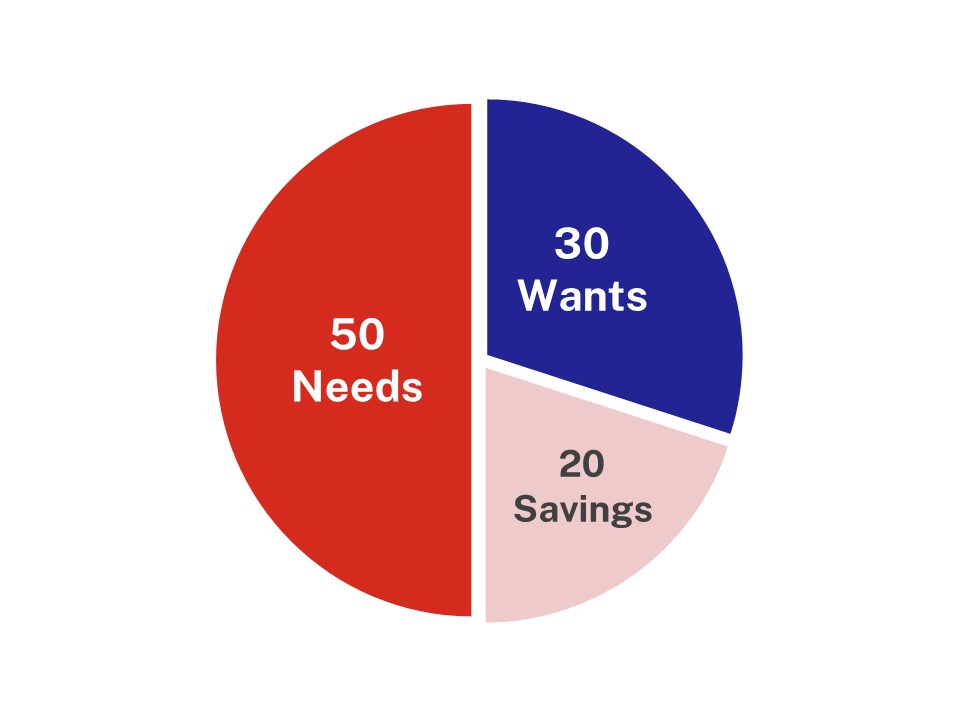

#Finance101: Have you heard of the 50/30/20 rule?

How to allocate your monthly spending with the 50/30/20 budgeting rule

The popular 50/30/20 Rule refers to three categories to divide your income – needs, wants and savings and investments, respectively.

50% on “Needs” refers to your lifestyle necessities like paying for utilities, groceries, rental, repaying any outstanding loans, and other bills including your mobile phone or insurance policies.

30% on “Wants” refers to your optional lifestyle spending like dining out, shopping, entertainment, travel and so on. These are things that usually make you happy and fulfilled (and if they’re not, you need to stop doing them!).

20% on “Savings and investment” refers to building up your emergency fund, and investing the rest into assets that ensure your future financial security.

Implementing the 50/30/20 Rule in your life

To keep calculations simple, let’s assume you take home $3,000 every month, after your CPF contribution.

That means you should ensure that up to $1,500 every month is spent on your needs, utilising no more than $900 on wants and setting aside $600 for savings and investment.

Next, categorise every expenditure each month into needs and wants.

You don’t have to be too hard on yourself – dining out, for example, can be categorised as “needs”, especially if you’re frugal and spend less than $10 a meal. A good rule of thumb to decide if it is a need or a want is to ask yourself whether the expenditure would have been worth avoiding. If the answer is yes, it’s a want. For example, could you have avoided taking a taxi if you’d just left earlier? Yes? Then categorise that taxi ride as a want.

Finally, add up all the “needs” and “wants” and see how close you are to the 50/30/20 Rule. Spending less than $1,500 of your $5,000 take-home pay on your “needs”? That’s great! Spending more than $900 on your “wants”? It’s time to review and see which of those expenditures you should be spending less on in future.

A parting word…

The 50/30/20 Rule is an excellent gauge to help us allocate our monthly income wisely and to make sure that we spend on what is needed and build emergency funds and nest eggs for the future. The discipline it instils is particularly important to ensure you’re not overspending on your “wants”.

While there’s no need to adhere to the 50/30/20 Rule religiously, it is a warning sign if your “wants” exceeds 30% of your income.

Kick-start your financial planning journey by doing a financial health check today!

Let us match you with a qualified financial representative

Our financial representative will answer any questions you may have about our products and planning.