Key Benefits

-

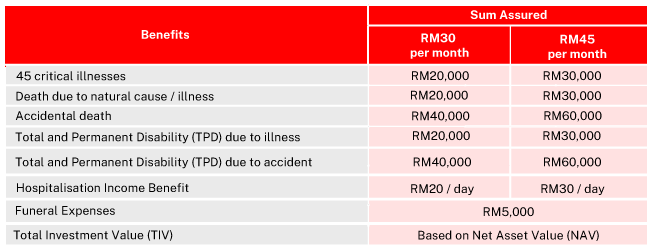

Coverage up to RM60,000 for RM30 - RM45 per month

-

Covers 45 critical illnesses & more

-

2X payout for personal accident

-

RM20 daily hospitalisation income benefit

-

Flexible cash withdrawal by redemption of units¹

-

Protection until 65 years next birthday

-

Extendable coverage for spouse and children

-

Same premium rate for all ages

How GMBIS Simplified Underwriting works

Eligibility

- Member and spouse: Age 19 - 60 years next birthday

- Children: Age 30 days - 23 years next birthday (not working, not married and full-time student)

- Coverage for spouse / children can only be extended if an Assured Member (employee/members) participates in the scheme

Policy maturity

Participation up to age sixty-five (65) years next birthday

Contribution method

Payment mode: Monthly only

Payment method: Credit / debit card

1. Apply now through https://greatmultiprotect.com/gss315-spif/

2. Fill in your details & complete your payment.

3. Receive your RM50 cashback voucher after your policy has been inforced. Cashback will be sent to your email address within 6 weeks after your policy has been inforced.

Understand the details before buying

1 Simplified Underwriting and Acceptance is subjected to terms and conditions

2 The cash value is not guaranteed and depends on the performance of the fund

The product information above is for general information only. It is not a contract of insurance. You are advised to refer to the Product Brochure, Sales Illustration, Product Disclosure Sheet and sample policy documents for detailed important features and benefits of the plan before purchasing the plan. The exclusions and limitations of benefits highlighted are not exhaustive. For further information, reference shall be made to the terms and conditions specified in the policy issued by Great Eastern Life Assurance (Malaysia) Berhad.