How to receive funds from ILP

You can receive your ILP funds through PayNow or direct crediting.

If you have not registered for PayNow, you can do so at a participating bank.

When you will receive the funds

If you have a local bank account, you will receive your funds in your designated bank account within 3 working days after your withdrawal request has been submitted.

If you do not have a local bank account, you will receive your funds via telegraphic transfer or bank draft within 1 week after your identity has been verified via the telephone.