- Customer Services

- Participating funds and bonuses

- Learn about participating funds and bonuses

Learn about participating funds and bonuses

The bonus rates for participating funds are dependent on various factors, such as global market conditions, investment outlook, and geopolitical developments, among others.

In deciding bonus rates, we also take into account the past performance of the participating funds while ensuring their sustainability in the long term.

We will continue to manage the participating funds prudently to provide you with stable returns.

Participating Funds (Par Funds)

- Par Fund Update 2023 (PDF) English | 中文

- Par Fund Update 2022 (PDF) English | 中文

- Par Fund Update 2021 (PDF)

This was previously known as The Overseas Assurance Corporation Limited (Participating Fund 2). It has been merged with Participating Fund into a combined Participating Fund with effect from 1 January 2023. For updates on the combined Participating Fund, refer to Par Fund Update 2023 above.

For more information, refer to our FAQs.

- Par Fund 2 Update 2022 (PDF) English | 中文

- Par Fund 2 Update 2021 (PDF)

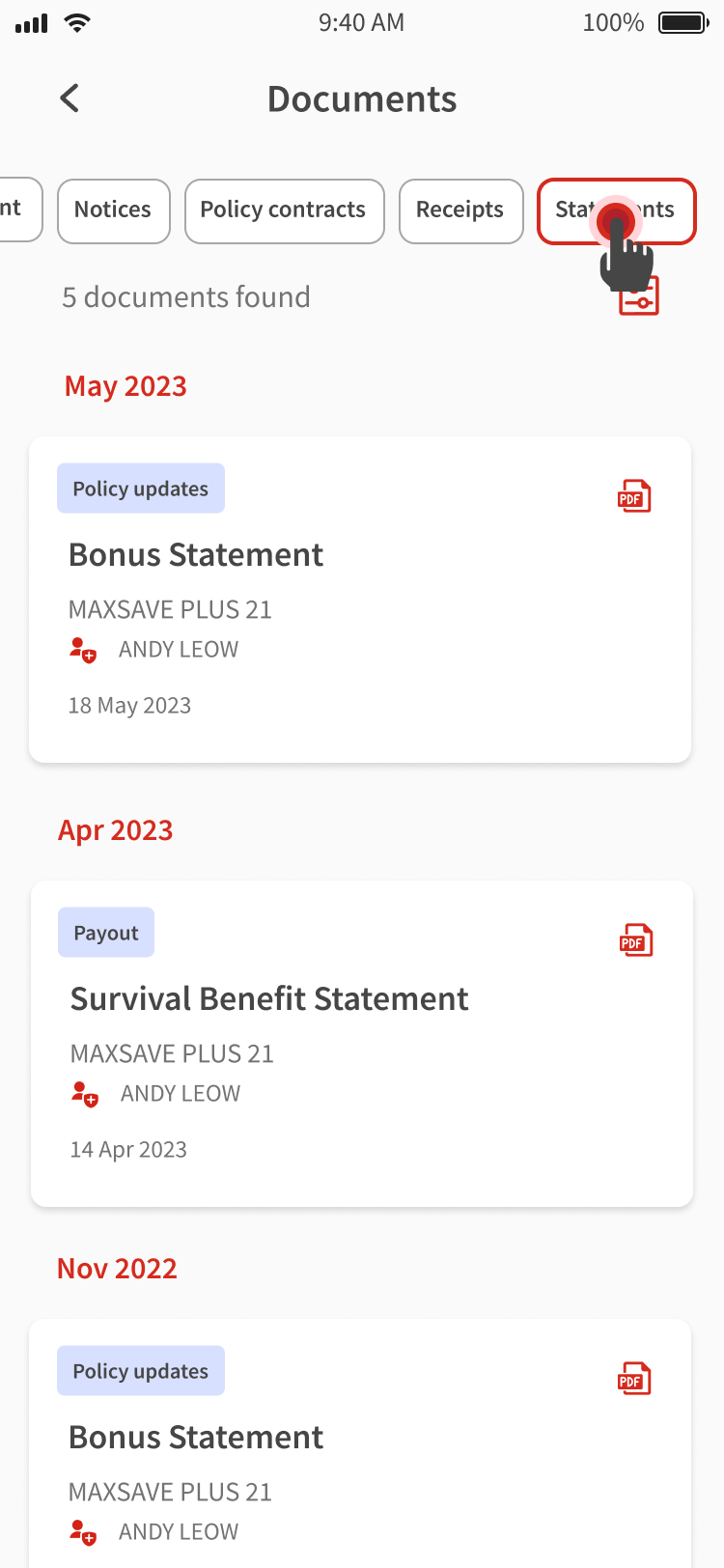

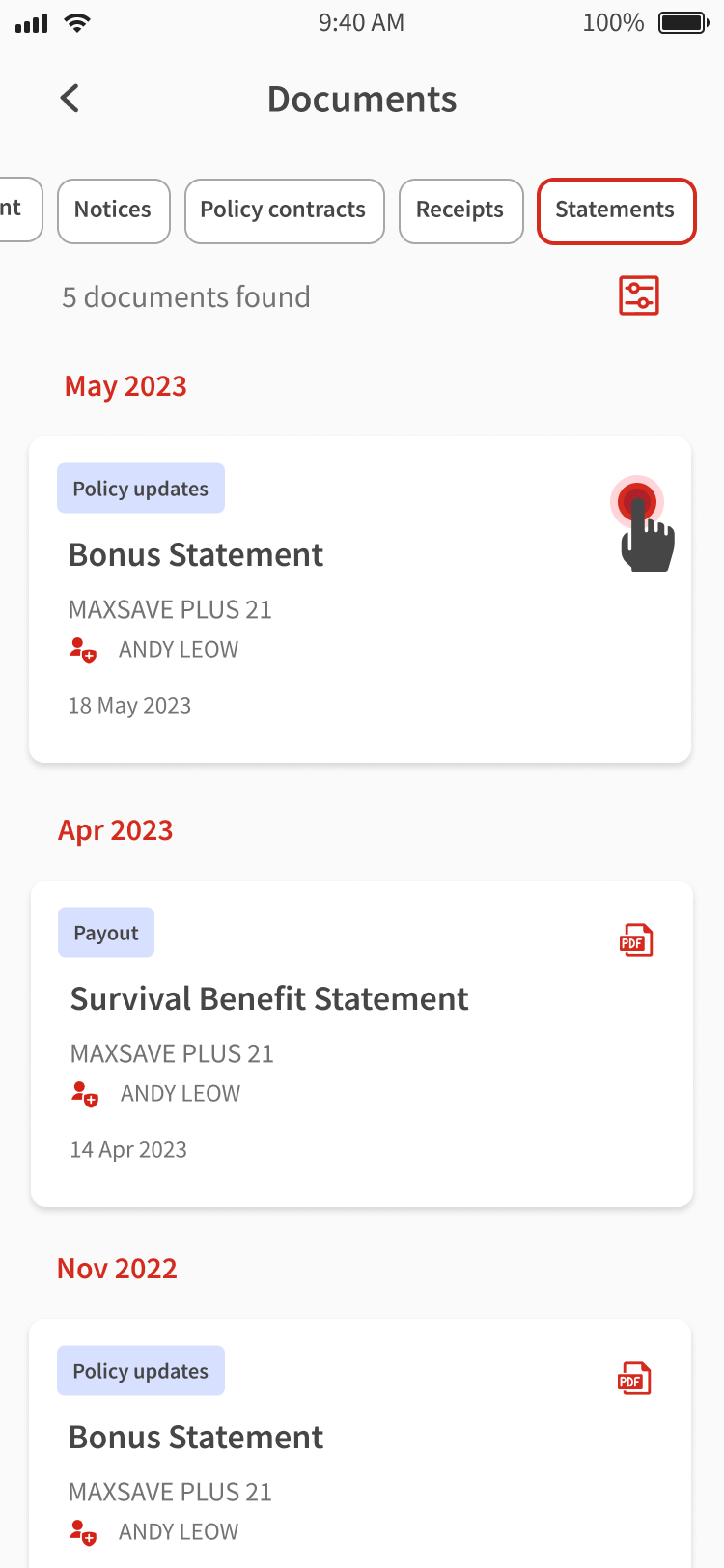

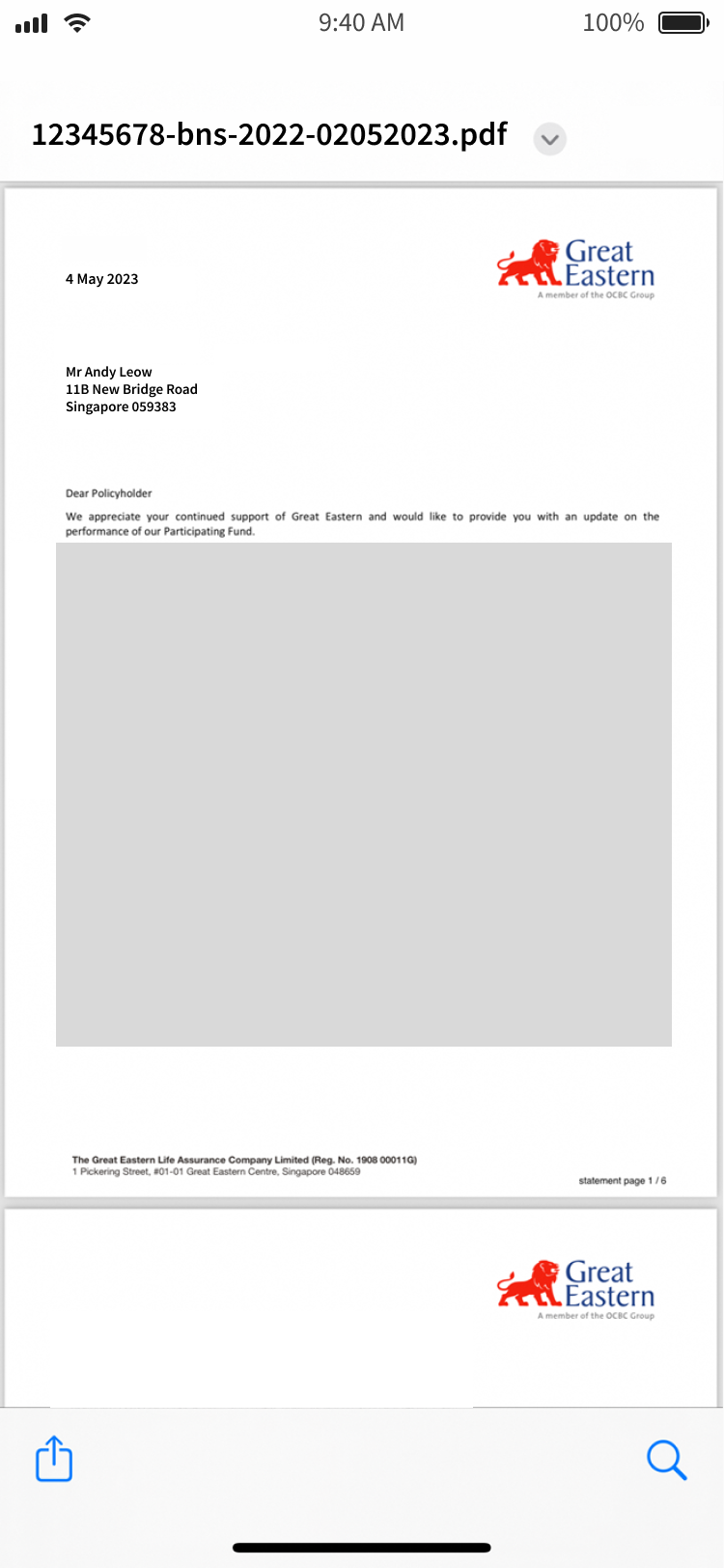

Bonus statement

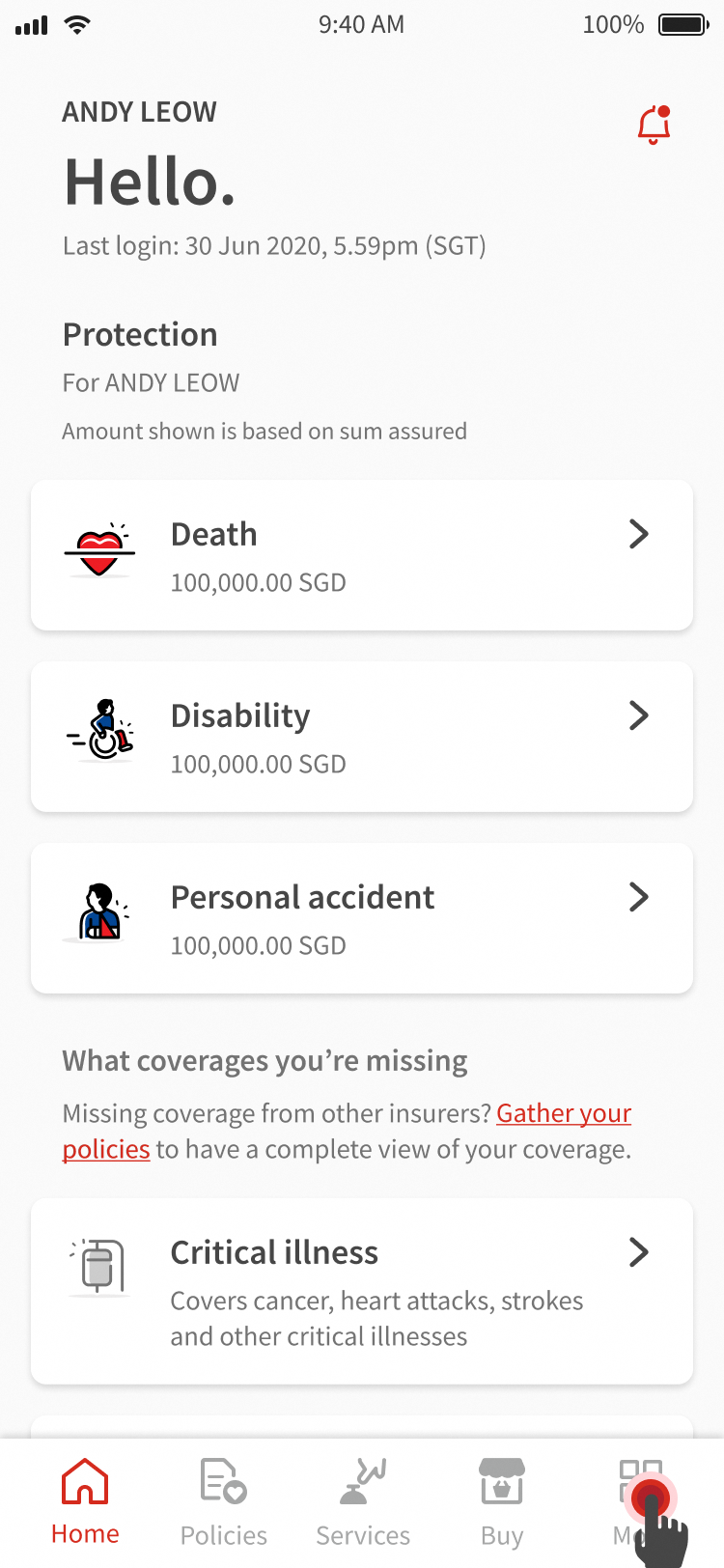

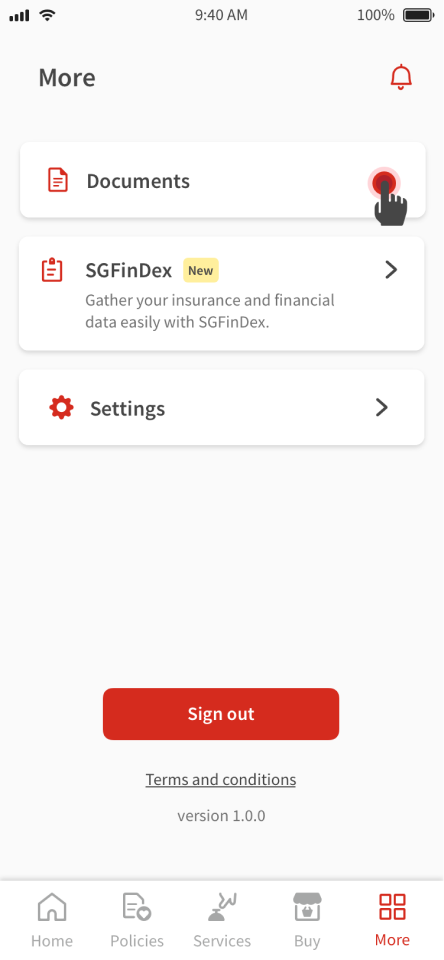

Great Eastern App

Questions and Answers

The bonus rates are maintained for 2023.

Once declared and vested, bonuses are guaranteed and payable in the event of a claim. Future bonuses, including maturity or terminal bonuses, are projected. The actual bonus rates declared in the future may be higher or lower, depending largely on the investment climate and economic conditions.

The policy illustration is meant to illustrate the potential level of policy benefits to policyholders, including the non-guaranteed elements, based on the prevailing outlook of the performance of the Par Fund. One of the key elements affecting the non-guaranteed policy benefits is investment returns which can vary from year to year.

The rates used in the illustration are not a reflection of the actual returns of both existing and future participating policies. The actual returns received for a participating policy will depend on the actual experience, including investment performance, of the Par Fund that will develop over the lifetime of the participating policy.

The illustrated values will be different from the bonus statement last year if your policy is a whole life policy and the life assured’s age is between 45 to 79 as the illustrated values are based on the year that is 20 years after the current year.

For example:

If your age today is 47, illustrated values this year are based on the year 2044 (20 years later from 2024). In the bonus statement last year, your age was 46 and illustrated values are based on the year 2043 (20 years later from 2023).

Bonus rates declared are approved by the board of directors after written recommendation from the appointed actuary. When making the recommendation for the amount of bonus to be declared for each policy, the appointed actuary has to take into consideration key factors that will affect the surplus available for distribution. These key factors include not only the investment performance and the outlook of the performance of the Par Fund in the medium to long term; they also include the claim experience, expenses, surrenders, and lapses.

The cumulative effect of past investment performance would be different for different plans, depending on the year of issue and type of plan.

We will be sending the Annual Bonus Statement for 2023 to all our policyholders by batches in July 2024.

The Annual Bonus Statement together with the Participating Fund update for 2023 will be mailed out to policyholders who are aged 60 years old and above, or have previously opted for hardcopy communications.

You may wish to update your preference via the following:

- Log on to eConnect

OR

- Call our Customer Service on 1800 248 2888 or email us at wecare-sg@greateasternlife.com

The Annual Bonus Statement will give you details of the bonus declared, including the current and past three years’ reversionary bonus rates allocated. It will also provide details of the change in the illustrated values if the bonus rate of your policy has been adjusted.

The Annual Bonus Statement will be accompanied by the Participating Fund update for 2023. The Participating Fund update will inform you of the performance of our Par Fund in 2023, the asset mix, overview of the economic outlook and the allocation of annual bonuses to Par Policies for the year.

There are also explanatory notes and infographics to help you understand the common insurance terms used as well as how illustrated values are derived.

Once declared, bonuses are guaranteed and are payable in the event of a claim.

We do not encourage you to withdraw the accumulated bonus prematurely. This is because you will be paid only the surrender value of the accumulated bonus. If you have short-term financial needs, you may wish to consider taking a policy loan instead.

This bonus statement is an annual statement applicable for participating policies which were in force at the end of 2023.

Updates for policies without Participating Funds will be reflected in a separate statement, and not together in the statement for policies with Participating Funds.

For endowment policies, we will show the “Illustrated Maturity Value”.

For whole life policies, we will show the “Illustrated Surrender Value” and “Illustrated Death Benefit” based on the life assured’s (LA) age today as follows:

- If LA’s age is below 45 – the illustrated values are based on the year that the LA turns 65

- If LA’s age is between 45 to 79 – the illustrated values are based on the year 2044 (20 years later)

- If LA’s age is above 79 – the illustrated values are based on the year that the LA turns 99

For policies with survival benefit and/or cash bonus, the illustrated values exclude any survival benefit and/or cash bonus kept on deposit with Great Eastern.

You may refer to the original policy illustration for these values.