#Finance101: Where are you in the Financial Game of Life?

5 stages of the financial wealth ladder

Have you played The Game of Life board game? It goes like this:

Each player goes through multiple stages including college, career, family, homeownership and retirement. Of course, in reality, life isn’t exactly that straightforward.

But here’s another game you might be interested in. It’s called the Financial Game of Life. Otherwise known as the “Wealth Ladder.”

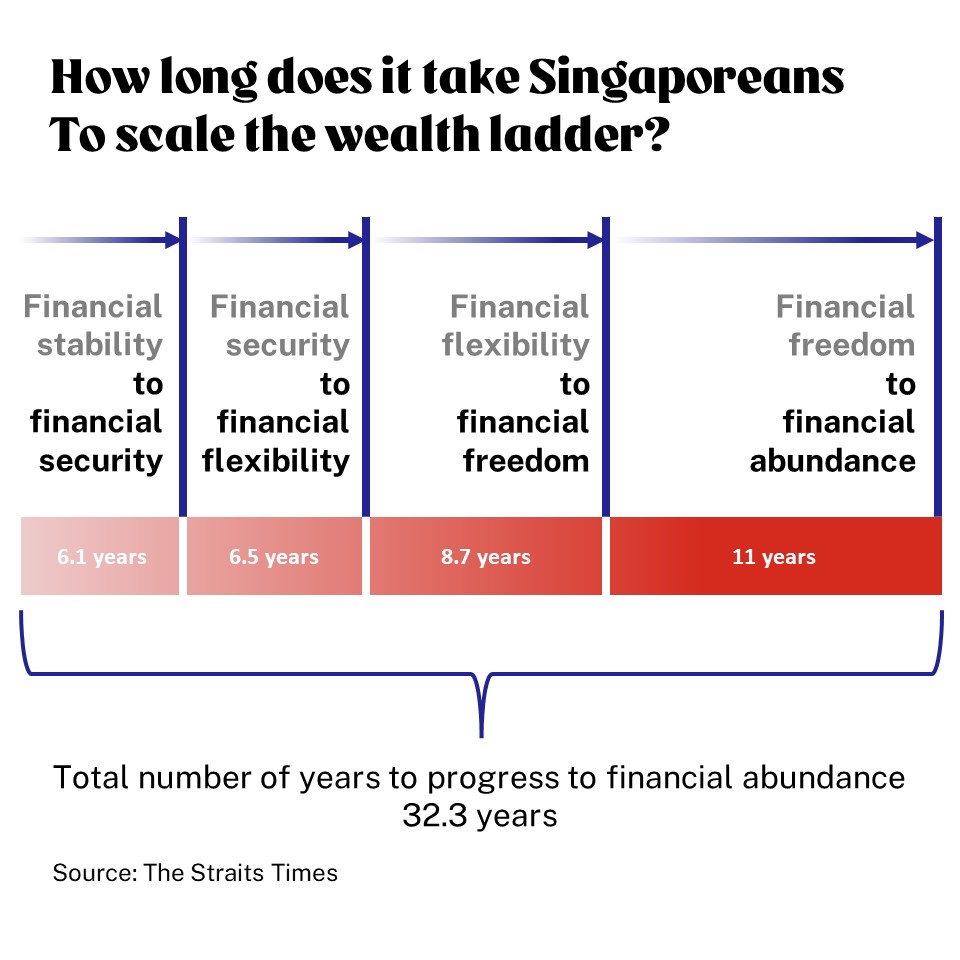

The higher you scale it, the better the state of your finances. And there are five rungs to it:

- Financial Stability

- Financial Security

- Financial Flexibility

- Financial Freedom

- Financial Abundance

In a study released earlier this year, wealth manager St James Place provided a rough estimate on how long the average Singaporean needed to move from the first stage to the last.

Let’s have a closer look!

Trying to build wealth? We’ve got wealth accumulation policies to help you get to where you want to be.

Let us match you with a qualified financial representative

Our financial representative will answer any questions you may have about our products and planning.