Unlock tax savings with the SRS

What exactly is the Supplementary Retirement Scheme (SRS)?

The Supplementary Retirement Scheme (SRS) is part of Singapore's Government’s policy for Singaporeans, Singapore Permanent Residents (PR), and foreigners to save for retirement needs.

In contrast to CPF contributions which are mandatory, contributions towards SRS are voluntary. Contributions into your SRS account are over and above your CPF savings, and are eligible for tax relief.

Save on your taxes. Accumulate more for your golden years.

Every year, you can choose to contribute funds into your SRS account which may be used to purchase various investment instruments to potentially earn higher returns for your retirement. Investment returns are tax-free before withdrawal and only 50% of the withdrawals from SRS are taxable on or after your statutory retirement age.

How it works

The following illustration is based on an individual's annual income of S$105,000 and a personal relief of S$21,400.

Get a dollar-for-dollar tax relief on your yearly income with every dollar saved into your SRS account. Work out how the yearly maximum SRS contribution of S$15,300 can help reduce your tax payment:

Using SRS for retirement

It’s never too early to start thinking about retirement. While SRS may be labelled as a retirement scheme, you can get started from 18 years old to open a SRS account with one of the 3 bank operators in Singapore:

- DBS Group Holdings Ltd

- Oversea-Chinese Banking Corporation Ltd

- United Overseas Bank Ltd

Funds from your SRS account can be used to invest in various financial products such as exchange traded funds, local shares, bonds, unit trusts or insurance products.

Benefits for investing using SRS

- Enjoy tax relief for every dollar saved into the account, plus benefit from lower tax payable.

- Freedom to invest SRS to boost retirement savings.

- Only 50% of withdrawals are taxable after retirement.

Here's how SRS funds can be invested into GREAT Prime Rewards 3

Ann, 43 years old. She earns an annual income of S$105,000, has a personal tax relief of S$21,400. She decides to contribute S$15,300 into her SRS account and enjoys tax savings of S$1,233.

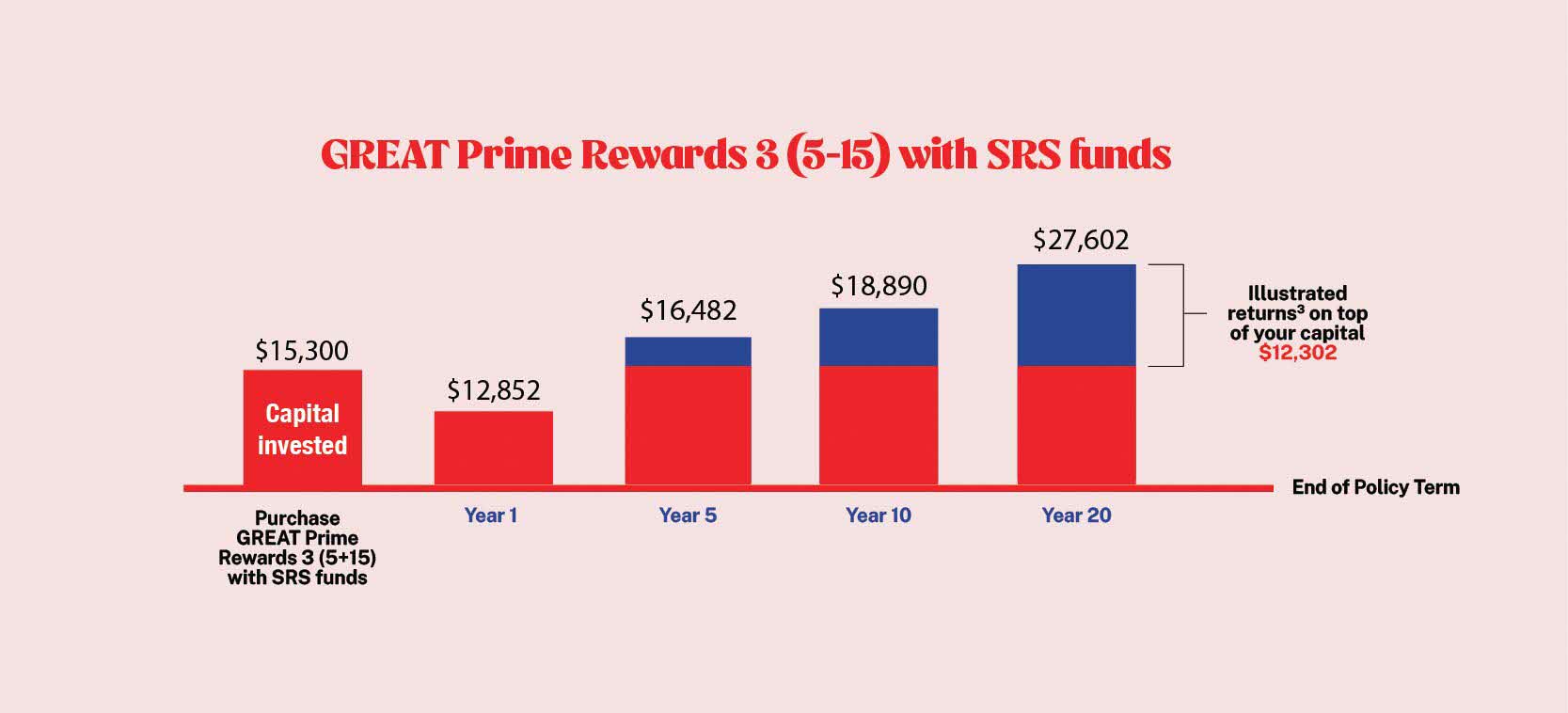

Ann decides to invest her SRS funds in GREAT Prime Rewards 3 (5+15) with a policy term of 20 years to earn potentially higher returns. She also chooses to accumulate the annual cash payouts to earn additional non-guaranteed interest.

The above figures are based on an Illustrated Investment Rate of Return (IIRR) at 4.25% per annum under the accumulation option. Based on an IIRR at 3.00% per annum, the total surrender value and accumulated payouts at end of policy year 1, 5, 10 and 20 are S$12,852, S$15,950, S$17,307, and S$21,567 respectively. The prevailing accumulation interest rate is 3.00% per annum based on an IIRR at 4.25% per annum and 1.50% per annum based on an IIRR at 3.00% per annum. This rate is not guaranteed and can be changed from time to time.

Our range of insurance plans available that can help maximise the growth potential of your SRS funds:

- GREAT Wealth Multiplier 3 (Single Premium)

- GREAT Prime Rewards 3

- GREAT Invest Advantage

- Prestige Portfolio

- GREAT SP Series (limited period tranche)

Speak to our experienced Financial Representative to find out how you can optimise your SRS funds to boost your retirement savings.

Let us match you with a qualified financial representative

Our financial representative will answer any questions you may have about our products and planning.